This post was originally published on this site

Exchange-traded funds that buy Chinese stocks were trading down Monday after China announced at its annual legislative session over the weekend a growth target near the low end of market expectations.

The Xtrackers Harvest CSI 300 China A-Shares ETF

ASHR,

and KraneShares CSI China Internet ETF

KWEB,

were each down around 1.9% Monday afternoon, while the Invesco China Technology ETF

CQQQ,

slumped 1.6% and the iShares MSCI China ETF

MCHI,

fell 1.1%, according to FactSet data, at last check.

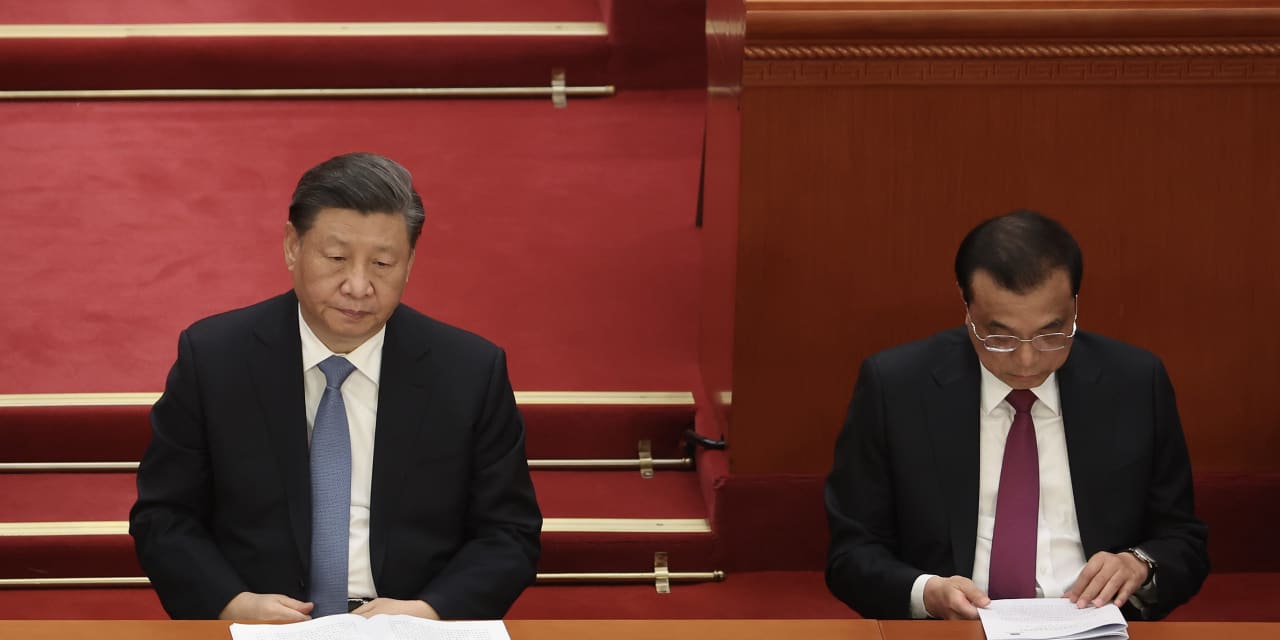

China announced at the start of its annual legislative session on Sunday that it’s targeting growth of around 5% this year, according to the Associated Press.

China’s official growth target for its gross domestic product was “near the low end of market expectations, but a solid step up from the 3.0% realized last year,” Mark Haefele, chief investment officer at UBS Global Wealth Management, said in a note Monday. “New institutional reforms and the results of the once-in-a-decade leadership reshuffle are expected to be revealed in the coming days, offering more insight on what investors can expect.”

John Higgins, chief markets economist at Capital Economics, wrote in a note Monday that “even if economic growth in China this year fails to eclipse the modest 5% target announced at the National People’s Congress (NPC) on Sunday, we expect its stock market to continue to recover and unwind more of the substantial underperformance it experienced between the spring of 2021 and autumn of 2022.”

See: Emerging-markets ETFs are ‘burning investor cash’ as China drags down performance

China’s economy is “already picking up” after the country abandoned its zero-COVID policy, according to Higgins.

“Admittedly, the growth target suggests the authorities will not go hell-for-leather to boost the economy after a long period of weakness during the zero-COVID policy era,” he said. “But this is no bad thing if it avoids problems down the road, such as the creation of a new wave of excess leverage in the property sector.”

Meanwhile, the U.S. stock market was up Monday afternoon, with all three major benchmarks rising after booking sharp gains on Friday. The Dow Jones Industrial Average

DJIA,

was trading 0.1% higher, while the S&P 500

SPX,

was up 0.2% and the technology-heavy Nasdaq Composite

COMP,

gained 0.2%, FactSet data show, at last check.