This post was originally published on this site

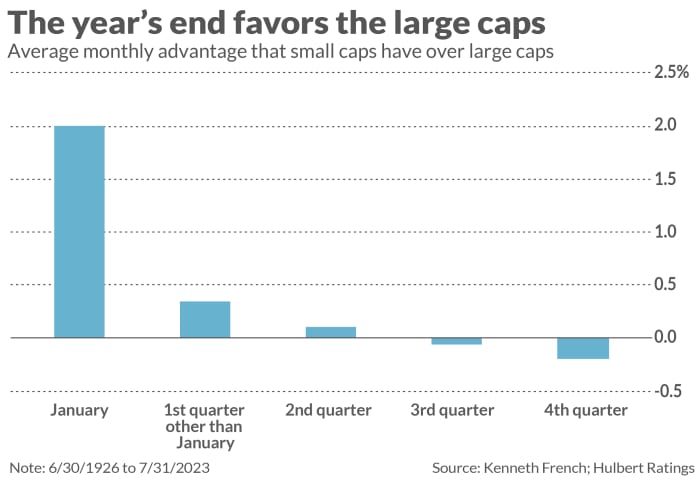

Seasonal tendencies for the U.S. stock market between now and the end of the year will favor large-cap stocks over small caps.

That has to be particularly disappointing for beleaguered investors in small caps, who have been underperforming the large caps for several months now. In contrast to the 17.4% year-to-date gain of the large-cap-dominated S&P 500

SPX,

for example, the iShares Russell 2000 ETF

IWM

] has gained 6.1% while the iShares Micro-Cap ETF

IWC

] has lost 2.3%.

Small-cap underperformance is likely to continue for several more months due to the compensation incentives under which institutional investors operate. Many managers will receive a year-end bonus if they finish the year ahead of the S&P 500. So as Dec. 31 gets nearer, they have a powerful incentive to start making their portfolios look increasingly like the S&P 500 — thereby locking in positive year-to-date outperformance. These managers will be tempted to avoid the small caps even if they think those stocks represent good value at current prices, since the risk of their year-to-date gain falling below the S&P 500 is too great.

This relationship between compensation incentives and the market was discovered in a 2003 study in the Journal of Business Finance & Accounting, by Lucy Ackert, a professor of finance at Kennesaw State University, and George Athanassakos, a professor of finance at the University of Western Ontario. Two years ago they updated their original study in the Journal of Risk and Financial Management and found that the pattern persists.

“ Once January rolls around, institutional investors’ compensation incentives shift in the small-caps’ favor. ”

The professors’ theory does contain some good news for small-cap investors, provided they are patient: Once January rolls around, institutional investors’ compensation incentives shift in the small-caps’ favor. That’s when their appetite for risk is the highest it will be throughout the calendar year.

The accompanying chart shows that stock market history accords nicely with the professors’ theory. Since 1926 small-cap relative strength, which is highest in January, declines steadily as the year progresses.

There are several ways in the stock market to lean on large-cap relative strength between now and the end of the year. Perhaps the simplest would be to invest in an S&P 500 index fund, such as the SPDR S&P 500 ETF

SPY.

A market-neutral way of betting on that strength would be to invest in SPY while simultaneously shorting an equal dollar amount of a small-cap fund, such as the iShares Micro-Cap ETF. This latter approach would turn a profit even if the market falls between now and year end, so long as small caps fall by more than the large caps.

If you want to bet on individual large-cap stocks, below are the 10 largest-cap stocks currently recommended for purchase by at least three of the investment newsletters that my auditing firm monitors:

| Stocks | Market Cap ($ billions) |

| Apple Inc (AAPL) | $2,858 |

| Microsoft Corp (MSFT) | $2,466 |

| Alphabet Inc (GOOG) | $1,652 |

| JPMorgan Chase & Co (JPM) | $1,101 |

| Bank Amer Corp (BAC) | $844 |

| Morgan Stanley (MS) | $470 |

| Pfizer Inc (PFE) | $217 |

| Disney Walt Co (DIS) | $198 |

| CVS Health Corp (CVS) | $150 |

| Medtronic Plc (MDT) | $124 |

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Here’s an easy way to make a more concentrated play on the ‘Magnificent Seven’ stocks

Plus: These four Dow stocks take top prizes for dividend growth