This post was originally published on this site

Interest rates are more likely to fall in coming months than rise.

Such a prediction seems ludicrous on its face, of course. It seems certain that U.S. interest rates will rise, with the only uncertainty being how much. The minutes of the Federal Reserve’s interest-rate setting committee meeting in March, released this week, show that the Fed is ready to raise interest rates in 50-basis-point increments at its meetings later this year. The emerging consensus is that these and other developments will “scare the bond market witless again.”

Nevertheless, the job of a contrarian is to “buy when blood is in the streets.” Like now. Support for this contrarian bet comes from focusing on interest rates on an after-tax and after-inflation basis. A study circulated several years ago by the National Bureau of Economic Research argued that this is the proper basis on which to make historical comparisons. Entitled “Are Interest Rates Really Low?,” the study was conducted by Daniel Feenberg, a research associate at NBER, Ivo Welch, a finance professor at UCLA, and Clinton Tepper, a Senior Portfolio Analytics Researcher at iCapitalNetwork.

It’s standard practice to take inflation into account when analyzing interest rates, but few recognize the importance of adjusting them for taxes. The study’s authors show that the bond market does take taxes into account when setting yields, so a failure to adjust for taxes leads analysts to draw misleading historical comparisons.

To illustrate, consider that the 10-year Treasury yield

TMUBMUSD10Y,

rose in nominal terms above 15% in 1981, far higher than the current 2.7%. Yet after adjusting for taxes and inflation (which was in the double-digits four decades ago), interest rates that year were lower than they are now.

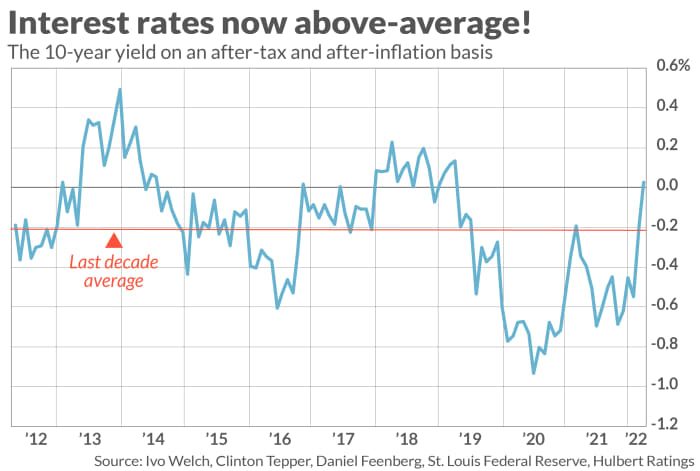

The chart below plots the 10-year Treasury yield over the past decade on this after-tax and after-inflation basis. To construct the chart, I relied on the researchers’ adjustment factor for taxes and on a Cleveland Federal Reserve model to adjust for inflation expectations. This model, which I’ve written about before, has a number of inputs, including Treasury yields, surveys of professional forecasters and the prices of inflation swaps.

Notice that on this basis the current 10-year yield is above the past 10-year average. Indeed, in recent days it rose above 0%, for the first time in three years.

What the model predicts

Given this, don’t be surprised if interest rates on this double-adjusted basis come down in coming months. Indeed, if we assume that adjusted interest rates are mean-reverting, then there’s a greater chance of such a decline than of an increase.

Note that a decline could come for any of several reasons. A decline in nominal interest rates is just one way. Another would be for expected inflation to rise without a corresponding increase in nominal rates.

Regardless of how it comes about, such a decline would be welcome news for bond investors on after-tax and after-inflation basis.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More:

Also read: