This post was originally published on this site

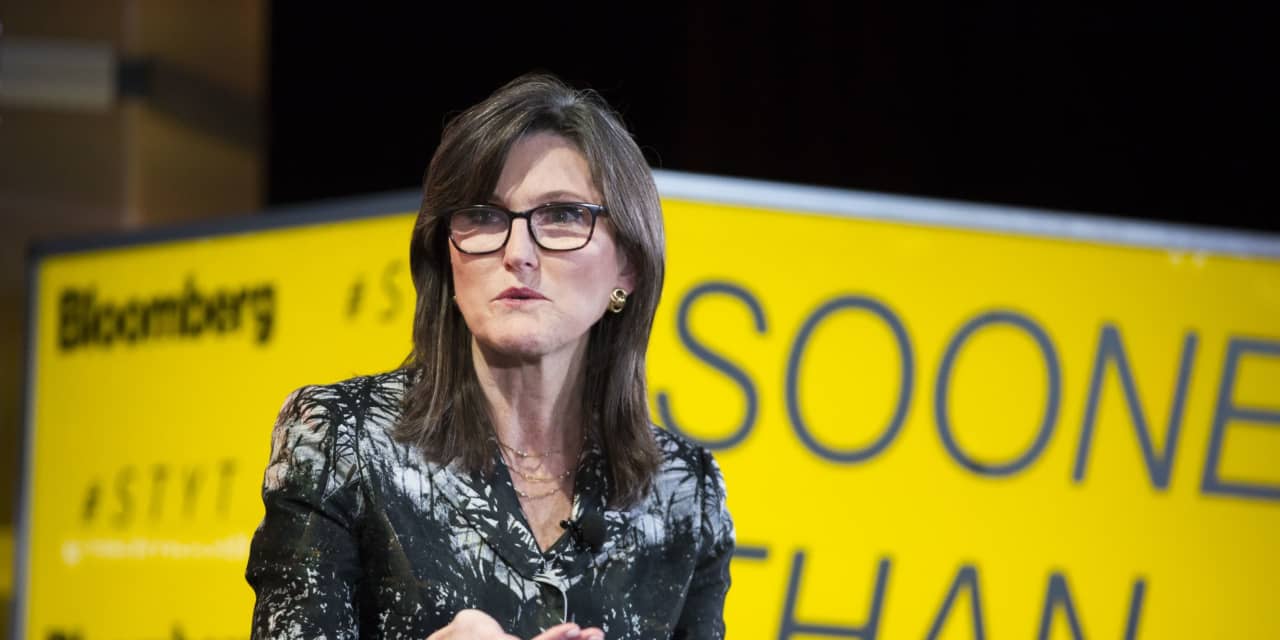

Cathie Wood’s flagship ARK Innovation ETF is sliding in Monday’s technology-led selloff in U.S. stocks, with the exchange-traded fund falling deepening its year-to-date losses.

ARK Innovation

ARKK,

was down about 3.9% Monday afternoon, increasing 2021 losses to about 14%, according to FactSet data, at last check. Wood’s Ark Investment Management created the actively managed ETF to invest in companies that are expected to benefit from “disruptive innovation.”

The Goldman Sachs Future Tech Leaders Equity ETF

GTEK,

which invests in listed companies with a market value of less than $100 billion, was also falling Monday, down about 3.6% in afternoon trading, FactSet data show. The recently launched ETF began trading last month.

Many investors have been expressing concern over valuations in tech, questioning whether the U.S. stock market is bound for a correction after repeatedly hitting new record highs earlier this year. On Monday afternoon the tech-heavy Nasdaq Composite Index

COMP,

was leading the selloff in equities with a sharp drop of more than 2%. The index is down over 7% from its Sept. 7 record close. Market technicians traditionally define a correction as a drop from a recent peak of at least 10%.

“It’s a good opportunity to make sure you’ve got your risk in check now because some of the biggest, fiercest drops have happened in October,” Phillip Toews, chief executive officer of Toews Asset Management, said in a phone interview Monday. “Don’t dither.”

Read: Beware ‘unrealistic complacency’ in stock market, Morgan Stanley warns

Market volatility has picked up during an “seasonally unfavorable period” for U.S. stocks and after a recent rise in Treasury rates, said Toews. The yield on the 10-year Treasury note

TMUBMUSD10Y,

has been edging higher over the past six weeks, trading around 1.48% Monday afternoon.

Tech stocks are seen as particularly vulnerable to rising yields. That is because yields factor into discounted cashflows models used to value equities, with higher rates weighing more heavily on the valuation of high-growth companies.

The Nasdaq dropped 3.2% last week in its biggest weekly decline since the period ended Feb. 26, according to Dow Jones Market Data. The S&P 500 index

SPX,

which has a large exposure to technology, lost 2.2% last week, similarly booking its biggest drop since late February.

See: ‘Something will give’ in U.S. stock market amid ‘discomforting sentiment signals,’ Citi warns

On Monday afternoon, the S&P 500 was down around 1.5%, with declines led by the information technology sector

SP500.45,

FactSet data show. The Dow Jones Industrial Average index

DJIA,

a blue-chip gauge of the U.S. stock market, was also down, but faring better than the S&P 500 and Nasdaq.