This post was originally published on this site

World leaders are soaking up the spotlight at the Glasgow climate summit, but the pressure to implement whatever is agreed will fall largely on companies, noted analysts at Deutsche Bank. And that’s going to create divisions between the corporate haves and have-nots.

Read: India’s Modi surprises COP26 climate summit with 2070 target for net-zero emissions

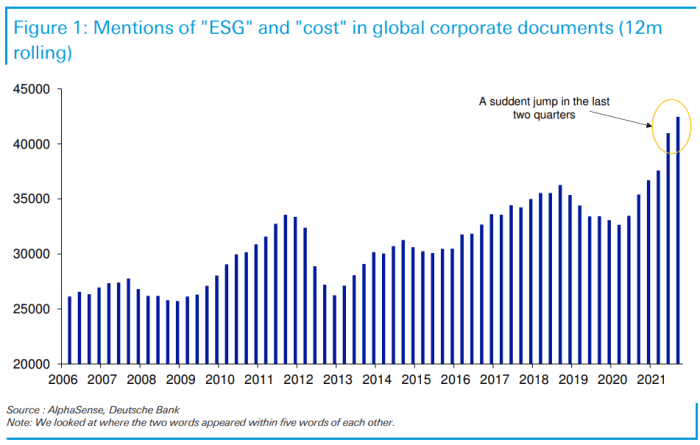

The analysts screened 15 years of corporate documents, counting the number of times “ESG,” the acronym for environmental, social and governance criteria, and “cost” appeared within five words of each other. As the chart below shows, the frequency has jumped in the last two quarters.

Deutsche Bank

Following the climate summit in Glasgow, U.K., known as COP26, companies will be pushed via policy or social pressure to spend more on efforts to mitigate climate change, wrote Jim Reid, macro strategist at Deutsche Bank, in a Tuesday note summarizing the research. The cost may be high, but proactive firms are already being rewarded by customers and investors, he observed, while those that delay could face penalties.

The problem, the analysts found, is that companies with the greatest carbon intensity, even within sectors, have lower cash reserves and profit margins. That will make it harder for them to bear the cost of reducing their carbon profile, Reid said, and is “likely to risk making the strong relatively stronger and the weak, relatively weaker.”

Don’t miss: What is COP26 and when does this ‘ambitious’ global climate change event begin?

It isn’t all bad news, however. Reid said the companies in the bank’s consumer surveys show that customers are more willing to seek brands where they believe the company’s climate story, while investors are eager to grab climate-focused corporate bonds.

“Still, this is a double-edged sword,” Reid wrote. “Where a company is deemed to lag its peers, product boycotts are becoming more common.”

U.S. stocks were extending gains Tuesday, with investors focused on the start of a two-day Federal Reserve policy meeting. The Dow Jones Industrial Average

DJIA,

S&P 500

SPX,

and Nasdaq Composite

COMP,

rose modestly, scoring another round of all-time highs.