This post was originally published on this site

(Bloomberg) — Japanese stocks dropped and U.S. futures surrendered gains Tuesday after a wave of initial enthusiasm about central banks kicking into gear to protect the global economy had stoked global equities.

Australia’s dollar rose even after the central bank cut its benchmark rate by a quarter point, underscoring how traders’ expectations have rapidly shifted in recent days. Some investors flagged the risk that policy makers fail to move with sufficient size and urgency. The yen climbed and Treasuries rallied anew. Chinese and Korean stocks kept their earlier gains, however, and extended its Monday rally.

Central bankers from the U.S., Japan and Europe have in recent days pledged to act as appropriate to address mounting risks from the coronavirus and Group of Seven finance chiefs confer by phone Tuesday. The Reserve Bank of Australia, in its policy statement Tuesday, noted that expectations are for further monetary stimulus by most economies in coming months, including the U.S.

“If the Fed surprises in a meaningful way, that could help further — but you could argue the market already discounts it,” said Quincy Krosby, chief market strategist at Prudential Financial Inc (NYSE:). “I’m also looking to see if we have anything from the fiscal side,” she said. Packages such as Italy’s $4 billion effort “are the sorts of headlines that would boost confidence that governments are prepared to act,” she said.

The central banks’ turn follows signs of mounting damage to the global economy. The OECD is warning that growth will sink to levels not seen in more than a decade. Global manufacturing contracted in February by the most since 2009 as the outbreak severely disrupted demand, trade and supply chains.

Here are some key events coming up:

- U.S. citizens in states including California and Texas will vote on “Super Tuesday” for a Democratic candidate to run against President Donald Trump in November’s election.

- The Bank of Canada has a rate decision on Wednesday.

- OPEC ministers gather in Vienna on March 5-6.

These are the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 1:39 p.m. in Tokyo. The S&P 500 Index rose 4.6%.

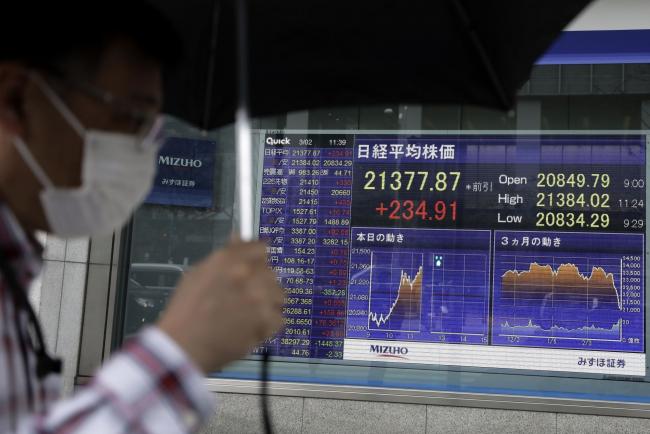

- index dropped 0.9% after rising as much as 1.7% earlier.

- Australia’s S&P/ASX 200 Index climbed 0.9%.

- South Korea’s Kospi index rose 1.5%.

- Hong Kong’s rose 0.8%.

- added 1.4%.

- MSCI Asia-Pacific Index added 0.7%.

Currencies

- The Japanese yen rose 0.5% to 107.78 per dollar.

- The was little changed at 6.9708 per dollar.

- The euro gained 0.2% to $1.1151.

Bonds

- The yield on 10-year Treasuries fell about four basis points, to 1.12%.

- Australia’s 10-year bond yield fell about three basis points to 0.78%.

Commodities

- West Texas Intermediate crude climbed 2.4% to $47.87 a barrel.

- Gold rose 0.6% to $1,598.75 an ounce.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.