This post was originally published on this site

Nearly all of European Wax Center Inc.’s clients — some 95% — are women, according to Chief Executive David Berg, making men a target market for growth at the newly public company.

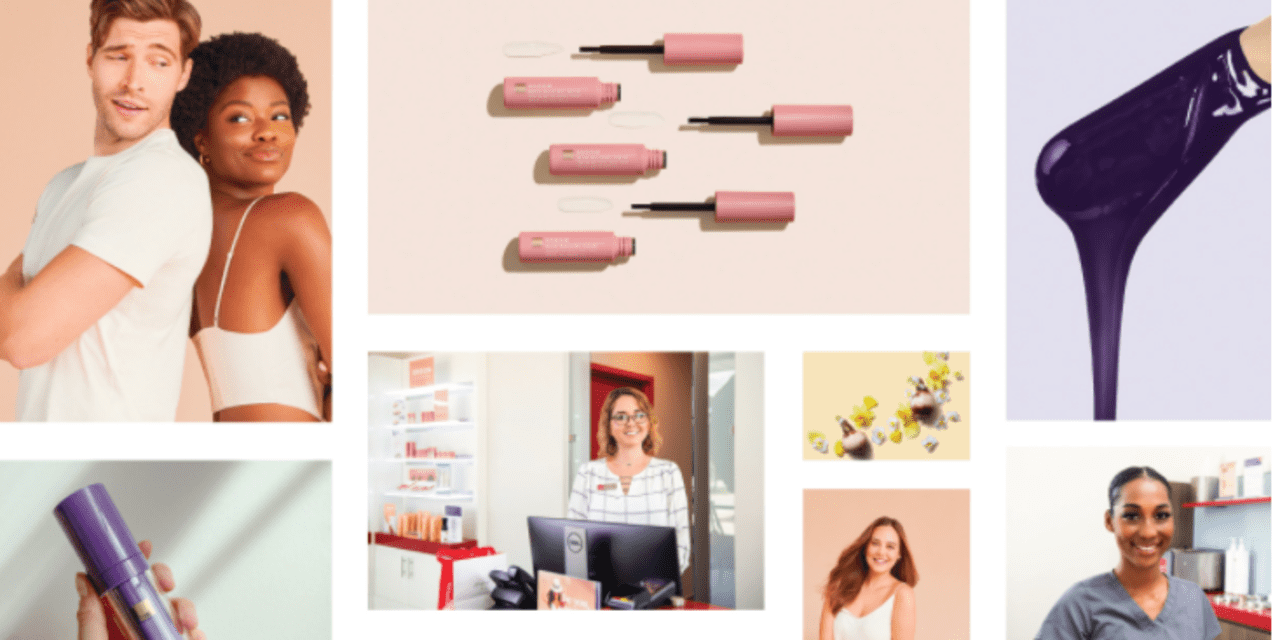

European Wax Center

EWCZ,

offers services including bikini waxing, and waxing of the eyebrows, back and legs. The company also sells skincare products.

The company began trading last Thursday, with shares jumping nearly 12% out of the gate. Shares priced at $17. The stock was recently trading up 3.5% at $23.04.

“Waxing is recurring in nature,” Berg told MarketWatch after the IPO.” Our best guests are coming in on a regular basis as part of (a) beauty and skincare routine.”

Berg says that waxing started as an infrequent habit, something done for a significant other or a special occasion. Now, “guests are doing this for themselves,” with clients ranging in age from 18 to 60.

Nonetheless, European Wax Center said in its prospectus that the business is subject to seasonality, with higher demand leading into summer and holidays.

See: Exclusive: Impossible Foods names new CFO ahead of rumored IPO

The company is a highly-franchised one, with more than 260 franchisees as of March 27, 2021, many of them operating more than one location. Maintaining good relations with franchisees and the damage that franchisees could do to the business are among the risk factors described in the prospectus.

There were 808 locations across 44 states as of March 27, 2021, of which five were corporate-owned. There could be more than 3,000 locations in the U.S. in the next 15 years, the prospectus said.

Systemwide sales totaled $469 million in 2020, down from $687 million in 2019. Sales had steadily increased between 2010 to 2019 before COVID-19, according to the company’s prospectus.

Revenue in 2020 was $103 million, down from $154 million the year before. For the 13 weeks ending June 26, revenue totaled $47.6 million.

European Wax Center acknowledges that it has a lot of debt, at a pro forma $175 million as of March 27. That debt is mentioned as one of the risk factors in its filing documents.

The company puts its total addressable domestic market at $18 billion in a fragmented category that includes beauty salons and other waxing-focused operators.

With the company setting its sights on the next phase of growth, going public is an indication to prospective staff members and franchisees that European Wax Center is a desirable to invest in as a career and business, and a sign to guests that this is a company that ought to be trusted with a personal and intimate service, Berg said.

Plano, Tex.-based European Wax Center is a controlled company, with General Atlantic Equityholders in possession of 54.5% of the of the combined voting power of outstanding common stock.

European Wax Center is also an emerging growth company, which means it does not have to make the same disclosures required of bigger public companies. A business remains an emerging growth company until it reaches a number of milestones, including annual revenue of more than $1.07 billion.

European Wax Center does not intend to pay a dividend.

Berg has been CEO since October 2018. Jennifer Vanderveldt has been chief financial officer since December 2020. Prior to that, she was head of strategy for consumer insights and analytics at Michaels Cos.

With events and summer travel coming back, clients have also been getting waxed again.

“As we reopen centers post-COVID, we knew they were going to come back. And they kept coming back,” Berg said. “With doing nails and getting a haircut, it’s part of the self-care regimen.”

The Renaissance IPO ETF

IPO,

is flat for the year to date while the benchmark S&P 500 index

SPX,

has gained 18%.