This post was originally published on this site

If Walmart Inc. wasn’t family-controlled or Lyft Inc. didn’t have a dual-class stock structure, shareholder resolutions calling on both companies to disclose more information about their lobbying activities would have passed this proxy season.

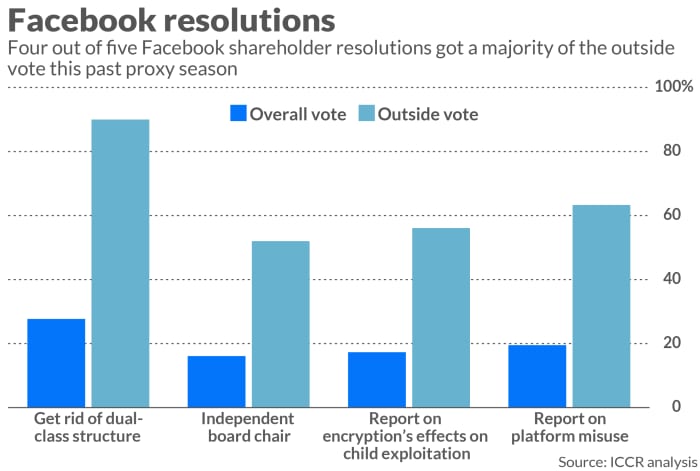

Similarly, four out of five shareholder proposals at Facebook Inc.

FB,

received a majority of outside votes this year despite showing lower overall vote totals. And not counting Chief Executive Mark Zuckerberg’s 57.9% of voting power, the company’s own proposal about board directors’ compensation barely passed, getting just 50.9% of outside votes, according to an analysis by the Interfaith Center on Corporate Responsibility.

As some of the nation’s biggest and most influential companies face pressure to make changes amid the growing trend of socially responsible investing, their shareholders can only do so much. Companies like Facebook

FB,

Walmart

WMT,

and Lyft

LYFT,

— where insiders or family members like the Waltons of Walmart have majority or near majority control — can disregard shareholder proposals and demands about everything from more transparency about political contributions to racial-equity audits. At such companies, most shareholder resolutions are doomed.

“At Facebook, the annual general meeting is largely just theater,” said Robert Bartlett, a law professor at UC Berkeley who teaches securities regulation and corporate finance. The proposal that got the most outside votes this year? The one calling for Facebook to dump its dual-class stock structure, which got only 27.7% of the overall vote but 90% of the outside vote.

Frustrated institutional investors and shareholder advocacy groups say all they can do is keep trying to push companies in as many ways as possible — and that it will take both internal and external pressure to push for changes.

“There’s an arrogance about it that just cries out for some sort of justice,” said Michael Connor, executive director of Open MIC (Media and Information Companies Initiative), a nonprofit that works on socially responsible investing. Socially responsible investing — also known as environmental, social and governance (ESG) — has grown more popular in recent years, and is especially so among younger investors. Surveys show they care more about investing in companies whose values align with theirs than their older counterparts.

Connor added: “Once you’ve sold the company to the public, it’s the public’s company.”

See: ESG investing now accounts for one-third of total U.S. assets under management

Compounding the issue is that dual-class stock IPOs have done better than those with a single class of stock recently, according to data from a professor who tracks IPOs.

Jay Ritter, a finance professor at the University of Florida who collected the data, has an explanation for that: “A larger fraction of the dual-class IPOs have been tech stocks, and tech stocks have outperformed other sectors.”

So while some investors may show their displeasure by divesting from certain companies, “the fact that the dual-class IPOs have done well, on average, has led investors to be relatively complacent,” Ritter said.

Before the crop of companies that have gone public over the past couple of decades that adopted multi-class stock structures, such structures were “fairly rare,” Bartlett said. “You saw it in media companies because you wanted editorial independence and didn’t want that to be compromised.”

A rise in corporate takeovers in the 1980s changed that, with dual-class stock structures becoming more popular as a way to try to fend them off. Then Google went public in 2004 with shares with unequal voting rights (Class A shares were worth one vote apiece while Class B shares were worth 10 votes each), and other tech companies followed suit — like Facebook. And in 2017, Snap Inc.

SNAP,

went public and gave common stockholders no voting rights. Other well-known companies with multi-class shares have since made their debuts on the public stock markets, including Lyft, Pinterest Inc.

PINS,

DoorDash Inc.

DASH,

and Airbnb Inc.

ABNB,

In-depth: Snap backlash won’t stop founder-friendly stock structures

According to Ritter’s research, in 1980, 1.4% of initial public offerings were by companies that had dual-class shares. In 2004, when Google had its IPO, that number was 7.5% and has been mostly in the double digits since. Last year, 20% of all IPOs and 43.2% of tech IPOs were dual-class-share companies. This year, through the end of July, dual-class companies comprised 28.9% of all IPOs and 45.8% of tech IPOs.

In the case of Facebook, the social-media giant has been under fire for a variety of issues for several years as its power and reach have grown. But it continues to report increasing revenue and profit, and its stock has outperformed the S&P 500 and the rest of the tech industry in the past five years, according to FactSet.

What could help keep companies accountable, according to Bartlett: If the Securities and Exchange Commission tied listing requirements to dual-class structures with sunset provisions. And he said index providers “have been very aggressive in pushing for one vote for one share.” For example, in 2017 Standard & Poor’s and FTSE Russell announced they would no longer include companies with multi-class stock structures in their indexes, although some such companies remain because they were grandfathered in.

Year to date, 7% of companies in the S&P 500 index had unequal voting rights, while in the Russell 3000 that number was 9.4%, and in the IT sector-heavy GICS 45 it was 10.2%, according to ISS Corporate Solutions.

“There’s a lot of public focus and concern around companies like Facebook making decisions and the influence and power they have,” said Richard Clayton, research director at CtW Investment Group. “If there was a one-vote-per-share structure in place when Facebook went public, then the company would’ve already made big changes.”

The other shareholder proposals that got majority outside votes at Facebook: one calling for an independent chair (Zuckerberg is both chairman and CEO); another calling for a report on how the company’s encryption technology is affecting child exploitation; and a call for a board report on platform misuse.

See: Facebook opposes adding civil-rights expert to its board

At ride-hailing company Lyft, where the executive officers and other insiders have more than 37% of voting power, the shareholder proposal urging more disclosure of the company’s lobbying got a 39.5% overall vote but a 73.4% outside vote.

“These tech companies are doing well if you look at the value of their stock,” said Josh Zinner, CEO of the Interfaith Center on Corporate Responsibility, which represents nearly 300 institutional investors. “Our concerns are about the long-term sustainability of companies and their impact on society. That’s measured over time.”

But the dual-class stock structure is not always bad for a company or society, some experts say.

“There’s shareholder activism that’s short-term in nature,” said Michael Callahan, a law professor at Stanford University who’s also executive director of the Arthur and Toni Rembe Rock Center for Corporate Governance. “It can be distracting for employees, morale and the culture” of a company, especially one whose founder may have a long-term vision that needs time to come to fruition.

Ritter agreed, and mentioned activist investors who push for hostile takeovers that can result in employees losing their jobs, for example.

Checks and balances are important, Callahan acknowledged. He pointed to internal pressure, such as employee activism, which can influence a company’s policies. And shareholders are making a difference, depending on the issue. According to shareholder-advocacy group As You Sow, there were 34 majority votes for ESG shareholder resolutions as of June 2021, beating last year’s record of 21.

“Exxon was a watershed event,” Callahan said, referring to an activist hedge fund winning three board seats at Exxon this year as it agitated for the oil giant to adopt clean-energy policies. “The market can do a lot.”