This post was originally published on this site

Funds that specialize in U.S. high-yield or “junk bonds” have been reckoning with their worst outflows to start a year since 2010, according to a tally by Goldman Sachs research.

With another large $3.5 billion of weekly outflows through Thursday, investors have withdrawn a total of $15.8 billion from U.S. junk-bond funds since the year began, the most over the same stretch in a dozen years, per Goldman.

“In both the USD and EUR markets, the composition of fund flows continues to show a strong aversion towards HY bonds,” Goldman’s credit research team lead by Lotfi Karoui, wrote in a weekly client note.

The rebuke of junk-bond funds and other risk assets comes as the Federal Reserve prepares to tackle inflation pegged at 40-year highs, first by raising short-term rates for the first time since 2018, and then by starting to shrink its near $9 trillion balance sheet.

European high-yield bond funds saw $1.5 billion in weekly outflows, pegged by Goldman analysts as the largest ever.

Sentiment further soured on Friday after White House National Security Adviser Jake Sullivan said that Moscow was in position to mount a “major military action” in Ukraine, and that an invasion could begin “any day now.”

The Dow Jones Industrial Average DJIA was off about 500 points at last check Friday afternoon, or 1.5%, while the S&P 500 index SPX was down 2% and the Nasdaq Composite Index COMP was 2.8% lower. U.S. stocks also were headed for weekly losses.

Credit investors often sell ETFs first for liquidity when markets get choppy. The iShares iBoxx $ High Yield Corporate Bond ETF,

HYG,

the sector’s biggest U.S. junk-bond exchange-traded fund, was down only 0.3% Friday, at last check, but off 4.9% on the year, according to FactSet.

Extractions this year from U.S. junk-bond funds represent the equivalent of shedding 3.8% of the sector’s assets under management from the start of 2022, according to Karoui’s team.

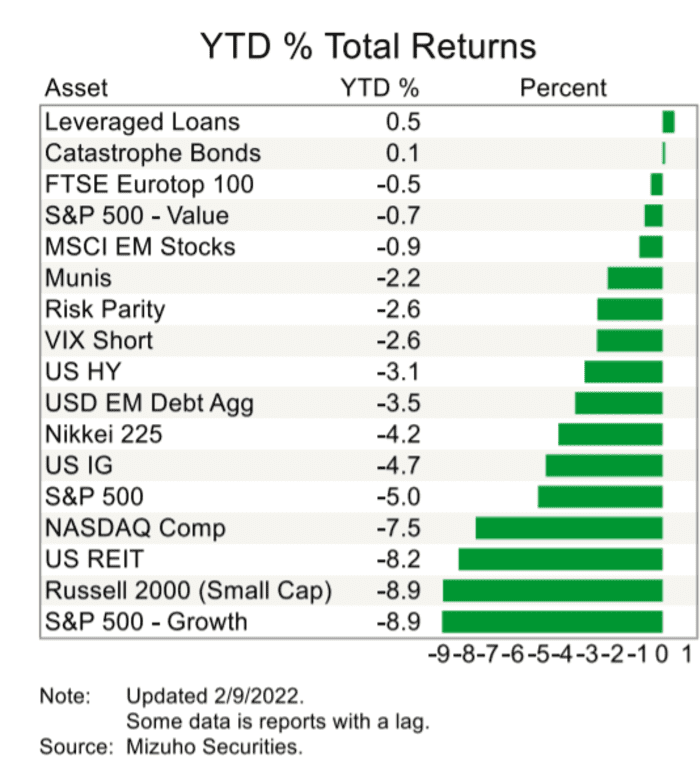

The prospect of the “Fed moving from its multi-year campaign of ‘easy’ monetary policy to one of monetary policy tightening threw markets into a tailspin to start the year,” Mizuho Securities’ Brian Zinser, chief corporate bond strategist, and his team wrote, in a Thursday client note.

Mizuho’s team charted out, by asset class, the wall of negative total returns on the year-to-date, showing few sectors of financial markets were in positive territory through Feb. 9:

U.S. high yield total returns down 3.1% on the year, but far worst for other assets

Mizuho Securities

“Investor sentiment shifted dramatically, as inflation data & commentary from the Fed caused markets to reassess risks across asset classes,” the team said, adding that climbing 10-year Treasury yields

TMUBMUSD10Y,

used to price everything from commercial property loans to corporate bonds, this year has added to “a deep hole” for corporate credit returns.