This post was originally published on this site

Hedge-fund manager John Paulson has often told the story of how his sister cried when his father brought home a baby grand piano and not the Steinway she had hoped for because the Steinway’s price was out of reach.

Paulson, who famously made billions of dollars shorting the housing market ahead of the 2008 financial crisis, grew up to acquire not just a Steinway piano (several, in fact) but the entire company back in 2013 and is now preparing to take Steinway Musical Instruments Holdings Inc. back to the public markets after a nine-year stint as a private company.

The underwriters, a team of eight banks led by Goldman Sachs, BofA Securities and Barclays, have not yet set terms for the deal. But the company is planning to list on the New York Stock Exchange, under the ticker symbol “STWY,” and not its previous ticker symbol “LVB,” a tribute to Ludwig van Beethoven.

Coming in the midst of a very dry spell for initial public offerings, the deal is expected to spark some buzz.

“Steinway should be a refreshing IPO for the market,” said James Gellert, chief executive of RapidRatings, a company that assesses the finances of private and public companies.

“Very strong [financial health] companies debuting are rare and Steinway seems just the right company to emerge despite a volatile equity market. A super brand name, recognizable business, storied history and rare asset to come to market combined with strong, long-term [core health] and strong short term [financial health] is just what the market needs.”

Gellert was referring to RapidRatings’ metrics for evaluating the financial strength of a company, its financial health rating, or FHR, and core health score, or CHS. The former is a measure of short-term probability of default, and the latter evaluates efficiencies in a business over a two- to three-year perspective.

Gellert acknowledged that many IPO momentum buyers look for high-growth tech businesses and biotechs to fuel the space, “and Steinway is anything but flashy and new-economy.” If investors are seeking a strong business, however, this will be a welcomed offering, he said.

Steinway was launched in 1853 in New York City, by German immigrant Henry Engelhard Steinway, who built the first Steinway piano in a loft on Varick Street in Manhattan.

That early craftsmanship has built the company into one of the best-known makers of musical instruments in the world and one of the most revered. A range of musicians and artists, from China’s Lang Lang to recent Grammy winner Jon Batiste, use Steinway pianos for recording and live performances.

The company has two reporting segments: piano and band. The latter offers instruments under the Conn-Selmer umbrella. The company has 33 retail showrooms across the world and a network of about 180 dealers with local knowledge and ties to musical communities.

The company is divided into two reporting units: piano and band.

Steinway Musical Instruments Holdings Inc.

Its main factory is still in New York, located in Astoria in Queens, and it also makes pianos in Hamburg, Germany.

In 2015, the company launched the Steinway Spirio, which as well as being playable like any piano, can play itself, allowing consumers to enjoy recorded performances by renowned pianists in their own homes.

By 2019, that technology was expanded with the launch of Spirio | r, to include recording and high-res editing as well as playback capabilities. In 2021, the company launched Spiriocast software, which allows consumers to instantly stream live performances synced with video and audit from one Spirio | r piano to another across the world.

Here are 5 things to know about Steinway ahead of its IPO:

It’s profitable, and the outlook is positive

Steinway had net income of $59.3 million in fiscal 2021, up from $51.8 million in fiscal 2020, according to its IPO filing documents. Sales rose to $538.4 million from $415.9 million.

RapidRatings confirms its strong underlying health with an FHR of 79 in 2021, up from 60 in 2020. That puts it firmly in the company’s low-risk category.

Steinway’s CHS climbed to 67 in 2021 from 47 in 2020, suggesting “high levels of efficiency and a strong foundation supporting long-term viability and sustainable performance,” said RapidRatings.

In fact, the company scored highly overall in leverage, liquidity and earnings performance. It showed strength in five of seven performance categories, and was cash-flow positive in the most recent year with coverage of capital expenditures and debt both very strong.

The piano segment remains the dominant one, accounting for 75.5% of fiscal 2021 sales. The Americas region accounted for 53.6% of sales, followed by 28.4% in the Asia-Pacific region.

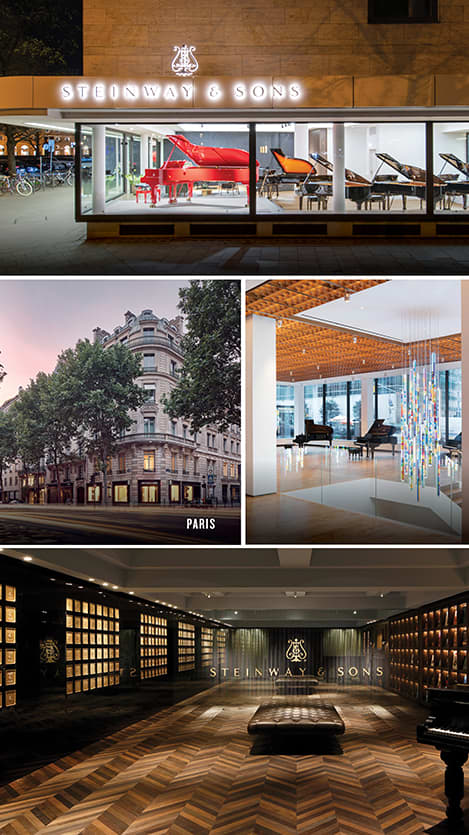

Steinway retail locations in, clockwise from top, Munich, New York, Tokyo and Paris.

Steinway Musical Instruments Holdings Inc.

As pianos are a “high-performance and professionally-endorsed offering, meticulously crafted through an intensive process lasting at least six months,” the company can only produce a limited volume and has to sell them at a high price point.

That leaves the company sensitive to macroeconomic conditions and to the coronavirus pandemic, which not only shuttered stores but forced the cancellation of events and recitals, which are key means of marketing its products.

In 2013, the company initially negotiated a sale to private-equity firm KKR & Co. for $35 a share to shore up its financial position. It was during a “go shop” period allowing other bidders to enter the fray that Paulson agreed to pay $40 a share, or a total of $512 million.

Since then, Paulson has invested in technology, in manufacturing processes and machinery, in training the workforce, and in company-owned showrooms, including the Steinway Hall retail and performance space in Midtown Manhattan, which was designed by architect Annabelle Selldorf.

Steinway is a luxury play

Steinway’s pianos are not cheap. A grand piano costs between $60,000 and $340,000, according to the IPO prospectus. A smaller, upright piano starts at $40,000.

That puts the company squarely in the global personal-luxury-goods category, which is expected to grow to $1.3 trillion by 2026 from $945.8 billion in 2021, according to Euromonitor data cited in the prospectus.

But luxury goods, which include the priciest cars, jewelry, yachts and other high-end items, is a highly competitive field.

“If the Steinway brand becomes less attractive to consumers and HNWI (high-net-worth individuals) and UHNWI (ultrahigh-net-worth) populations choose to purchase other luxury goods instead of our Steinway pianos, demand for our products could decline and have an adverse impact on our financial condition and results of operations,” the company warns.

Steinway is placing a big bet on China

Steinway is not shy about its ambitions to grow in China, which is home to the second largest group of high-net-worth individuals in the world after the U.S. — and to many aspiring concert pianists.

China is the biggest market in the world for pianos with an average of about 400,000 a year sold, according to Steinway’s prospectus, compared with an average of about 30,000 a year in the U.S.

The company’s main production facility is in Queens, in New York City, and another manufacturing site is in Hamburg, Germany.

Steinway Musical Instruments Holdings Inc.

Roughly 30 million Chinese children take piano lessons, according to statistics from the Chinese Musicians’ Association, some likely influenced by the likes of Lang Lang and Yuja Wang, both of whom have commercial relationships with Steinway.

“Over 40,000 children participated in Steinway’s 2021 International Children & Youth Piano Competition in China,” according to the prospectus.

“To further serve the growing population of developing pianists in China, the Juilliard School made one of the largest orders of pianos in Steinway history in 2019 for its first overseas campus in Tianjin, China.”

That trend is unlikely to change soon, given the broad-based support offered by the Chinese government to develop musical talent. The government has invested heavily in opening new concert halls, and the number of concert halls that own Steinway pianos has grown to 134 in 2021 from just 11 in 2012.

Creating beautiful musical instruments requires rare skills — and that’s a risk

Steinway’s pianos are made by highly skilled craftspeople through an artisanal process that takes up to six months. Those workers are hardly ten-a-penny.

“Many of the skills we require are not typically taught in traditional universities or schools,” the prospectus observes. “For example, the process of bending the Steinway piano rim is an acquired skill and not widely taught. Similarly, the skills required to construct and repair our pianos are taught only in highly-specialized trade schools or passed down from generation to generation.”

Should anything upset that chain, the company may not be able to “sustain our historical technologies,” derailing its business. For now, it relies on in-house training and mentoring.

“If we are unable to retain or attract employees with the technical expertise to promote the growth of our Spirio line, our business, reputation and financial condition could be adversely affected,” concedes the prospectus.

It needs to beef up its accounting oversight

Steinway admits to one risk factor that might be more closely associated with a startup, or a young company with little experience of the demands of public market disclosures.

“In connection with the audit of our consolidated financial statements for fiscal year 2020, we identified certain material weaknesses in our internal controls over financial reporting,” the company says in its prospectus. “Specifically, we did not have sufficient processes for the provisioning and governance of user access to financially significant systems that resulted in a lack of segregation of duties related to journal entries.

The company also did not have adequate processes in place to allow for “accurate and timely financial reporting according to GAAP as related to noncash stock-based and other compensation,” it continues.

Read now: The IPOs to expect in 2022: Reddit, Instacart and others could hit Wall Street