This post was originally published on this site

Investors should watch this part of the Treasury yield curve for recession signals, according to the Wells Fargo Investment Institute.

With talk of a recession ramping up on Wall Street as the Federal Reserve gears up to fight high inflation, investors may want to keep an eye on the slope of the yield curve between 10-year Treasury yield

TMUBMUSD10Y,

and its 1-year

TMUBMUSD01Y,

counterpart.

When the 10-year rate briefly fell below the 2-year yield in April, the inversion raised concerns that the American economy could be headed for its next downturn. But as the Fed tries to engineer a “soft landing” for the economy without wrecking the recovery from the pandemic, the strategy team at the Wells Fargo Institute thinks there could be a better way to monitor signs of a looming recession.

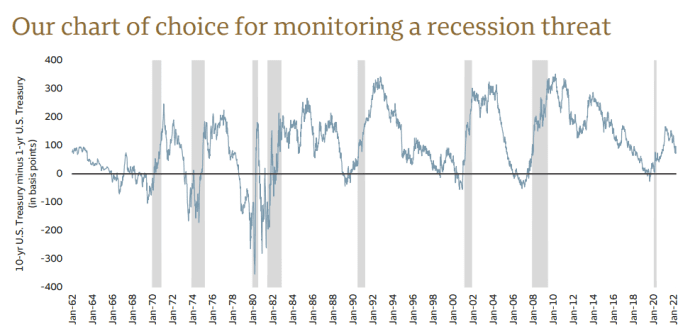

“If investors want to select a single yield curve spreads as a signal, we favor watching for when the 1-year U.S. Treasury yield exceeds the 10-year U.S. Treasury yield — by more than 25 basis points, and for at least 4 consecutive weeks,” wrote the Wells team led by Brian Rehling, head of global fixed income strategy, and Luis Alvarado, investment strategy analyst.

That hasn’t happened yet (see chart), or not since the U.S. tumbled into a brief but sharp 2020 recession at the onset of the pandemic.

This part of the yield curve may be a better recession indicator

Wells Fargo Investment Institute, Bloomberg, Federal Reserve Bank of St. Louis FRED database

Several points along the Treasury curve have been in focus this year. How accurate has a 10s/1s inversion been in predicting past recessions? “We saw at least a 4-week inversion between 19 and 93 weeks before each of the last 7 recessions (shaded are in chart) — with an average of 43 weeks, or just over 10 months, before a U.S. recession officially started,” the team said this week, in a client note.

Furthermore, when pegging the inversion to several weeks and a 25-basis-point trigger, the team said this type of inversion “would be a strong indication that a recession is likely within in the next 12 months.”

U.S. stocks were aiming for a bounce on Wednesday, a day after the Nasdaq Composite

COMP,

fell to its lowest level since December 2020. The Dow Jones Industrial Average

DJIA,

was up about 300 points, at last check, and the S&P 500

SPX,

was up 1%, according to FactSet.

Read: Are recession worries overblown? Here’s why a downturn appears far off