This post was originally published on this site

Europe as a whole could feel the pinch of higher energy costs after Russia’s invasion of Ukraine briefly sent the price of crude above $100 a barrel for the first time in more than seven years.

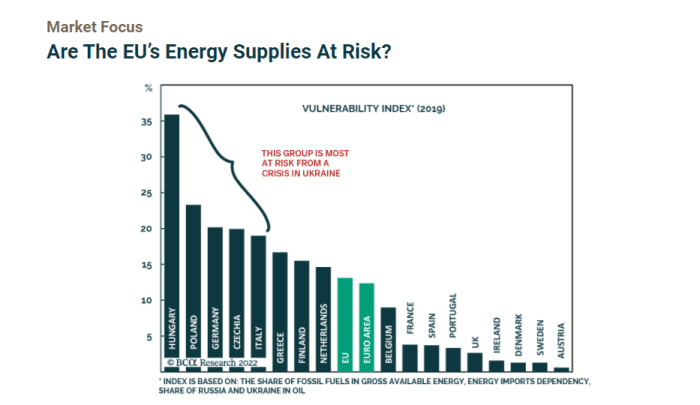

A closer looks shows that a handful of individual countries would be most at risk to energy shocks following Moscow’s military assault, starting with Hungary, Poland, Germany, Czechia and Italy, according to BCA Research.

Hungary tops the list of countries in Western Europe most vulnerable to energy shocks from Russia’s war in Ukraine.

BCA Research

“The danger is that either Russia halts its energy exports to Europe or EU sanctions target the Russian energy sector,” BCA Researchers wrote, in a client note.

The team also pointed to a common interest among both parties to continue energy trade, with energy supplies from Russia being integral to economies in the European Union and fossil-fuel sales counting as a major Russian revenue source.

Crude prices

CL00

BRN00

edged below $95 a barrel on Friday, as Russian troops entered Kyiv, Ukraine’s capital, but also as news reports said Russia might be willing to engage in talks with Ukraine’s leadership.

Earlier this week, German Chancellor Olaf Scholz suspended the Nord Stream 2 natural-gas pipeline, a complete but not yet operating undersea pipeline that connects Russia to Europe via Germany.

Read: Why Russia’s invasion of Ukraine could lift oil prices to a 14-year high

Back in the U.S., President Joe Biden on Thursday promised to do everything in his power to lessen the pain felt at the gas pump, while announcing new sanctions against Russia to punish it for the invasion, but also to deter Moscow from expanding its war beyond Ukraine to NATO nations.

In One Chart: Epic stock-market bounce shows investors care ‘not about war but sanctions’, analyst says

U.S. stocks shot higher Friday, with the S&P 500

SPX

and Nasdaq Composite Index

COMP

both aiming for weekly gains around 0.7%, even with the outbreak of war. The Dow Jones Industrial Average

DJIA

was up about 800 points at last check, but off about 0.1% for the week, according to FactSet.

The two big U.S. junk-bond exchange-traded funds

HYG

JNK,

which have outsize exposure to energy producers, were on pace for 0.8% weekly gains.

Also see: Why the energy shock from Russia’s invasion of Ukraine won’t wreck the stock market