This post was originally published on this site

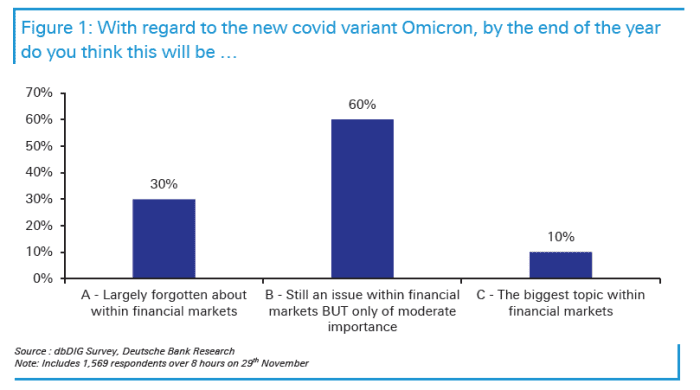

Investors aren’t dismissing the omicron variant’s potential to shake up financial markets, but only a small minority expect it to be the top worry when the bell rings on 2021 at the end of next month, according to a flash poll of clients conducted by Deutsche Bank on Monday.

That makes for a “relatively relaxed financial market which will be a worry if the news flow becomes negative on the variant,” said Deutsche Bank macro strategist Jim Reid in a note.

Deutsche Bank Research

Based on 1,569 responses, the survey found that only 10% expect the variant to be the “biggest topic” within financial markets on Dec. 31 (see chart above), while 60% see it as likely to be still an issue, “but only of moderate importance.” The remaining 30% expect the variant to be “largely forgotten.”

The takeaway, said Reid, is that markets “are probably not set up for bad news on this front. So, negative omicron news is likely to be bad for markets without huge additional stimulus.”

Reid, in a note, added that for his part he would have opted for the “moderate” B choice “with a bias nearer to A than C, so I will be equally offside if omicron becomes a game changer.”

It could be a couple of weeks before health officials can determine whether omicron is more transmissible or lethal than previous variants, leaving vulnerable to headline-driven volatility.

The World Health Organization on Monday said the overall global risk from omicron is “very high.” President Joe Biden on Monday said that Americans won’t have to deal with the types of lockdowns that some Europeans are facing.

The discovery of the omicron variant late last week sparked a global stock market selloff that saw the Dow Jones Industrial Average

DJIA,

plunge more than 900 points, or 2.5%, while the S&P 500

SPX,

and Nasdaq Composite

COMP,

also slid more than 2%. Oil futures tanked, with the U.S. benchmark

CL00,

plunging 13%, while Treasury yields tumbled as investors sought safety in government paper (yields and Treasury prices move in opposite directions).

Thin trading conditions were blamed for amplifying market moves in Friday’s shortened trading sessions a day after U.S. markets were closed for Thanksgiving. Stocks and crude were both reclaiming some of the lost ground in Monday’s session as Treasury yields rose.