This post was originally published on this site

Momentum strategies don’t appear to work with bitcoin

BTCUSD,

The past couple of weeks provide a good illustration of why. From an Oct. 19 high of almost $67,000, bitcoin fell $9,000 over the next eight days to just above $58,000 — indicating that the short-term trend was most definitely down. But, far from that trend continuing, bitcoin turned back up and over the next 12 days completely erased that decline.

The same reversal tendency appears to be the case with longer-term trends. In the early months of this year bitcoin more than doubled, for example, rising from its year-end 2020 price of $29,000 to more than $63,000 in April. That trend then reversed itself, and over the subsequent three months bitcoin erased all of its year-to-date gain. But then, in July, the trend reversed again, and by October bitcoin was trading at a new all-time high.

Such trend reversals wreak havoc with the portfolios of trend-following systems. Because trend-following bitcoin traders are buying high and selling low, many have been losing money even while bitcoin itself is skyrocketing. The investment implication: If you want to invest in bitcoin, you should buy and hold. Or better yet, “buy and HODL.”

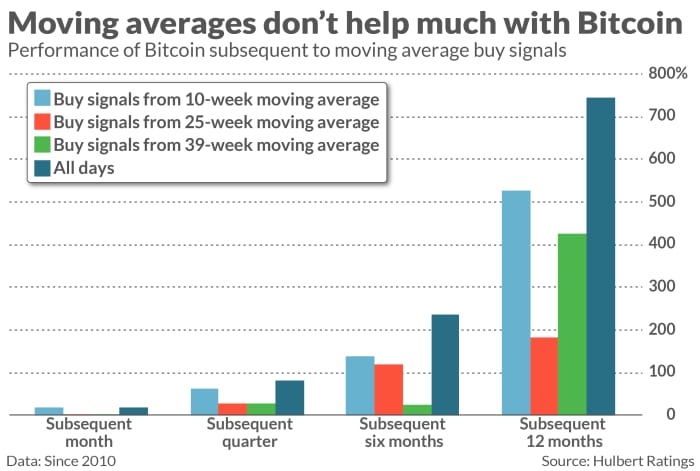

The trend reversals bitcoin has experienced this year, while breathtaking, are not unique, based on my analysis of the cryptocurrency’s price history since 2010. To determine if trend following with bitcoin holds promise, I calculated the performance of moving average systems of different lengths — 10-weeks, 25-weeks,and 39-weeks. Notice from the chart below that, regardless of the moving average length, bitcoin performed more poorly in the wake of a buy signal than it did the rest of the time.

Moving averages aren’t the only way of capturing a trend, of course. But these results are certainly discouraging.

I next applied to bitcoin the standard academic definition of stock market momentum, which focuses on a look-back period of 12 months and a look-forward period of one month. I did so because, in the stock market, this definition of momentum has had a long and illustrious history — dating back to the mid-1920s, in fact.

In bitcoin, this approach would have been a big disappointment in recent years. Though the approach did well in some of bitcoin’s early years, since 2018 it’s been worse than a coin flip. Over a period just shy of the past four years, bitcoin has produced an average monthly gain of 5.1% whenever the cryptocurrency’s trailing 12-month return was positive. In contrast it has produced an average monthly gain of 8.8% whenever bitcoin’s trailing 12-month return was negative.

I couldn’t measure all possible combinations of look-back and look-ahead periods of various lengths. But among the combination of periods I did focus on, I found no strong evidence that trend following with bitcoin has worked consistently. This isn’t to say that none will ever be found. But based on the experience of recent years, I wouldn’t hold your breath.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: What some say is behind crypto’s record rally to $3 trillion, as bitcoin hits new high

Plus: Meme stocks like GameStop, AMC pose risks to financial stability, Fed says