This post was originally published on this site

Federal Reserve Chair Jerome Powell has finally jettisoned the use of the word “transitory” to describe the rise in inflation. But to the Fed’s critics, it’s still not enough.

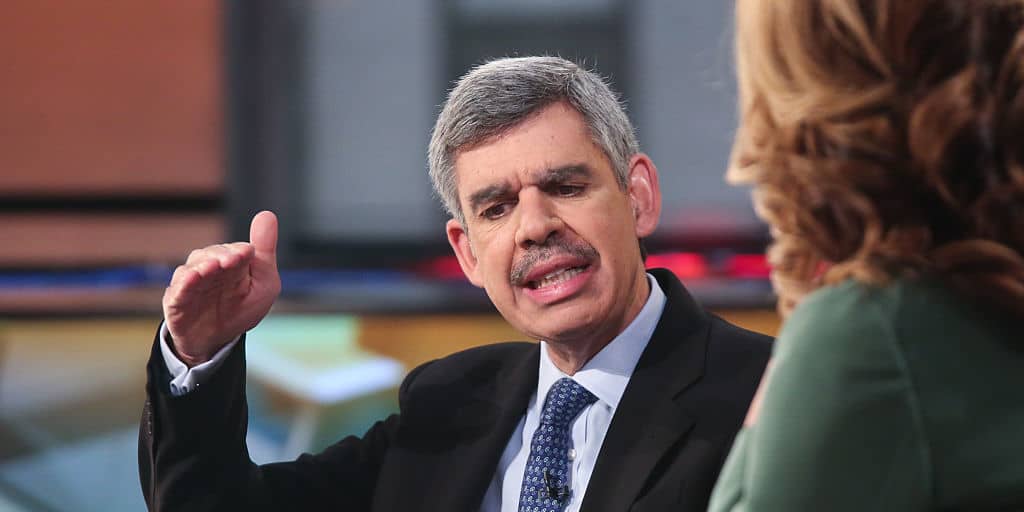

Mohamed El-Erian, chief economic adviser for Allianz, went on the CBS program “Face the Nation” on Sunday and stuck the proverbial dagger in.

“The characterization of inflation as transitory, is probably the worst inflation call in the history of the Federal Reserve. And it results in a high probability of a policy mistake. So, the Fed must quickly, starting this week regain control of the inflation narrative and regain its own credibility. Otherwise, it will become a driver of higher inflation expectations that feed onto themselves.”

The Labor Department on Friday reported that consumer prices rose by nearly 7% in the 12 months ending November, the fastest pace in 39 years.

El-Erian did allow that Powell and the Fed can still catch up now and regain control, as he recommended the Fed ease off the accelerator.

“There is no reason why they should be injecting so much liquidity. There is no reason why they should be boosting the housing market at a time when house prices are pricing Americans out of buying homes. They should ease their foot off the accelerator in order to avoid slamming on the brakes later on,” he said.

The Fed this week is expected to ease off the accelerator by increasing the pace at which it decreases the purchases of bonds.

Arne Petimezas, senior analyst at AFS Group in Amsterdam, said El-Erian might be correct in his analysis of the Fed currently, but not historically, pointing to its inaction during the Great Depression.