This post was originally published on this site

““I don’t want to own debt, you know bonds and those things.””

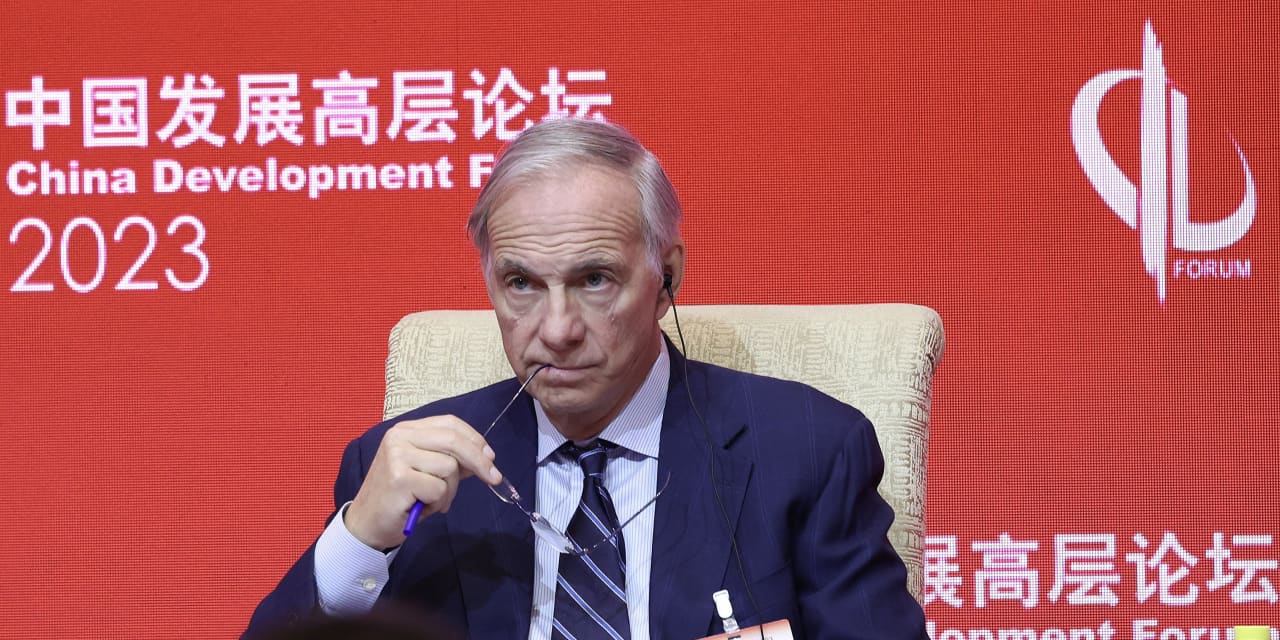

That was the response by the billionaire founder of one of the world’s biggest hedge funds when asked where he would put capital to work right now.

“Temporarily right now, cash, I think is good…and the interest rates are fine. I don’t think they will be sustained that way,” Bridgewater Associates’ Ray Dalio said Thursday at the Milken Institute’s 10th annual Asian Summit in Singapore.

The move into cash has been growing with the yield on the 30-day Treasury bills atop 5%, while investors can also get 4% on certificates of deposit and high-yield savings accounts, but there has also been pushback.

Wells Fargo Investment Institute strategist Veronica Willis told clients last month that even if cash yields stay higher in the near term, history shows investors lose out in the long run as cash tends to underperform and act as a drag on their investments.

Hence the word “temporarily” from Dalio. But his clear disdain for bonds might also run against the crowd, as the 10-year Treasury yield

BX:TMUBMUSD10Y

topped its highest since 2007 last month.

Saira Malik, chief investment officer at Nuveen, recently advised investors to make the shift into longer-dated bonds sooner than later because she says the broader market tends to outperform after a Federal Reserve pause on interest rates and often continues to do well in the following year.

Investors have become less concerned, as of late, that the Fed will keep hiking rates, with inflation data out Wednesday only showing a couple of surprises. Markets are pricing in slim chance of a Fed rate hike in borrowing costs after next week’s meeting, though a hike in November may still be up in the air.

Dalio, who has a net worth of $16.5 billion, according to Bloomberg’s Billionaires Index, said when it comes to investing, he wants to “be in the right places, geographies,” and have diversification. “What I don’t know is going to be much more important than what I do know.”

“Diversification can reduce your risk without reducing the return if you know how to do it well. And then I have to pay attention to the implications of the great disruptions that are going to take place because the world will be radically different tin five years…the next election, the debt situation, all of those things are going to change. And then with the new technologies…it’s going to be like a time warp. It’s a different world.”

And that will “disrupt the disrupters,” so it will be important to know who will be using those technologies in the best way, said Dalio.

Read: Investors need to be wary of ‘priced for perfection’ stock markets, warns Larry Summers