This post was originally published on this site

Source: Workday’s Clients

Investment Thesis

Workday (WDAY) is a software company that provides businesses with finance tools (FINS) and human capital management tools (HCM), both of which improve the workday efficiency. Workday established itself as a leader in human capital management about 10 years ago. Nowadays, the company strives to expand its suite of offerings to help businesses with finances, planning, and procurement, as we will discover later on.

Workday’s HCM simplifies recruiting, employee benefits, talent management, and human resources. Workday’s FINS software focuses on payroll solutions, auditing through AI, and a variety of other finance services.

With nearly $7T being invested in “digitizing the workplace,” Workday operates at the center of an explosive secular growth trend. The uncertainty and market turmoil has therefore created an attractive entry point for this stalwart cloud provider, which is led by one of its original founders, Aneel Bhursi.

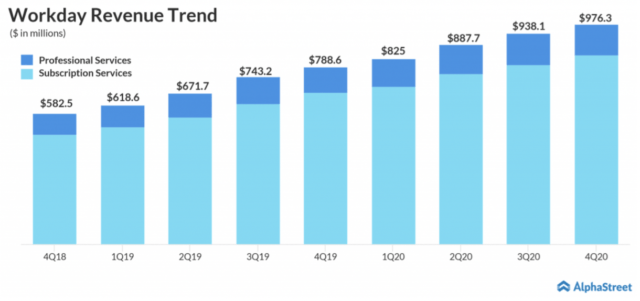

Today, I am going to illustrate how Workday will continue to increase its free cash flow (which is being disguised by aggressive re-investment at present) by continuing to generate revenue from its core HCM business, while it looks for strong growth in its relatively new FINS business.

How Has Workday Come To Dominate Its Market?

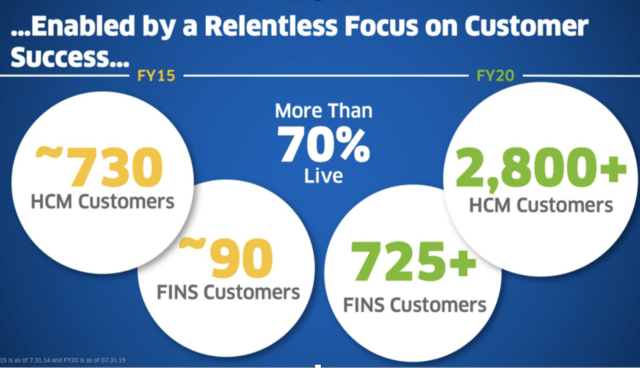

Source: Analyst Day Late 2019

Workday has established a strong customer base for its HCM platform and will continue to generate revenue from current and future partners, as evidenced by its 95% retention rate. The company has been expanding its FINS services and plans to fully develop one suite, within which companies have all the tools they need to drive maximum efficiencies in their HR and finance departments.

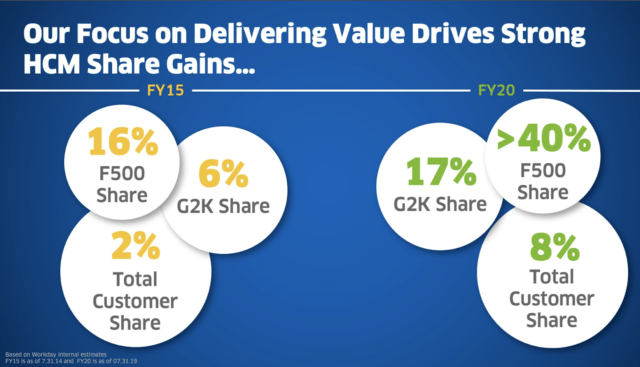

Source: Analyst Day Late 2019

So let’s dive into HCM!

HCM

Managing human capital is often a pain point for businesses as it can often be more of an art than a science, but Workday’s HCM software leverages data analytics and deep learning, by which it assuages this pain. That is, its platform is designed to use data analytics to enable medium and large enterprises to optimize the time and resources of their HR staff.

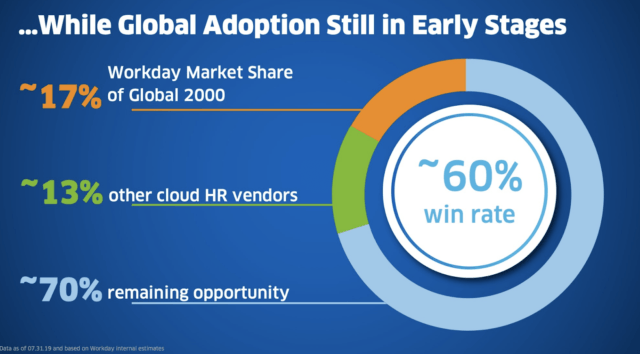

In October of 2019, Aneel Bhusri, said in an interview that there is a “20% penetration in the human resources market.” In that, only 20% of current large scale enterprises have transitioned away from their legacy, on-premise systems into a cloud-based environment. This represents the immense opportunity for Workday to grow its HCM customer base as the market expands, while offering a host of other products, such as FINS.

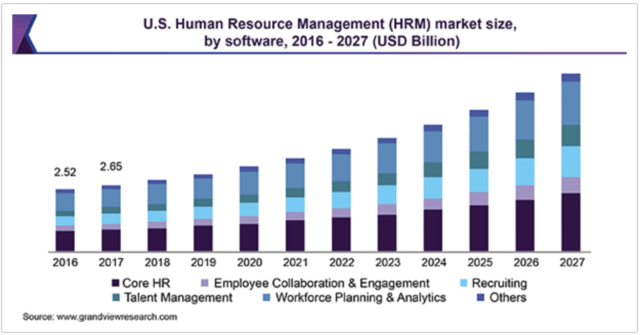

Source: Analyst Day Late 2019

Workday has been able to increase its customer base by over 2000 customers while capturing 40% of the Fortune 500 companies. With the growing trend of digitizing and making “smart” human capital management, Workday will continue to win in this market.

The core human capital management market (and to a greater extent, the cloud-based HCM market) is expected to steadily increase in the U.S as well as internationally. The global market for human capital management is expected to increase 11.7% in CAGR from 2020 to 2027. At the heart of this trend, Workday stands with 97% customer satisfaction rate since 2012. This rate demonstrates it offers a strong service and that the company will be able to expand its markets within the U.S. and internationally, as can be seen below.

Source: Analyst Day Late 2019

In 2019, Workday generated 76% of its revenue from the U.S., but the company is eyeing global growth for the long term.

Diversifying Revenue Streams

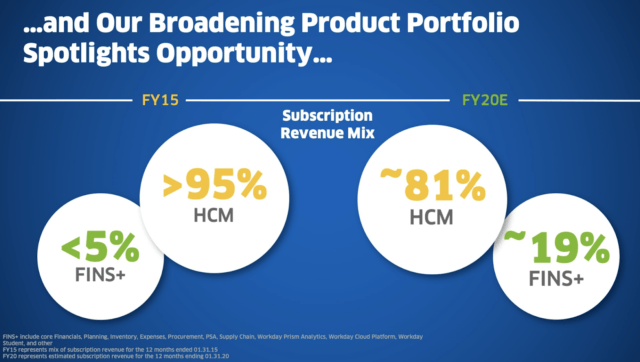

As can be seen below, in 2015, Workday generated greater than 95% of its revenues from HCM alone. Today, the mix is less concentrated, which likely assuages investors’ fears that Workday may be a one-trick pony, so to speak.

Source: Analyst Day Late 2019

FINS

The financial component of Workday’s business brings accounting, consolidation, procurement, projects, reporting, and analytics into one financial management system. The software gives its customers a platform to understand how their company is performing. Here are FINS’ services:

Source: Analyst Day Late 2019

Currently, the company is focusing on growing this segment, since they see large room for growth in financial management software. In October’s interview (linked above), Bhusri said that there is only a 5% penetration in these finance services. Moreover, Workday has developed a strong foundation in this segment. For example, Workday has created a system that performs audits that are fast and cuts costs using AI. It also has an established system that operates in 190 countries markets, which gives them an international advantage over competitors since they’re able to offer their services globally.

And understanding the tax laws (not to mention labor laws) of 190 countries is certainly no small feat!

Talk about a strong moat!

Source: Analyst Day Late 2019

One Ecosystem

Workday’s suite combines the HCM and FINS software to create a full enterprise resource planning system. According to Bhusri, Workday receives 50% of its business from existing customers and the other 50% from new HCM customers. The single system will allow the company to upsell customers who are drawn to its HCM system.

Financial Analysis

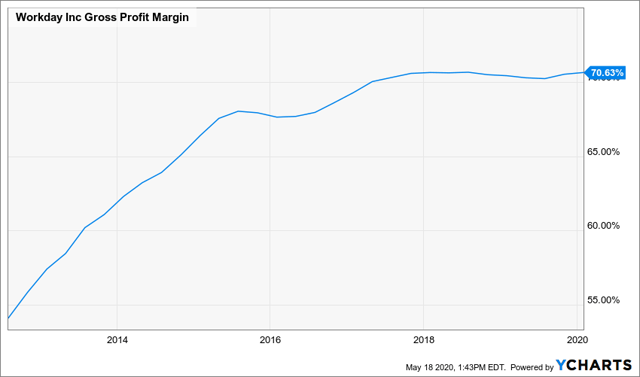

HCM has been the driver for revenue and has been generating lots of cash for Workday, as evidenced by its 70.63% gross margins. Workday is currently reinvesting in its business segments, namely FINS, aggressively so as to generate stable, strong top-line growth. In 2019, the company spent $1.2 billion in research and development and another $1.5 billion in 2020!

Source: YCharts

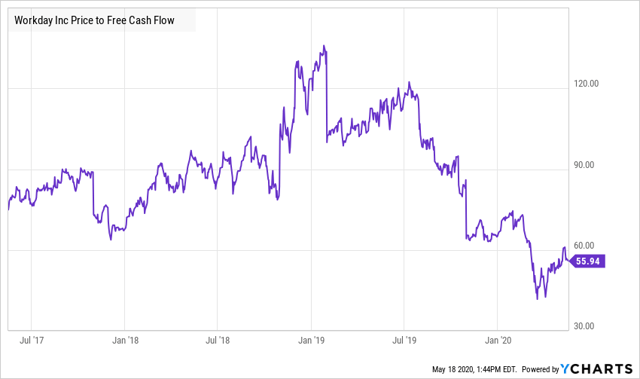

As can be seen below, the company is actually generating steady free cash flow, and its multiple is the lowest it’s been since it went public.

Source: YCharts

So What Should We Pay For It?

L.A. Stevens Valuation Model

To determine a fair value for Workday’s business, we will employ our proprietary valuation model. Here’s what it entails:

- Traditional discounted cash flow Model using free cash flow to equity discounted by our (as shareholders) cost of capital.

- Discounted cash flow model including the effects of buybacks.

- Normalizing valuation for future growth prospects at the end of 10 years (3a.). Using today’s share price and the projected share price at the end of 10 years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

Now, let’s check out the results!

Assumptions:

|

Assumption |

Value |

|

Free cash flow per share |

$5.92 |

|

Free cash flow per share growth rate |

15% |

|

Terminal growth rate |

2% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate |

9.8% |

Source: L.A. Stevens Valuation Model

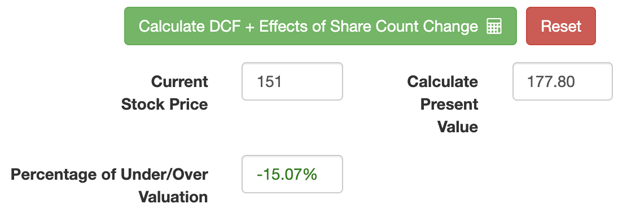

Based on the L.A. Stevens Valuation Model, the stock is trading at 15.07% below its fair value of $177.80.

Implementing Margin Of Safety

Now, the company just grew at 23.8%. The world will invest close to $7T in digitizing the workplace by 2023.

It’s not hard to imagine a scenario where Workday grows at a sustained rate higher than 15% throughout the 2020s.

But we want to create intrinsic value projections such that we can be very, very wrong and still be right!

Hence, I have used extremely conservative assumptions in crafting my valuation.

Total Expected Return

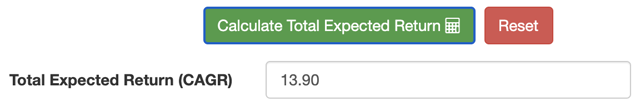

Source: L.A. Stevens Valuation Model

- Therefore, I rate Workday a strong buy as of today (as the price hovers around $170).

Conclusion

Workday is a dominant cloud-based company that has built a strong foundation with its HCM software, on which it is now building out a suite of other products, such as FINS. The company will continue to win under the leadership of its visionary founder CEO while it continues to aid in the transition away from inefficient on-premise, legacy HCM and finance systems.

As always, thanks for reading; remember to follow for more, and happy investing!

Beating the Market: Education, Returns, and Community

Did you find our analysis compelling? Would you like more in-depth, institutional quality analysis, alongside many more incredible, potentially market-beating opportunities?

At Beating the Market (my Marketplace Service), we find dividend payers, high-growth stocks, and a mixture of the two. My stock picks will not only help you achieve your financial goals, but also, they often beat the market.

So start your free two-week trial today to begin beating the market and achieving your financial goals!

Disclosure: I am/we are long WDAY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.