This post was originally published on this site

It certainly seems that Jerome Powell got more hawkish after he was re-nominated to be Federal Reserve chair.

The so-called Powell Pivot occurred in late November, barely a week after President Joe Biden re-nominated him, when he suddenly said it wasn’t right to call inflation “transitory” and warned of tighter policy ahead.

He wouldn’t be the first Fed chair to turn more hawkish in a second term, according to a draft of a research paper.

Matt Peron, director of research at Janus Henderson, and Yosef Bonaparte, the director of external affairs in finance and associate professor of finance at CU Denver Business School and a Janus Henderson research associate, have studied the impact of the seniority of Fed chiefs.

Their hypothesis was that the longer the Fed chair stayed in office, the more investors learn about their policies. Another hypothesis was that Fed chiefs in the first term would be reluctant to make rate hikes because they didn’t want the economy to slow, which would lower the likelihood of being reappointed by the president.

In a draft paper, the authors finds economic policy uncertainty drops by 11% in the second, and more, terms of a Fed chair.

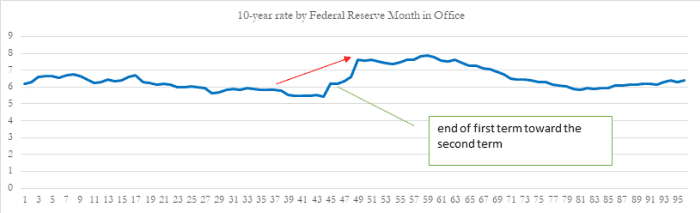

Bond yields also rise. The 10-year Treasury

TMUBMUSD10Y,

on average, rises by 98 basis points in the latter terms, and the 2-year yield

TMUBMUSD02Y,

rises by an average of 57 basis points.

The good news, looking at the chart, is that bond yields then fade later in the second term. The data runs from June 1976 to Oct. 2021.