This post was originally published on this site

Small-cap stocks appear to have staged a long-sought breakout to the upside, with the Russell 2000 on Tuesday joining major benchmarks in record territory for the first time since March. But one chart watcher worries the move may be attracting too much attention.

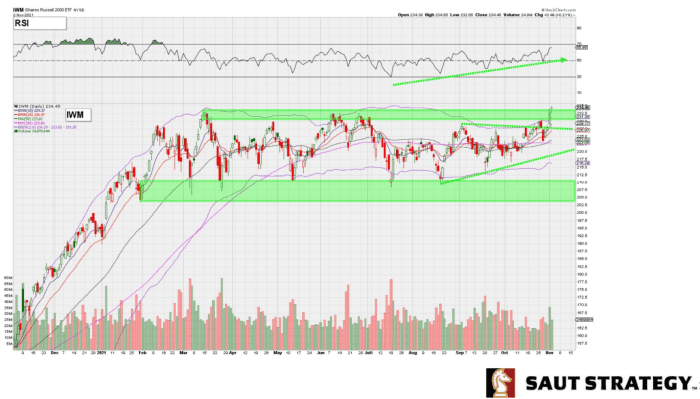

“Ignoring everything else, the small-caps hitting new all-time highs is a good thing…The problem, though, is that too many other eyes may also be on this chart and the breakout,” wrote technical analyst Andrew Adams in a Wednesday note for Saut Strategy.

The Russell 2000

RUT,

an index that tracks the 2,000 smallest stocks in the broad Russell 3000

RUA,

was up 1.2% on Wednesday, a day after claiming its first record close since March 15. The move appeared to break the index out of a trading range that’s prevailed over the last eight months.

Adams pointed to the chart below for the index-tracking iShares Russell 2000 ETF

IWM,

Saut Strategy

Small-caps, which had surged in late 2020 and early 2021 on optimism over the reopening of the U.S. and global economy, had subsequently trailed large-cap benchmarks which have hit a series of records in recent weeks.

The Russell is up 21.1% in the year to date, compared with a 23.1% gain for the S&P

SPX,

The S&P 500, Dow Jones Industrial Average

DJIA,

and Nasdaq Composite

COMP,

each ended at a third consecutive record on Tuesday.

Adams said he suspects one of two scenarios that will complicate the move for small-caps:

[T]his could take the form of a false breakout where IWM has to first pull back before trying to break out later for real. Or on the flip side we could wake up one morning to much higher small cap levels that force traders and investors to decide if they want to pay up and buy or wait to see if a dip occurs. A ‘gap and go’ move can be very powerful, so I will be on the lookout for something like these two options to occur.

Either scenario is more likely than a boring breakout that produces a slow-and-steady uptrend, he said. That’s particularly the case with large-cap averages pushing up against “near-term extremes,” which could make it difficult for them to keep pace with small-caps, potentially fueling the “false breakout” scenario.

“The market rarely makes it so easy to make money, so any time something looks overly obvious, there is potential for something to happen to throw off the ‘cleanness’ of the pattern,” warned Adams, who said he does think small-caps will probably move higher and provide another leg to the upside.