This post was originally published on this site

Ray Dalio said he believes that Russia’s invasion of Ukraine is a serious threat to the established postwar world order and leaves him with two critical questions: Will this war spread beyond Ukraine to involve NATO, and how will China respond?

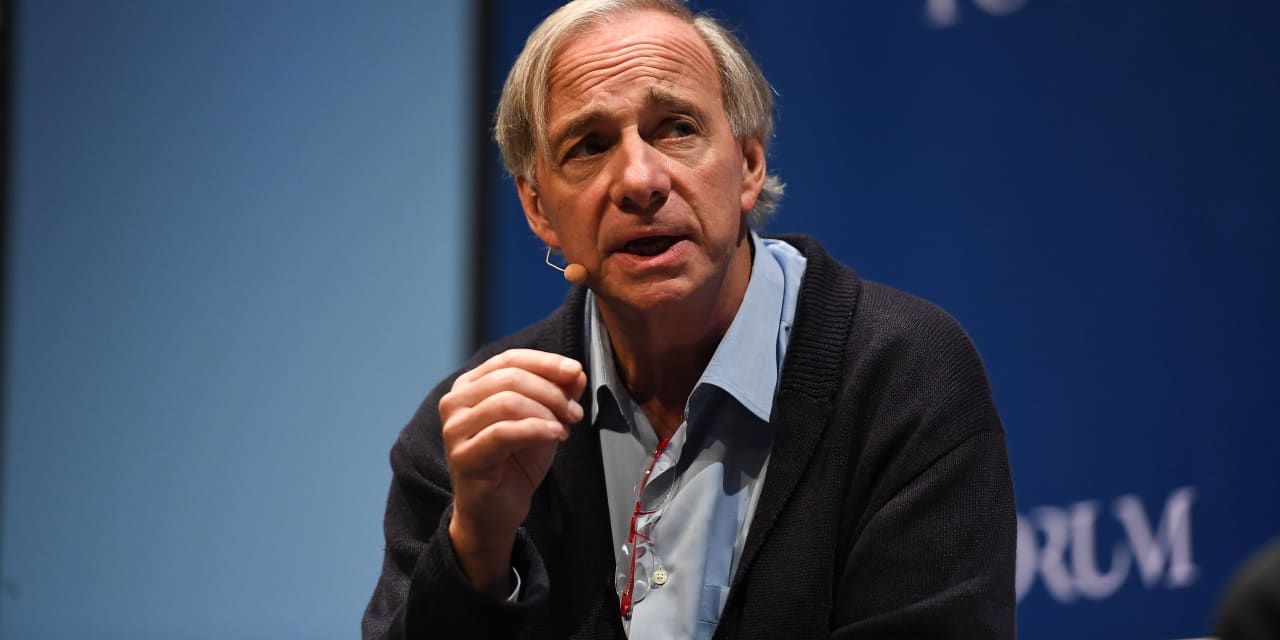

Dalio is the founder, co-chief investment officer and chairman of Bridgewater Associates, the world’s largest hedge-fund firm, and author of “Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail,” which addresses the often-extreme shifts that reshape global politics and financial markets time and again.

In a commentary posted on LinkedIn late Tuesday, Dalio wrote that the economic sanctions that Europe and the U.S. have imposed on Russia and its financial system will take a heavy toll on the Russian economy, at a minimal cost to NATO countries. The sanctions could even bring political change at the top to Russia, he added.

“The economic pain that Russians will feel will be so bad that it would be surprising if there wasn’t big internal opposition to [Russian President Vladimir] Putin’s policies that could threaten or topple his regime.”

Russia’s response to the economic sanctions is uncertain and unpredictable, but could be consequential, Dalio observed. “These circumstances highlight the obvious questions of a) whether Putin will respond by upping the ante by giving NATO countries something big to lose, what that will be, and how it will be handled, or b) whether he can successfully backpedal to have some sort of compromise (unlikely). Putin giving NATO countries something big to lose (e.g., in a nuclear confrontation) would be worrisome.”

China’s role

A second major unknown is how much support China gives to Russia to weather the sanctions. Wrote Dalio: “It would not have been logical for Putin to have taken the path he took alone, and it is well known that China and Russia are very aligned in many ways and that can be very helpful in minimizing the effects of the sanctions.”

Dalio noted that China’s yuan-based payments system could be a way for Russia to conduct international trade now that major Russian banks have been shut out of the global Society for Worldwide Interbank Financial Telecommunication (SWIFT) system. But he said he believes it’s more probable that China would not help Russia in this way. “In any case,” Dalio wrote, “I’m waiting to see what China will do because that will have a big effect on what the rapidly changing world order will soon look like.”

Dalio went on in his post to address the possibility that the Russia-Ukraine conflict and the economic sanctions could ignite a “hot” war involving NATO countries. He observes that military wars are typically preceded by economic wars that include asset freezes, blocks to capital markets access and embargoes — as Western powers have been inflicting on Russia since its invasion began last week.

Said Dalio: “The magnitudes of increases and levels of these are a classic red flag that we should worry about a hot war between the major powers. At this moment we haven’t yet seen a retaliation by Russia, though we are hearing nuclear and other threats. So it appears that we are in the ‘at the brink’ part of the cycle that is just after the big intensification of the economic war attacks and just before the military hot war.”

“ ‘Odds favor not getting into a hot war between Russia and NATO countries for the foreseeable future. At the same time I believe that they aren’t low enough for me to not consider and protect myself against the possibility.’ ”

Dalio emphasized that he was not stating the inevitable. “Odds favor not getting into a hot war between Russia and NATO countries for the foreseeable future,” he wrote. “At the same time I believe that they aren’t low enough for me to not consider and protect myself against the possibility.”

Gold and other safe havens

The possibility of a broader war in Europe casts a shadow on traditionally safe investments, Dalio wrote. “When hot wars happen,” he added, “classically it pays to sell out of debt and buy gold because wars are financed by borrowing and printing money, which devalues debt and money, and because there is a justifiable reluctance to accept credit.” He reiterated a key point in “Principles for Dealing with the Changing World Order”: “Gold — or, in some cases, silver or barter — was the coin of the realm” during wartime.