This post was originally published on this site

Mentions of environmental, social and governance in corporate earnings calls skyrocketed since the onset of the pandemic, according to investment-management firm Pimco.

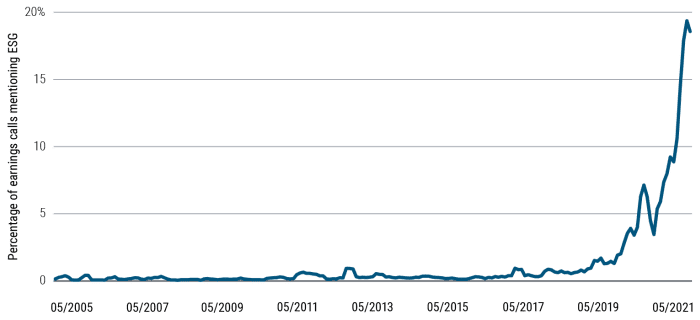

Pimco, which oversees $2.2 trillion in assets, analyzed earnings call transcripts of about 10,000 global companies between May 2005 and May 2021. From May 2005 to May 2018, environmental, social and governance (ESG) mentions hovered between 0% to 1% of calls. By 2019, mentions rose to 5%, and by May 2021, it was 19%.

Pimco published the following chart in a July 14 report:

Interest in ESG investing has slowly picked up in the past several years. The U.S. SIF Foundation has tracked sustainable investing by professional money managers since 1995, and noted in its latest report released in November that U.S. sustainable investing assets totaled $17.1 trillion in 2020, a 42% increase over 2018. Sustainable investing considers both financial return and social and environmental good.

There are several reasons behind the surge in ESG mentions in earnings calls. An April survey by fund manager Natixis showed 72% of institutional investors implemented ESG factors, considering it an integral part of sound investing.

There’s also a growing awareness of environmental factors. The U.S. recently rejoined the Paris Accord, Europe passed the EU Green Deal and China is seeking to be carbon-neutral by 2050. Corporations are also pledging net-zero 2050 targets, with Facebook

FB,

and Alphabet

GOOGL,

being the largest buyers of renewable energy in 2019. Consumers, particularly millennials and younger generations, are willing to pay a premium for green products.

Fund issuers are also on the bandwagon. On July 15, Goldman Sachs launched an exchange traded fund focused on climate transition, citing the alignment between governments, corporations and consumers. In April, BlackRock’s climate transition fund had one of the largest launches in 2021, gathering $1 billion in a day, with institutional support.

Changes at Pimco

Pimco’s analysts say they are using the growing trend in ESG to influence their asset allocation strategy.

“Within Pimco’s multi-asset portfolios, this ESG lens has us favoring an overweight in select companies in green sectors (such as renewable energy), digital sectors (such as semiconductors), along with forestry and pulp products, while we remain cautious on fossil fuel industries,” the analysts say.

Debbie Carlson is a MarketWatch columnist. She doesn’t own any of the funds or stocks mentioned in this article. Follow her on Twitter @DebbieCarlson1.