This post was originally published on this site

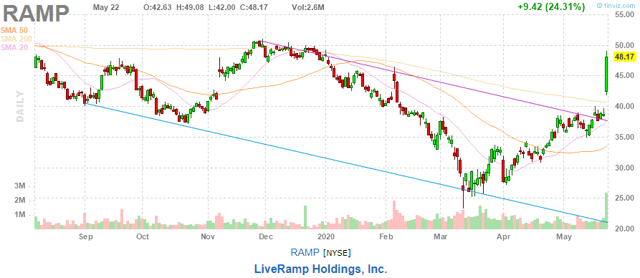

We have covered ad data platform company LiveRamp (RAMP) multiple times over the past couple of years, and the latest of these even predicted that the company’s day in the sun would come. But so far we had little to show for it:

Which has surprised us quite a bit, as we long held the belief that this is quite a gem of a company with a number of structural tailwinds behind it, like:

- The rise of programmatic advertising

- The rise of CTV

- The need for an independent data (identity, onboarding, marketplace etc.) platform

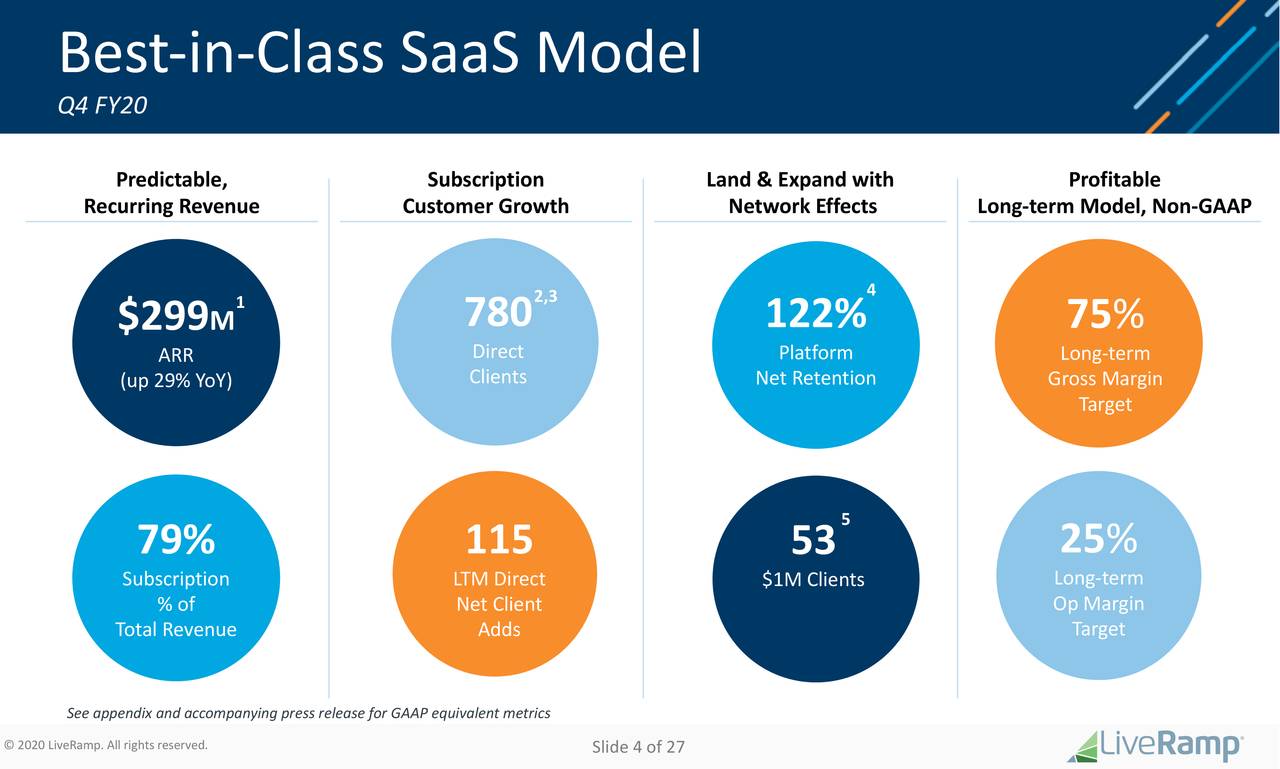

- A robust SaaS based business model

- A tremendously strong balance sheet

Sure, it wasn’t profitable (it still isn’t) and it wasn’t always cash flow positive (since splitting off from Axicom), but it could easily afford to keep investing in growth given its enormous cash hoard (still $700 million despite outsized share buybacks).

And slowly but surely it is cementing its position in the industry, and now that other ad tech companies are facing declining revenues, LiveRamp is still growing and its operational performance is set to improve this year despite the pandemic.

While the pandemic is clearly slowing down its revenue growth, not all of its impact is necessarily negative, so let’s start here.

COVID-19

The company is doing pretty well because:

- Most of LiveRamp’s business is SaaS – that is subscription-based, which simply continues in most cases.

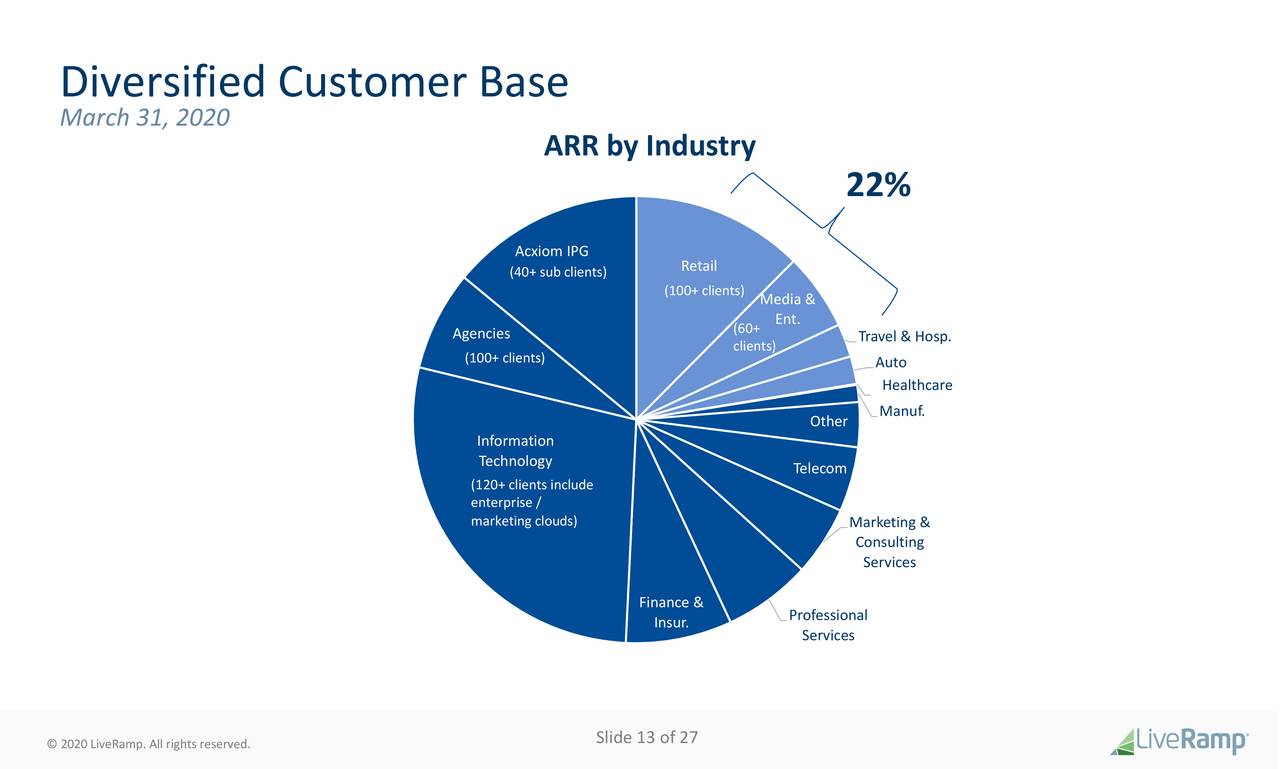

- Only 22% of its customer base is heavily affected (see slide below).

- Customers in heavily affected sectors have asked for flexibility, which management is offering, typically leading to a (3-month) pause and equal lengthening of the subscription contract.

- The contraction seems to be concentrated in smaller companies (higher churn, lower net customer adds, requests for flexibility in payment terms, etc.)

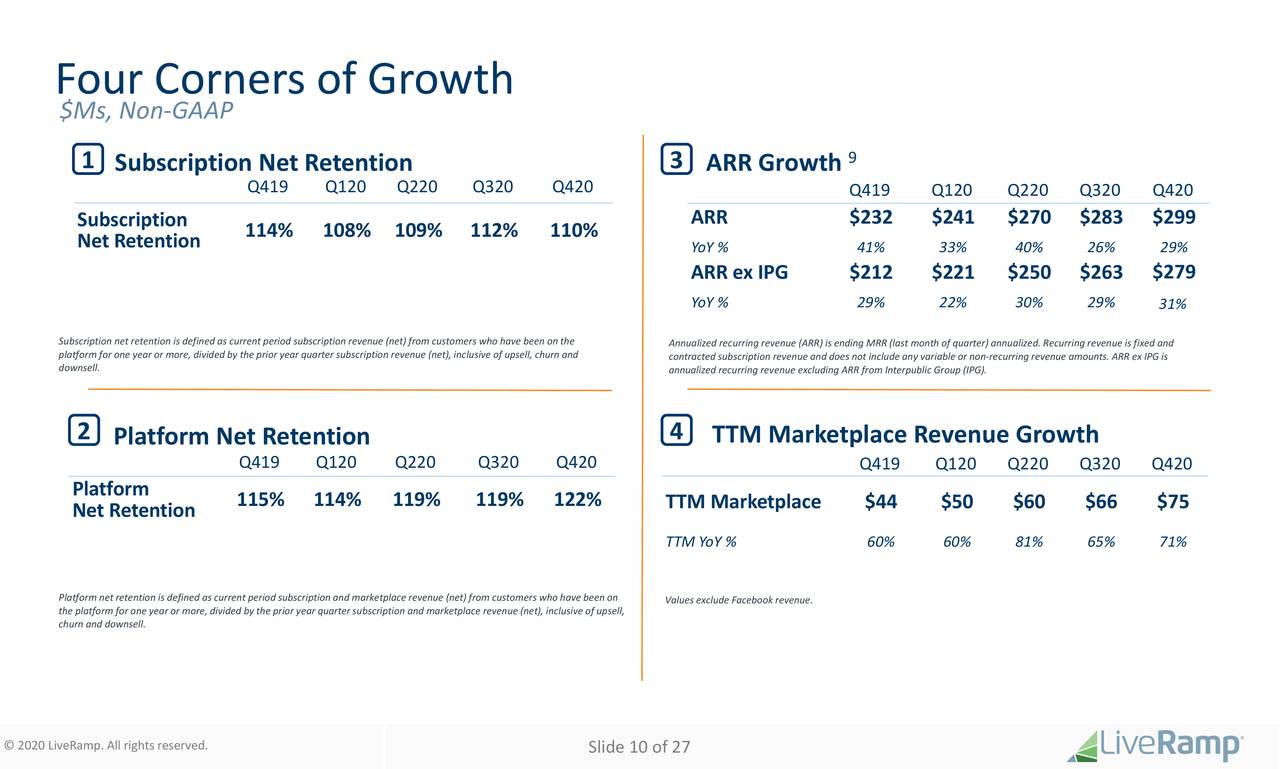

With respect to the robustness of its business model, the company gave some pointers in the earnings deck:

Here is LiveRamp’s customer base, with 22% in sectors heavily affected by the pandemic. From the earnings deck:

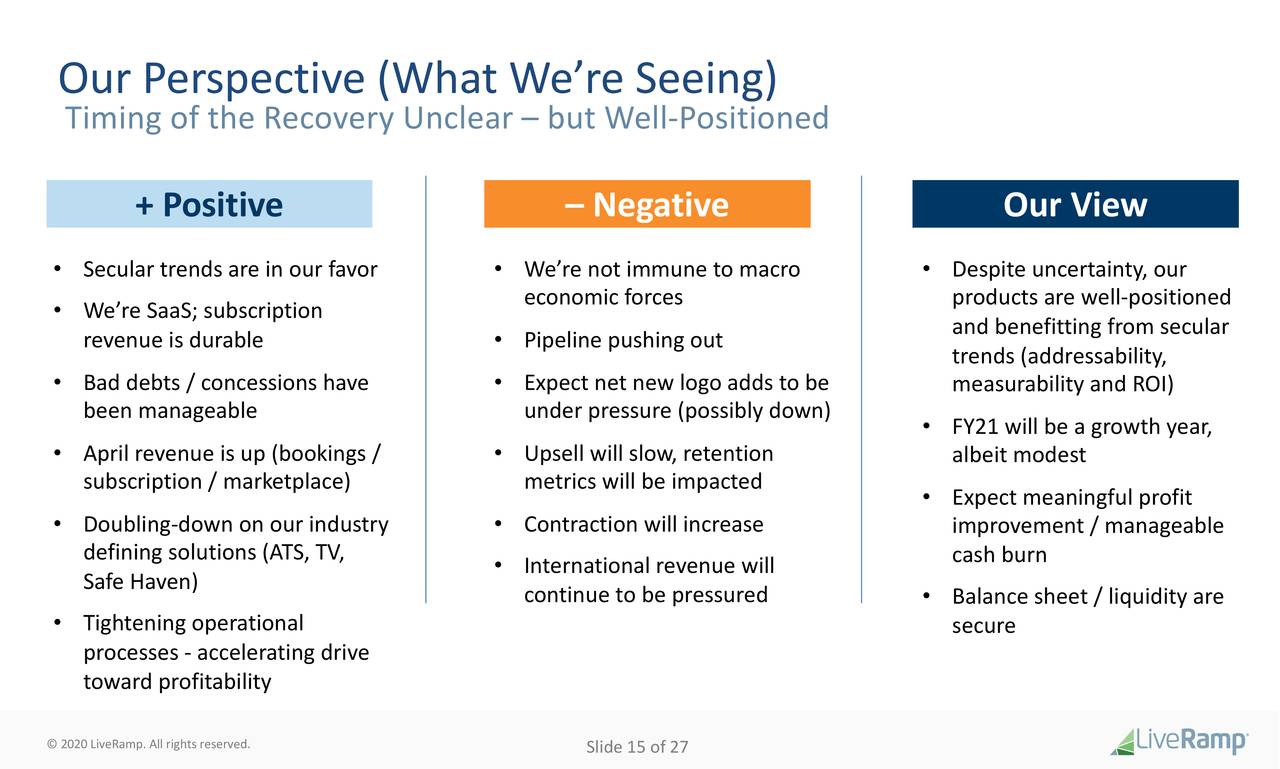

Management summarized this in one slide from the earnings deck:

As one can see in the last column, management actually sees a silver lining, as the suspension of normal business also has given more of the company’s customers time to reflect on a reorientation of their ad strategy.

As more of its customers are forced to do more with less, all of this leads more customers to an increased focus on addressability and measurability and ROI of their ad spend, which is right up the street of LiveRamp’s solutions (after all, it is a data broker that enables addressability, measurability and ROI). Here is management (from the Q4CC):

Our product suite and in particular solutions like ATS, advanced TV and Safe Haven helps to ensure every marketing dollar spent is addressable, accountable and measurable.

We will get to some of these below. Then, there is the company’s iron-clad balance sheet, which not only led to a huge buyback during the crash ($104 million), it also gives LiveRamp strategic options to accelerate investments and/or acquire companies weakened by the pandemic.

LiveRamp also allows healthcare companies to recruit healthcare workers or telemedicine patients with the help of the company’s products at no charge (as well as a number of other non-profit organizations).

Authenticated Traffic Solution (ATS)

This is the alternative that the company introduced in May last year as an alternative to third-party cookies, which have found foul in the eyes of regulators and web browsers (Chrome will phase them out).

If successful, it will bolster the company as the Switzerland of data, the neutral middleware company in the ad space. The way ATS works is publishers match consented user data like email addresses (when they make users sign up) to LiveRamp’s IdentityLink graph.

This is a database of (anonymous) profiles of people, which generates a token which is wrapped in (a now first-party) cookie, used as the identifier in header bidding and stuff (Clickz):

The token in that first-party cookie then is also passed via the wrapper to supply-side platforms (SSPs) and demand-side platforms (DSPs), where it can be targeted with ads designed for that particular user.

Adoption, while not universal, is already well underway, with four out of the five largest SSPs (and 18 in total) and 35 DSPs participating or in the process of doing so. Basically, as Joe Stanhope, a principal analyst at Forrester, argued:

LiveRamp is situated to turn the crisis into a business opportunity

One problem is that making readers sign up is a low percentage game, but there are ways around that. For instance, publishers can bribe them, providing premium content for people who do. And there are advantages (from the Q4CC):

Any publisher who has compelling content is already offering a value exchange and it’s just making that from being an implicit value exchange to explicit. And as soon as they do that, as soon as they collect those consents and literally upload a lighter code on their page to benefit from ATS, then they can start to generate significant advantages and monetization. Our initial tests have suggested that could be 20% or more and obviously in markets that have the most adoption of Safari and Firefox or the most exposure to Chrome, the yield is going to be even greater and the urgency to adopt something like ATS will increase.

And there was the President and CFO adding (from the Q4CC):

ATS is not a U.S. thing, it’s a global thing. So it is truly a global product offering for LiveRamp. And when you think about our acceleration and recovery, this really globalizes our company much, much more quickly. We have momentum with ATS in Japan. We have momentum with ATS in Australia. We have momentum in Italy and Germany, France, UK and keep going in Spain. So, this is a global phenomena and it is a global phenomena with brands. Many of the largest advertisers in the world again are not simply U.S. companies, they are global companies and they want uniform addressability in every single market in which they operate and that’s a very, very positive thing for us.

So it looks like the Forrester analyst was onto something.

Safe Haven

ATS is quite complementary with a more recent company initiative, Save Haven. From the PR:

LiveRamp Safe Haven enables omnichannel data and audience collaboration in a neutral, permission-controlled, privacy-first environment to ensure the safety and security of data while delivering the highest possible matches between partners. Sitting on top of a foundation of identity resolution, LiveRamp Safe Haven provides advanced analytics tools to help businesses such as brands, retailers and media networks collaborate with their partners and extract insights from event-level data to inform business decisions and unlock outcome-based measurement capabilities. Example use cases of LiveRamp Safe Haven include the ability to connect a brand with a retailer to refine audience segments with transaction data, or connect a publisher with an advertiser to curate audiences and measure outcomes.

Management said Safe Haven had over 10 leading global brand wins, which is driving the company’s ACV (annual contract value) up, and it has generated “tremendous global interest” since the launch.

Marketplace

From the earnings deck:

Growth of LiveRamp’s marketplace is continuing unabated, rising 71% in Q4 y/y, and much of that seems to be CTV-related (from the Q4CC):

We saw strong growth in third-party data sales in Q4 to support advanced television targeting and our consumer social program.

CTV

Another strong growth area is the company’s CTV business, where revenue was up 70% in Q4 y/y. With regard to this business (from the Q4CC):

we believe the last 2 months have significantly accelerated our opportunity in advanced television. If there were ever to be a tipping point for data-driven television, we are witnessing it. With live sports canceled and the traditional upfronts canceled or postponed, we are seeing a sharp shift in activity to regional buying and CTV, both of which have the opportunity to be data-driven and addressable. Our CTV related revenues were again very strong in the quarter and our total advanced television business was up well in excess of 50%.

The company made some interesting acquisitions and partnerships recently, like Data Plus Math, acquired in June last year (see here for some of the measurement capabilities), improving the measurability and addressability and hence ROI of CTV advertising campaigns.

Then, there is its recent partnership with comScore (SCOR) (a provider of TV viewership data), which management believes is a “game changer for outcome-based television measurement” (from the Q4CC).

Q3 results

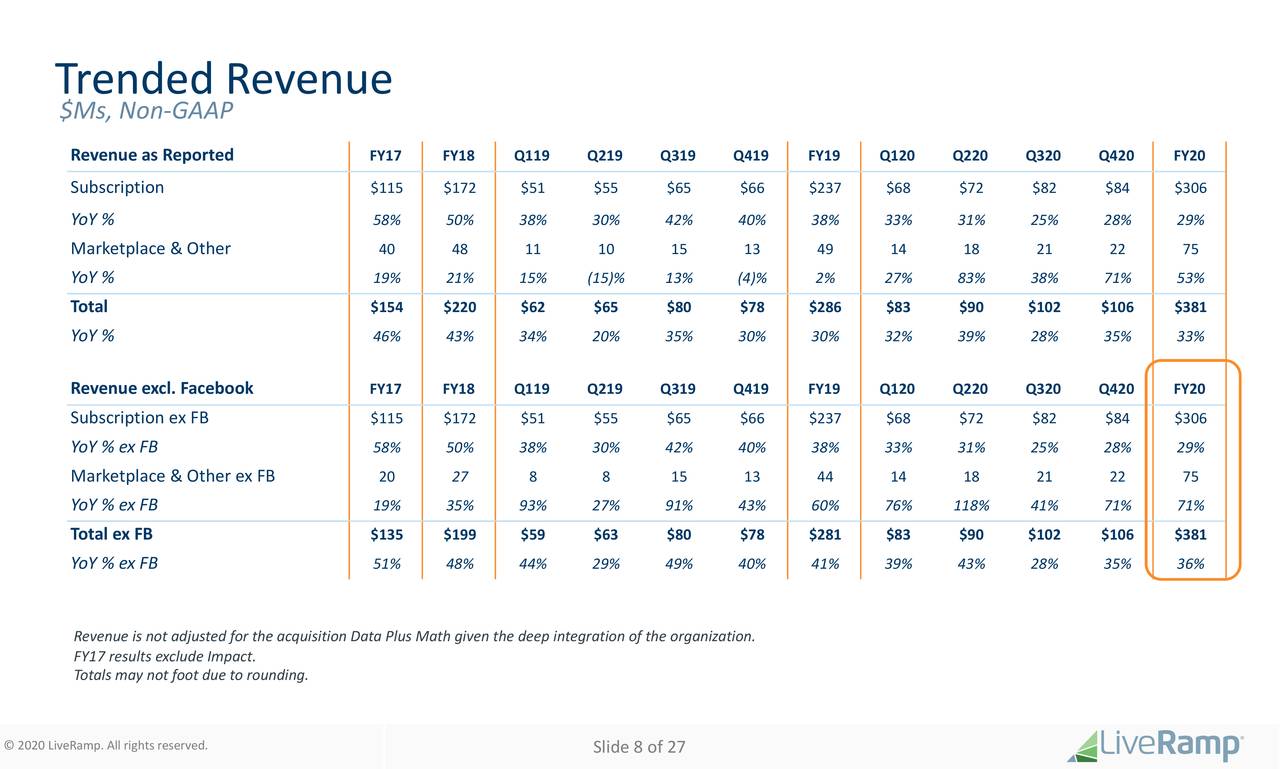

From the earnings deck:

The numbers were surprisingly good, with revenue 5.6% above expectations and non-GAAP EPS beating by $0.09 and coming in at -$0.05.

Guidance

While LiveRamp withdrew its FY2021 (starting in April 2020) guidance, the company did argue that it will keep growing revenues and even experience an improvement in profitability (that is, losses declining).

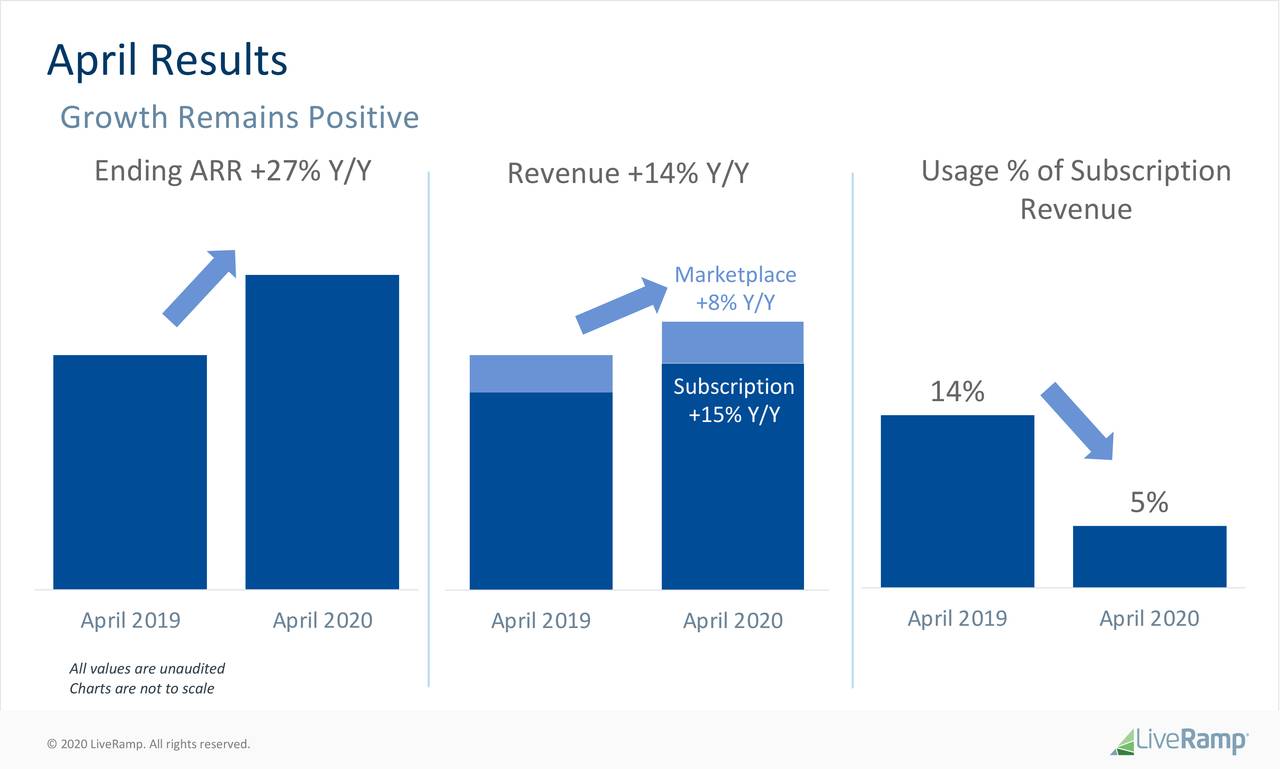

And indeed, things haven’t gone too bad in April and May. From the Q4CC:

In fact, our volumes indexed against the first 10 weeks of the calendar year were up in April and for the first 2 weeks of May. However, the usage portion of our subscription revenue as a percentage of total subscription revenue did decline compared to the prior year. Typically, the variable portion has averaged between 10% and 15% of total subscription revenue. For the month of April and the first 2 weeks of May, variable is averaging low to mid single-digits as a percentage of total subscription revenue.

April (the first month of Q1 2021) experienced reduced growth, but management stressed that where LiveRamp is still experiencing growth, other companies in the sector are actually experiencing declining revenues. From the earnings deck:

Management sees stabilization in May, so the decline in growth rates seem to have stopped, at least for now.

Margins

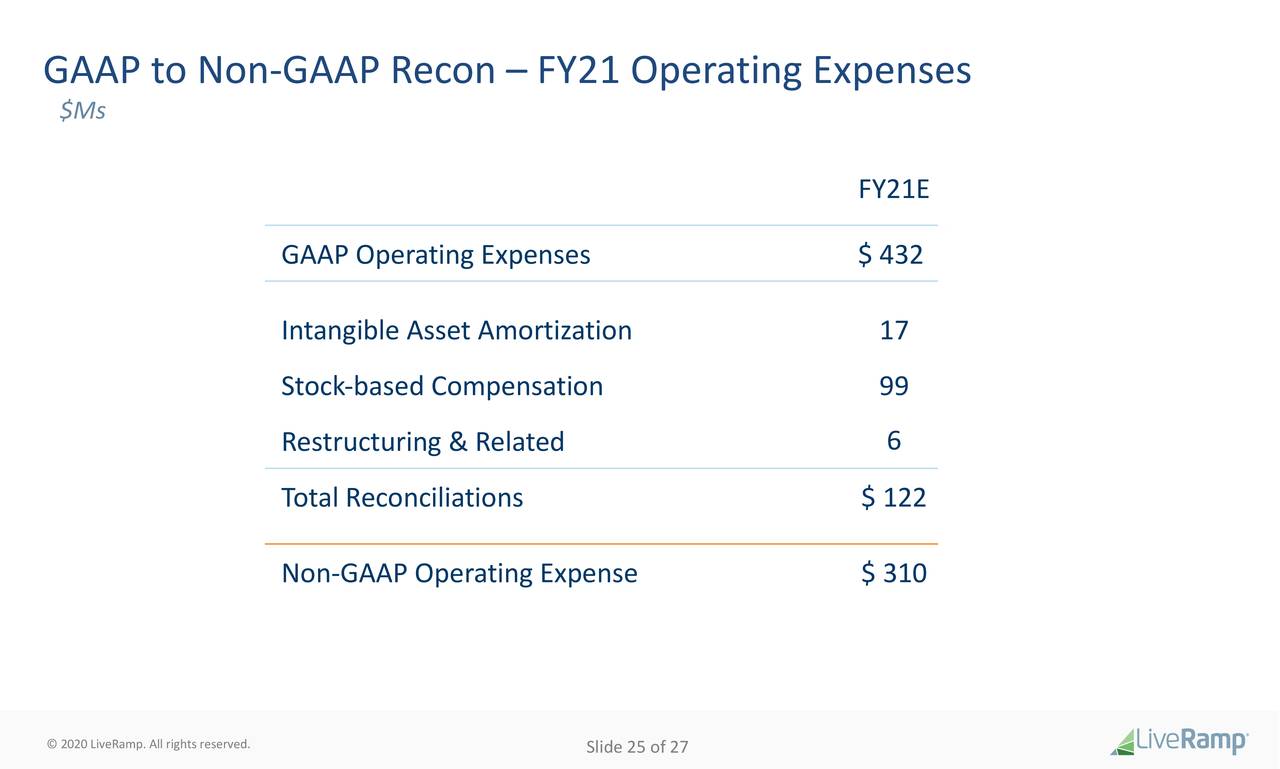

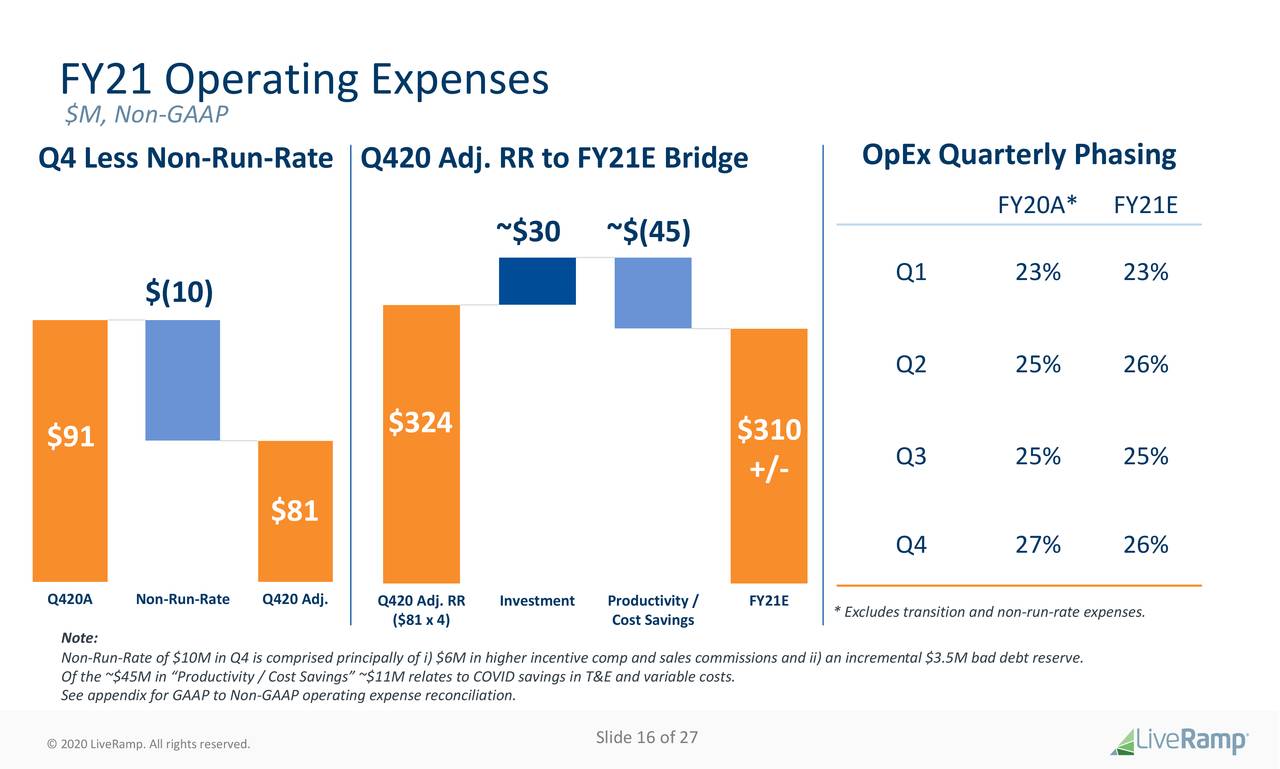

While the company did refrain from giving FY2021 revenue guidance, it did provide operational cost guidance. From the earnings deck:

That would be a decline of FY2020 non-GAAP OpEx, which was $324 million, so where does that come from? Well, for starters, $10 million of the expenses in Q4 were one-time, but there is more:

That is, the company is penciling in $45 million in savings. Some of this comes from platform enhancements (from the Q4CC):

We recently released several enhancements to our UI and also made significant improvements in reliability and turnaround times reducing the average turnaround time by as much as 40% in recent months. We have also streamlined our customer support structure to get customers faster, higher quality responses

The upshot from the combination of its growth initiatives and cost management is that these (from the Q4CC):

have dramatically brought in our profitability timeline.

Which is a big reason the shares rallied so strongly on the Q4 figures and CC.

Cash

LiveRamp has, of course, been given a huge cash kitty after its split from Axicon, and there is still so much cash ($718 million) left that this is a strength, which has been used for a 3.1 million share buyback for $103 million since the start of the calendar year. It only lost $2 million in free cash flow in Q4. And then (from the Q4CC):

during the year, we expect to receive a tax refund of approximately $30 million as a result of being able to carry-back our FY ‘20 tax losses.

So we really don’t have to worry about cash flow this year either.

Valuation

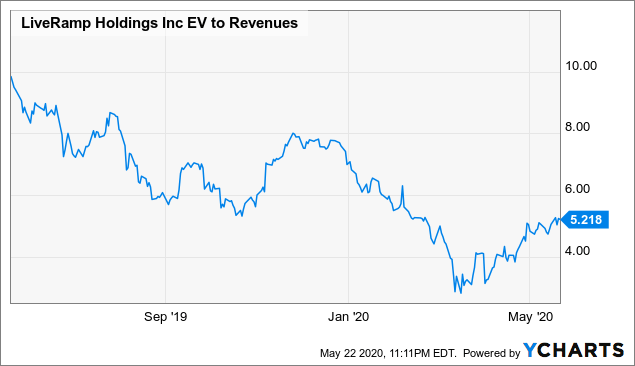

Data by YCharts

Data by YCharts

Conclusion

We have followed LiveRamp for a while now, and slowly but surely it is carving out and cementing a central position in the ad industry, driven by secular tailwinds and astute management spotting growth areas and customer needs and responding with the right growth initiatives, acquisitions and partnerships.

With the increasing importance of the company’s products and operational performance increasing, we think the shares deserve a higher multiple, even if this year growth will slow down quite a bit as a result of the pandemic.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in RAMP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.