This post was originally published on this site

When elected officials talk about policy and programs, and when journalists write about them, lots of big numbers tend to get tossed around, sometimes with little context that helps people make sense of them. That might be especially true during the pandemic, when nearly everything seems bigger — and sometimes badder — than usual.

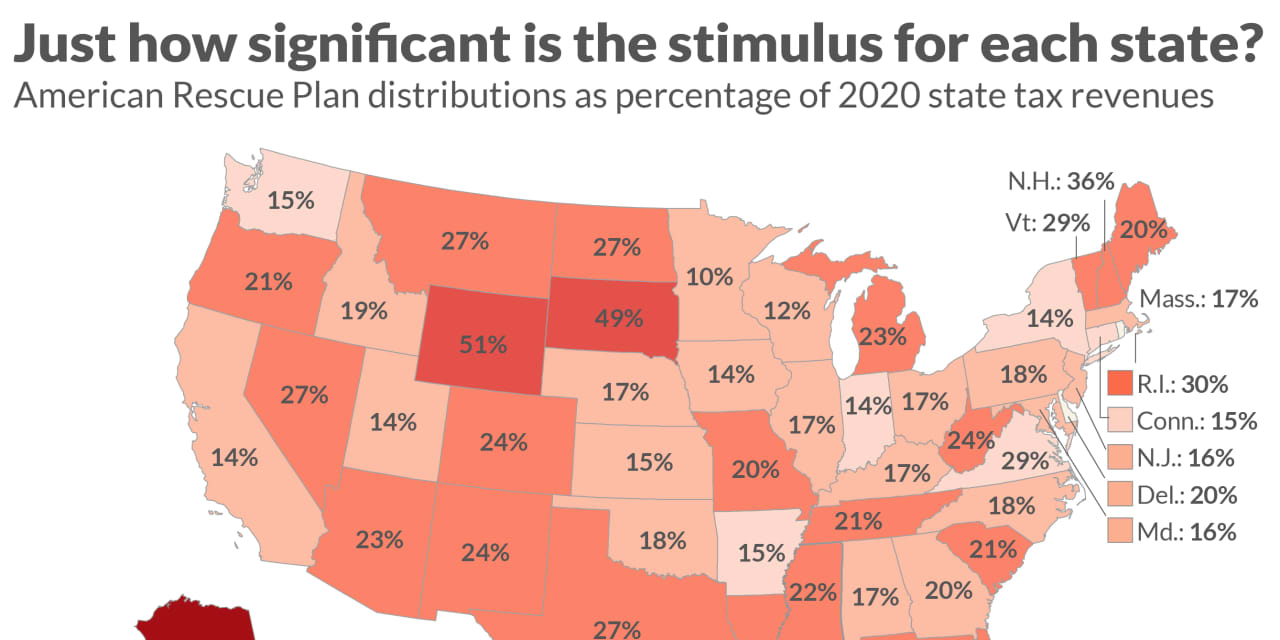

Researchers at the Cleveland Fed have some context on the American Rescue Plan, the federal stimulus package passed in March this year. Some $350 billion was directed to state and local governments, but as the researchers wrote, “When we hear that a county is receiving $500 million and a state is receiving $5 billion, both figures sound very large, but what we don’t know is how much change those allocations can create.”

For context, they divided each state’s stimulus allocation by its estimated 2020 tax collections. That measurement shows that states are receiving anywhere from nearly a full year’s worth of tax revenues, in the case of Alaska, to 10%, for Minnesota.

The median amount states will receive is equal to about 20% of its annual tax revenue, and the vast majority of the states are receiving between 10% and 30%. Other than Alaska, Wyoming and South Dakota also stand out.

See: U.S. state tax revenues end 2021 higher than 2019, report finds

Allocations are tied to states’ unemployment rates, but states also receive a set sum of $500 million, regardless of population, budget size, or anything else. That’s a boon for less populous states.

The federal dollars vary from amounts that “may offset some collections lost during lockdowns,” the Cleveland Fed researchers write, to amounts “that could create a once-in-a-generation opportunity to invest more than an entire year’s worth of tax revenue without taking on new debt.”