This post was originally published on this site

Bear markets have to end some time. But investors would do well to remember that many seeming bear-market exits prove to be a false dawn.

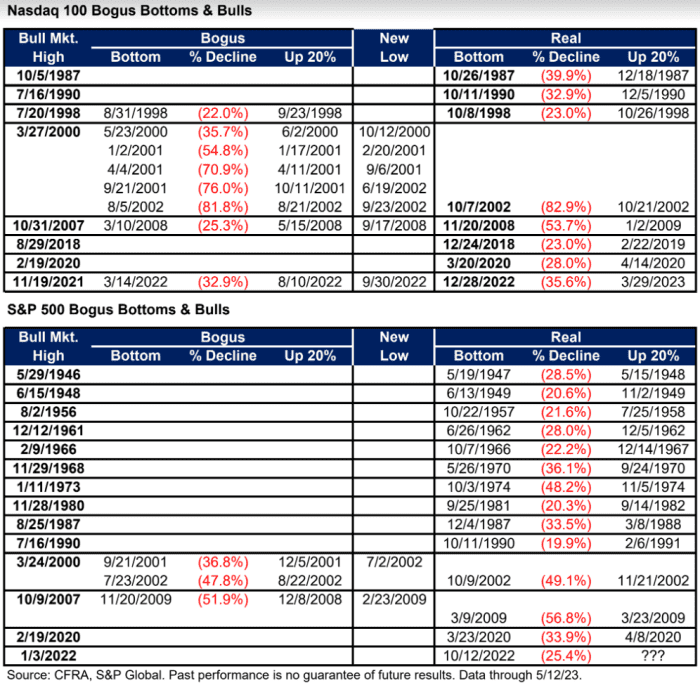

Sam Stovall, chief investment strategist at CFRA, noted media hoopla over the Nasdaq-100’s

NDX,

entry into a new bull market on March 29, after closing more than 20% above its bear-market low set on Dec. 28 — a pullback that saw the tech-concentrated index drop 35.6% from peak to trough.

The problem, he observed in a Monday note, is that “both the Nasdaq-100 and S&P 500

SPX,

have a history of setting bogus bear market bottoms and prematurely indicating the start of subsequent new bull markets, as defined by a 20% advance off of the prior bear market low.” (See tables below.)

CFRA

Under the criteria used by Dow Jones Market Data and many other market watchers, a 20% rise from a recent low signals the start of a bull market while a 20% fall signals the start of a bear market. That means the market is always in either a bull or bear market. Also, the market doesn’t hop into and out of either a bull or bear each time it crosses the threshold again. It takes another 10% or 20% move in the opposite direction to change the status.

As shown in the table, there have been eight bear markets for the Nasdaq-100 since its inception, Stovall said. And half of those bears saw bogus bottoms, with 20% advances off of the greater-than-20% declines subsequently eclipsed as the Nasdaq100 then fell to even lower lows during the bear markets of 1998, 2000-02, 2007-09, and 2021-23.

“Already, the current bear market experienced one bogus bottom. Time will tell if the current bull is for real,” Stovall wrote.

Similar warnings were issued last week when the Nasdaq Composite

COMP,

closed 20% above its recent bear-market low.

The S&P 500, the U.S. large-cap benchmark, has yet to exit the bear market it entered last year after sliding from an record close in early January 2022. The Dow Jones Industrial Average

DJIA,

exited its bear market in November.

The S&P 500 has also been subject to fake bear-market exits, but with far less frequency. Of the 14 bear markets since WWII, only two — 2000-02 and 2007-09 –– suffered bogus bottoms, Stovall said. During the 2000-02 episode, investors saw two such fake-outs, but only one during the 2007-09 period.

The potential for such fake-outs explains why there’s far from a universal embrace of the 20% rule. Some analysts contend a new bull market doesn’t begin until the previous high is taken out, while others use more complicated criteria.

Stovall noted the Nasdaq-100’s 2000-2002 bear market that followed the dot-com bubble burst saw five fake-outs, with an even lower low set between a half-month and 8.2 months after a “bogus bottom” was signaled.

“Therefore, one might conclude that new bull markets have to satisfy two criteria: 1) the 20% climb off of the bear market bottom that 2) does not set an even lower low within nine months,” he said.