This post was originally published on this site

Real interest rates are the highest they’ve been in years. That’s good for U.S. bond investors, and possibly good for U.S. stock investors as well.

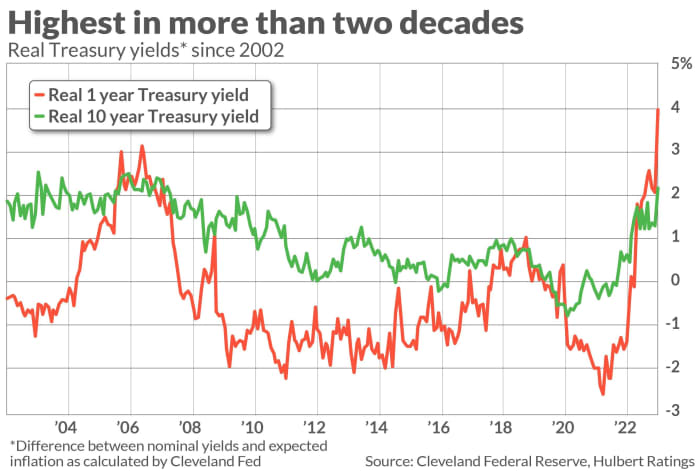

Real interest rates reflect the difference between nominal yields and inflation. Real rates were negative during the many years of the Federal Reserve’s near-zero interest policy, but began to shoot up several months ago.

This trend accelerated this past week, even as the Fed decided to keep rates steady. The table below compares the real rates one month ago (in the immediate wake of the May release of the April CPI) and today (following this week’s release of the May CPI data). Notice that nominal rates have risen over the last month as inflation expectations have declined; the difference between the two therefore has expanded significantly.

| Following the May 10 release of CPI data | Following the Jun 13 release of CPI data | |

| Nominal 1-year Treasury yield | 4.70% | 5.27% |

| Inflation expectations over subsequent year | 2.66% | 1.31% |

| Real 1-year Treasury yield | 2.04% | 3.96%% |

| Nominal 10-year Treasury yield | 3.43% | 3.83% |

| Inflation expectations over subsequent decade | 2.16% | 1.66% |

| Real 10-year Treasury yield | 1.27% | 2.17% |

A key component of these calculations is expected rather than actual inflation. That’s for two reasons, the most obvious of which is that we won’t know the actual inflation rate over the next year and 10 years until a year and a decade have passed. But a more basic reason to focus on expected inflation is that we want to know what investors currently think. It’s the difference between nominal interest rates and investors’ current expectations that represents how much of a margin over inflation they are demanding in order to invest in bonds.

The expected inflation rates used for this column come from a model updated monthly by the Cleveland Federal Reserve. It has a number of inputs, including Treasury and TIPS yields, surveys of professional forecasters, and inflation swaps (which are derivatives in which one party to the transaction agrees to swap fixed payments in return for payments tied to the inflation rate).

What high real rates mean for investors

Above-average real interest rates are good news for bonds, since high rates are more likely than not to decline. You can see this regression-to-the-mean tendency in the accompanying chart. The last time real rates were as high as they are now was in the months leading up to the 2008 Global Financial Crisis (GFC). From then until the bottom of that crisis, bonds experienced one of their more powerful bull markets in U.S. history.

You might conclude from stocks’ losses in the GFC that high real rates are bad for the stock market. But that conclusion would be premature, based on my analysis of stock market history back to 1871.

Since there’s no way of knowing what inflation expectations were in long-ago decades, I made the simplifying assumption that investors at any given time expected inflation over the subsequent 12 months to be equal to what it was over the trailing 12 months. On that assumption, I found a modest positive correlation between expected inflation and the stock market’s return over the subsequent one- and five-year periods.

Given that this correlation was so modest, however, the stronger investment implication of the currently high real interest rates is that the outlook for bonds is quite good.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Also read: The bulls finally control the stock market and the signs point higher