This post was originally published on this site

After a flurry of initial public offering launches last week set the market up for a busy fall for deals, 11 are expected to price this week and raise more than $3 billion in proceeds.

If all deals materialize, it will make 2021 the biggest year for IPO proceeds ever, and shatter the previous record by about 30%, according to Bill Smith, founder and chief executive of Renaissance Capital, a provider of institutional research and IPO exchange-traded funds. The market is expected to see some 375 deals for the year, raising $125 billion, according to Renaissance, beating the $97 billion raised in 2000 during the dot.com boom.

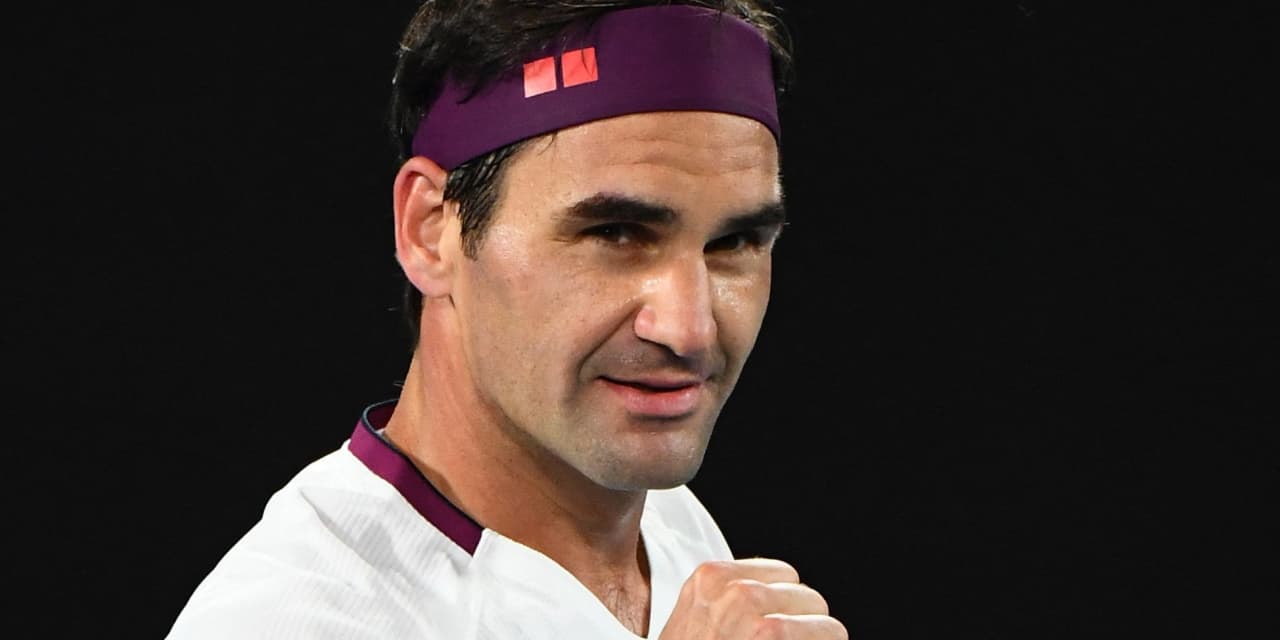

“After the long summer break, this week is a litmus test for upcoming tech, biotech, and consumer IPOs,” Smith wrote in commentary. The list includes a Swiss sneaker company backed by tennis giant Roger Federer, a drive-through coffee kiosk operator and a mortgage insurer that was spun out of insurer Genworth Financial.

The biggest deal of the week is expected to come from Thoughtworks

TWKS,

a Chicago-based technology consulting firm company that will go public at a valuation of up to $6.1 billion.

The company, which expects to change its name to Thoughtworks from Turing Holding Corp. with the IPO, said a total of 36.84 million shares will be offered in the IPO, split between the company and selling shareholders.

The deal is expected to price at between $18 and $20 a share and the stock will trade on the Nasdaq under the ticker symbol “TWKS.” Goldman Sachs and JPMorgan are the lead underwriters. The company recorded net income of $79.3 million on revenue of $803.4 million in 2020, after income of $28.4 million on revenue of $772.2 million in 2019.

Swiss sneaker maker On Holding

ONON

is expected to raise up to $622 million at a valuation of almost $6 billion. On has applied to list 31.1 million shares priced at $18 to $20 each on the New York Stock Exchange, under the ticker symbol “ONON.”

Also: Burn in the U.S.A.: Why grill maker Weber has a big supply-chain advantage over its competitors

Related: European Wax Center has plenty of room to grow and a business built on consistency, analysts say

Goldman Sachs, Morgan Stanley and Morgan Stanley are lead underwriters in a syndicate of nine banks on the deal. Proceeds are to be used for general corporate purposes. The company has a line that it co-developed with Federer.

Also: Warby Parker IPO: 5 things to know about the affordable eyeglass maker before its direct listing

The company had net income of 3.8 million ($4.1 million) Swiss francs in the six months through June 30, after a loss of 33.1 million francs in the year-earlier period, according to its IPO documents. Sales came to 315.5 million francs, up from 170.9 million.

Also from Switzerland, sports betting site Sportrader Group AG SRAD plans to offer 19 million shares priced at $25 to $28 each, or a valuation of up to $31 billion. The company has applied to list on Nasdaq under the ticker “SRAD.” JPMorgan, Morgan Stanley, Citigroup and UBS are lead underwriters in a syndicate of 13 banks working on the deal.

Proceeds will be used for working capital and to spur growth. The company had a net profit of $29.9 million in the first six months of the year, on revenue of $321 million, according to its filing documents.

Dutch Bros Inc.

BROS,

an operator of drive-through shops that serve hot and cold drinks mostly in western states, is planning to offer 21.1 million shares priced at $18 to $20 each in its IPO, valuing the company at up to $3.3 billion.

BofA Securities, JPMorgan and Jefferies are lead underwriters in a syndicate of 13 banks working on the deal. The company has applied to list on the New York Stock Exchange under the ticker symbol “BROS.”

Proceeds are to be used to purchase additional Class A shares — the company is planning to have four classes of stock with differing voting rights. The company had a net loss of $13.6 million, or 32 cents a share, in the first six months of the year, narrower than the loss of $16.5 million, or 38 cents a share, posted in the year-earlier period. Revenue fell to $227.9 million from $327.4 million.

Rounding out the list are:

• Definitive Healthcare Corp. DH,, a Massachusetts-based provider of healthcare commercial intelligence, is planning to offer 15.56 million shares in its PO, which is expected to price between $21 and $24 a share. At that pricing, the company could be valued at up to $3.55 billion.

• Enact Holdings Inc., a mortgage insurer owned by Genworth, is planning to offer 13.3 million shares priced at $19 to $20 each. The company would be valued at $3.3 billion at the top of that range. The company said all shares will be sold by Genworth and it will not receive any proceeds. It has applied to list on Nasdaq under the ticker “ACT.” Goldman Sachs and JP Morgan are lead underwriters in a team of nine banks working on the deal.

• ForgeRock FORG, a California-based identity security platform, is looking to raise up to $264 million with an offering of 11 million shares priced between $21 and $24 a share. That pricing would value the company a valuation of up to $1.91 billion.

The stock is expected to list on the NYSE under the ticker symbol “FORG.” Morgan Stanley and JPMorgan are the lead underwriters. The company recorded a net loss of $41.8 million on revenue of $127.6 million in 2020, after a loss of $36.9 million on revenue of $104.5 million in 2019.

• Dice Therapeutics

DRNA,

is expected to raise up to $170 million at a valuation of up to $583 million and list on Nasdaq under the ticker “DICE.” The biotech is developing therapies to treat chronic diseases in the field of immunology.

• Surgical robotics developer Procept BioRobotics

PRCT,

is aiming to raise up to $132 million at a valuation of about $1 billion with plans to list on Nasdaq under the ticker “PRCT.” BofA Securities and Goldman Sachs are lead underwriters.

“We develop, manufacture and sell the AquaBeam Robotic System, an advanced, image-guided, surgical robotic system for use in minimally-invasive urologic surgery with an initial focus on treating benign prostatic hyperplasia, or BPH,” the company says in its IPO documents.

• Tyra Biosciences is aiming to raise $107.2 million in proceeds at a valuation of $589 million. The biotech’s leading product candidate is a treatment for bladder cancer. It has applied to list on Nasdaq under the ticker “TYRA.”

• EzFill Holdings, anapp-based mobile-fueling company in South Florida, is planning to raise $25 million at a valuation of $100 million. The companyt as applied to list on Nasdaq under the ticker “EZFL.” ThinkEquity is sole underwriter.

The Renaissance IPO ETF

IPO,

has gained 6% in the year to date, while the S&P 500

SPX,

has gained 19%.