This post was originally published on this site

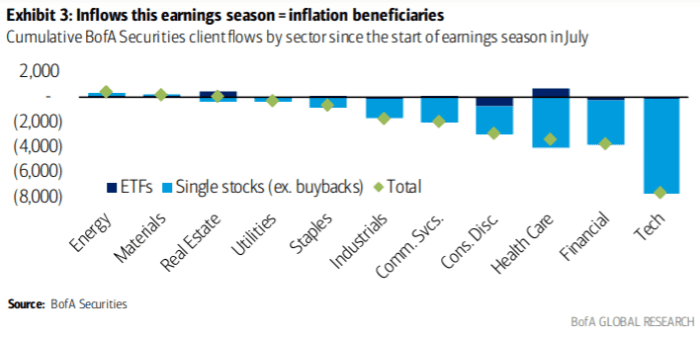

Investors have favored three sectors since companies began reporting in July the results of their earnings for the second quarter, moving capital into areas poised to benefit from higher inflation, according to BofA Global Research.

“Amid skyrocketing mentions of inflation on earnings calls,” BofA Global Research strategists said in a report this week that “clients have been buyers of equities in just three sectors: energy, materials and real estate.”

The strategists tracked BofA client capital flowing into and out of exchange-traded funds and single stocks, finding total inflows in few of the S&P 500’s 11 sectors. Energy attracted the most inflows, while technology saw the biggest outflows as clients bailed on single stocks during second-quarter earnings season, according to a chart in their Wednesday night report.

BOFA GLOBAL RESEARCH REPORT DATED SEPT. 8

“Energy and financials saw the biggest inflows last week, though the latter was entirely driven by buybacks,” the BofA strategists said in the report. Excluding buybacks, they said that energy and real estate led.

The energy sector

SP500.10,

of the S&P 500 index is down about 12% this quarter, according to FactSet data Thursday afternoon. In contrast, real estate

SP500.60,

has jumped almost 8% since the end of June, while the materials sector

SP500.15,

had advanced almost 2% in the third quarter, the data show.

Meanwhile, the S&P 500 index

SPX,

which is up almost 5% this quarter, was edging lower Thursday afternoon. The index has slipped in the last three days of trading, including Friday before Labor Day weekend.

Read: A nearly 10% S&P 500 correction last September has stock-market investors dreading autumn 2021

BofA clients, including hedge funds, institutional and retail, were net sellers of U.S. equities last week for the first time in three weeks, according to the report. The net selling was led by outflows from single stocks while passive investing remained “in vogue,” the strategists said.

“Clients continued to buy ETFs last week despite outflows from single stocks, with flows into both equity and fixed income ETFs,” they wrote. They’ve “still been big cumulative buyers of ETFs” this year.

The three sectors of the S&P 500 favored by investors as inflation mentions spiked during earnings season for the second quarter have put up big returns in 2021.

The Real Estate Select Sector SPDR Fund

XLRE,

has soared nearly 31% this year, while the Energy Select Sector SPDR Fund XLE has risen about 26%, according to FactSet data, at last check. The Materials Select Sector SPDR Fund is up about 16%.

Check out: Why uranium ETFs are going nuclear — almost literally — and how that trend might persist