This post was originally published on this site

Banking sector jitters and higher interest rates likely spell trouble for the roughly $5.5 trillion U.S. commercial real estate debt market.

The banking sector has been in the crosshairs of jittery investors since Silicon Valley Bank’s collapse in mid-March after it sold a portfolio of rate-sensitive “safe” securities at a loss, sparking a run on the bank by fearful depositors.

Since then, a subsidiary of New York Community Bancorp

NYCB,

snapped up assets and liabilities from the failed Signature Bank

SBNY,

at a 17% discount. However, the deal didn’t include its commercial real-estate portfolio, according to Barclays researchers, who viewed the development as “a negative” for commercial real estate, as the portfolio likely would have sold at a discount.

Another regional lender, First Republic Bank,

FRC,

has been in the spotlight too, after it received a historic $30 billion injection in deposits from big American banks to shore up confidence in smaller lenders. Its shares rose 29.5% on Tuesday, but still were down 87% on the year to date, according to FactSet.

“I don’t think it’s going to be a repeat of the 90s,” said Michael Thom, a partner at law firm Obermayer, referring to the boom and bust cycle in U.S. commercial real estate that led to a wave of bank failures.

But Thom does see landlords already having a tougher time getting new loans, especially on half-empty office buildings due to flexible work arrangements.

Here’s a look at 3 charts that highlight key areas of worry for commercial real estate and where debt tied to these properties resides in the U.S. banking system and beyond.

Who holds the risk?

Multifamily properties have been a “favored” property asset class in the wake of the global financial crisis, after a foreclosure wave hit underwater homeowners and boosted demand for rentals.

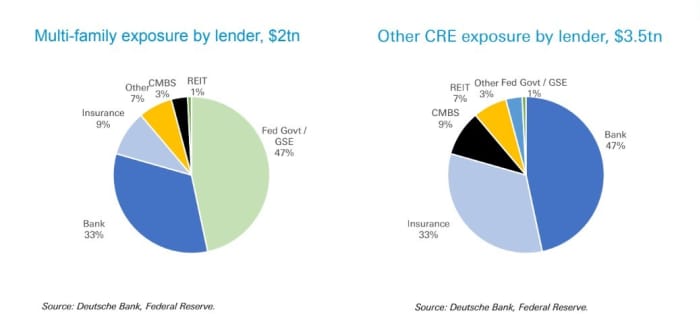

Since that time, the federal government has come to own nearly half of the $2 trillion multifamily loan pie (see chart), according to Deutsche Bank research. Banks own almost half of the exposure to the rest of the $3.5 trillion in commercial property debt market.

Banks own a big slice of the commercial mortgage debt pie.

Deutsche Bank research

Related: Be cautious of floating-rate commercial real estate debt, says Barclays

Deutsche Bank researchers led by Ed Reardon noted that commercial property prices dropped by 21% during the global financial crisis.

While it’s unclear how this cycle will play out, the Deutsche Bank team pointed to recent Fed stress tests of big banks that projected $75 billion in commercial real estate losses, at a 9.8% stressed loss rate.

The Green Street Commercial Property Index pegged U.S. property values as down 15% in March from a year before.

Watch small U.S. banks

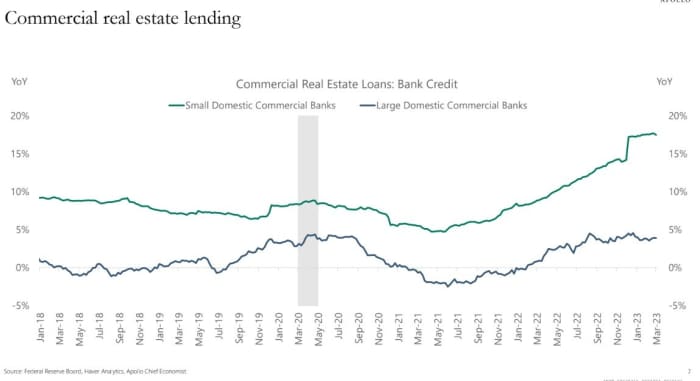

Small banks have become key players in commercial real estate over the past two decades. Their share of the loan pie among all banks rose to almost 68% in January, up from 52% 18 years ago, according to recent tally from Apollo Global Management.

What’s more, small banks grew lending in the sector by nearly 20% in March from a year before (see chart) as the Fed was rapidly increasing interest rates. Large banks increased their exposure by only about 5%.

Small banks grew their commercial real-estate loans as rates sharply climbed.

Apollo Global Management, Federal Reserve Bank, Haver Analytics

Office albatross?

While small banks often keep commercial real-estate loans on their books, Wall Street looks to package larger loans on skyscrapers, office towers and other property types into bond deals.

In good times, loan payments are passed onto investors in the bond deals. But when credit issues, late payments or defaults arise, it’s a bondholder problem. That’s the roughly $670 billion commercial mortgage-backed securities (CMBS) market in a nutshell.

Financing through the CMBS market has been a key way for many trophy office buildings in New York, San Francisco and other big U.S. cities to receive funding in recent decades.

Office properties, once considered a relatively safe investment, aren’t viewed the same way any longer, particularly with Kastle Systems’ gauging office vacancy in its 10-city barometer at only 47.3% as of March 20.

Shares of office REITs, or real-estate investment trusts, have plunged 51% over the past 12 months, according to Morgan Stanley researchers. That compares with a 23% drop for the Dow Jones Equity REIT Index

DJDBK,

for the same stretch.

The concern with hybrid work is that tenants won’t need as much office space as in the past, which could drag down property prices and hurt landlords with billions of debt coming due in the next few years, likely at higher rates.

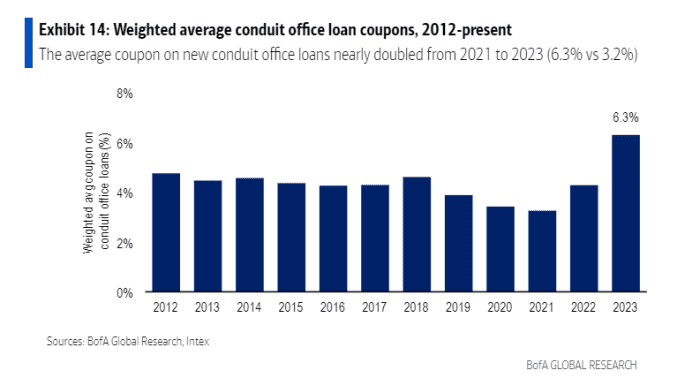

While some borrowers will get loan extensions or modifications, a “more expensive funding regime” could force others to “hand back the keys,” said BofA Global’s Alan Todd, who leads the bank’s CMBS research effort, in a recent client note.

To help gauge borrower costs, the average coupon for office loans in multi-borrower, or “conduit,” commercial mortgage bond deals has almost doubled to 6.3% since 2021.

Office loan coupons nearly double to 6.3% since 2021

BofA Global Research, Intex

Against this backdrop, Todd at BofA expects new CMBS issuance to finance buildings of only about $50 billion this year, or roughly half the volume of 2022.