This post was originally published on this site

Inflation’s a global phenomenon as disruptions to supply chains affect product availability globally, but it’s particularly hot in the U.S.

Consumer prices in the 12 months ending November jumped 6.8%, the fastest growth rate in 39 years. In the euro zone, consumer prices climbed 4.1%, while in Japan consumer prices rose a scant 0.1%.

One reason U.S. inflation might be hotter than the rest of the world is how countries decided to help their workers in the early days of the pandemic.

The U.S. mostly relied on generous unemployment benefits and direct stimulus checks, while Europe and Japan, by contrast, mostly relied on furlough programs.

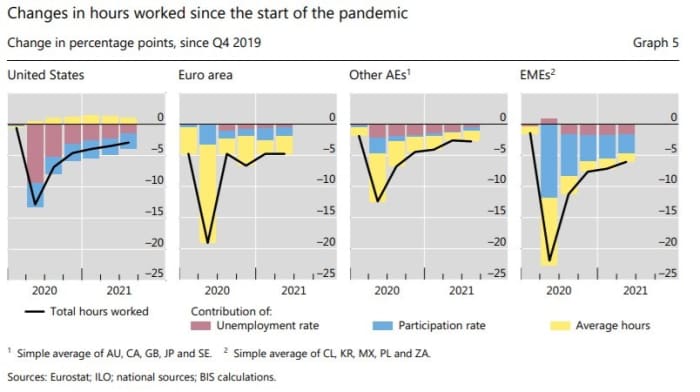

Hyun Song Shin, economic adviser and head of research at the Bank for International Settlements, finds that in some respects, the differing strategies got the jobs market back to similar places. Since the fourth quarter of 2019, the change in hours worked followed similar paths.

But the composition was far different. In the U.S., the rise in average hours worked was mostly due to lower unemployment, as well as a pickup in participation in the jobs market. In other developed markets, Shin found, the rise in average hours worked reflects workers taking on more hours at the same companies where they were previously employed.

Europe and Japan have not confronted the same issues the U.S. has found with a surge in job openings. “Preserving the employment relationship appears to have kept the economy on a path where the recovery is closer to bringing the economy to its pre-pandemic state, at least in terms of the Beveridge curve relationship,” said Shin, who previously was an economics professor at Princeton University. The Beveridge curve refers to the relationship between job openings and unemployment.

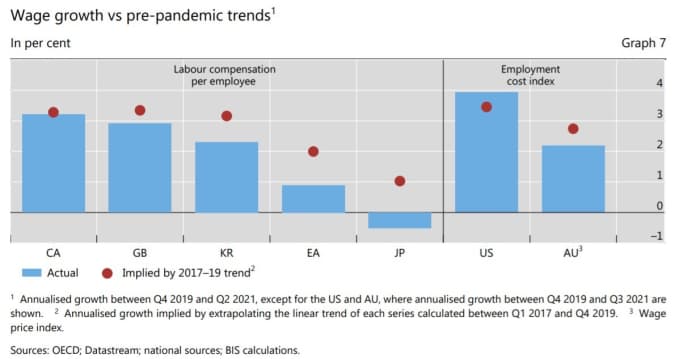

The U.K., he concedes, is one place that did rely on furlough programs but also has seen a rise in job vacancies. But in most advanced economies, average wage growth is more or less in line with pre-pandemic trends, or a little below. “It is notable, however, that in the United States, where labor market changes are most apparent, wage growth has picked up despite labor market conditions that appear weaker than before the pandemic,” he said.

And that’s why he suggests the U.S. might be facing an inflation problem longer than other economies.

“The key to gauging where global inflation is headed is in the labor market, and whether the reduced efficiency of matches exhibited in the Beveridge curves of some economies translates into a more sustained wage-price spiral. In this respect, longer-term structural issues are more important in understanding the current state of the global economy, especially when we consider future inflation developments,” he said.