This post was originally published on this site

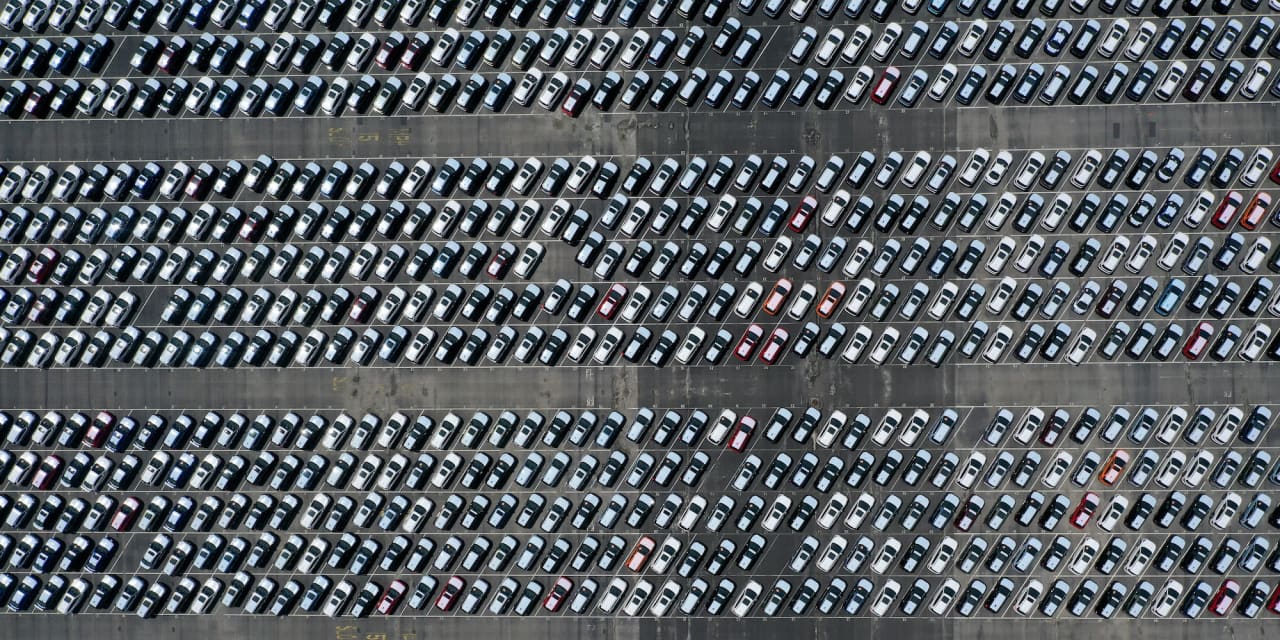

Americans are buying more cars early in 2023 than they did early in 2022. But the pace is already slowing.

New car prices have been rising for most of two years. Used car prices showed a similar rise through the early days of the COVID-19 pandemic, then stabilized and began to fall last autumn. But analysts think that pattern could reverse, with new car prices falling and used car prices rising if current trends hold.

Check out: The 2024 Honda Prologue: Honda’s new electric SUV is attractive and spacious. When can you get one?

Sales rate fluctuating early this year

Auto industry analysts measure sales by calculating the seasonally adjusted annual rate (SAAR). It removes normal seasonal fluctuations — Americans buy more cars some months than others in pretty predictable patterns, so the measure smooths them out. The SAAR then multiplies the month’s sales rate by 12 to show how many cars Americans would buy if they shopped at this rate all year.

In an average pre-pandemic year, Americans bought as many as 17 million new cars. Last year, we bought just 13.7 million.

In January, sales sped up, not to pre-pandemic rates, but much higher than last year’s figure. The SAAR got as high as 15.7 million.

It has since cooled off. Cox Automotive predicts that, when February ends, it will land at about 14.4 million — not much higher than the slow rate of 2022.

Price pattern could flip

But within the sales figures lies an exciting trend. New car prices have steadily risen, but analysts think that could change.

Most new car buyers borrow money to buy their cars. Repeated Federal Reserve interest rate increases have new car loans growing more expensive.

Meanwhile, a microchip shortage has forced automakers to be picky about which cars they build. Knowing high-interest rates mean only high-income, good-credit consumers can easily afford new cars, car builders have focused on mainly producing high-end models. That cycle has left new cars hard to afford.

Also see: The cost of car insurance is up—why it’s going to get worse

Used car supplies, meanwhile, are rebounding from pandemic lows. That has made new car prices more affordable.

“We have diverging markets today,” explains Charlie Chesbrough, senior economist at Cox Automotive (Kelley Blue Book’s parent company).

“New-vehicle prices remain high while used retail prices are now in decline. New inventory is slowly stabilizing while used supply is falling,” he says. “However, I wouldn’t be surprised to see this situation change later in the spring.”

High new car prices could send many buyers “leaving the new market for the used,” Chesbrough explains. Car dealers “may find they have too little used inventory,” which could push prices up.

Factories, meanwhile, “may find they have too much new-vehicle inventory and be forced to be more aggressive with incentives to boost sales.”

There are already some signs the flip has started. New car prices fell slightly in January. Sticker price is just part of what makes it hard, or easy, to afford a new car. New cars grew more affordable as incomes improved, and the average monthly payment ticked down for the first time in six months.

Read next: Used car values are dropping. Here’s when forecasters expect prices to normalize

Used car prices also fell in January, so the flip hasn’t begun in earnest. But dealers had fewer used cars to sell in February. If that pattern holds, used car prices could rise even as new car prices fall.

This story originally ran on KBB.com.