This post was originally published on this site

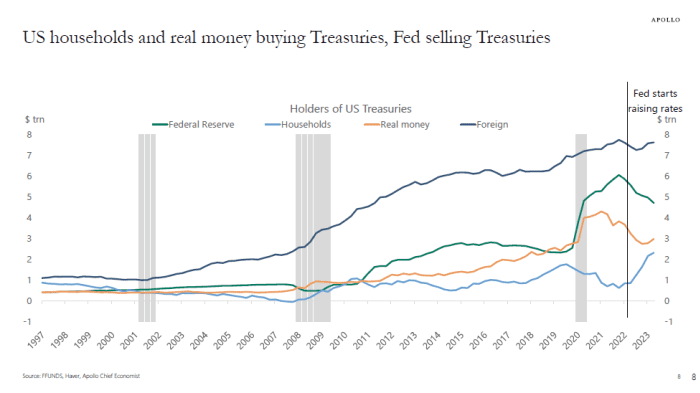

U.S. households have made big moves in the roughly $25 trillion U.S. Treasury market since the Federal Reserve began its campaign of rate hikes last year.

Their holdings have shot up to about $2.5 trillion from less than $1 trillion when the Fed began raising rates in 2022, to reach the highest level in the past 25 years, according to Torsten Slok, chief economist at Apollo Global Management.

U.S. households now own more Treasury securities than any time in the past 25 years.

FFUNDS, Haver, Apollo Chief Economist

“The bottom line is that US households and real money are finding current levels of US yields attractive,” Slok wrote in emailed commentary Friday.

The sharp rise of the 10-year Treasury yield

BX:TMUBMUSD10Y

to almost 4.5% in recent sessions, the highest level since late 2007, has been a key focus on Wall Street. Big technology stocks and other rate-sensitive sectors of the market sold off sharply after the Federal Reserve signaled it could keep its policy rate higher for longer than anticipated.

A slight pullback Friday in the 10-year Treasury yield, a benchmark rate used to fuel the U.S. economy, was giving stocks a slight boost, but equities still were on pace for sharp weekly losses.

See: ‘Hurricane’ in Treasurys relents slightly as yields dip from multi-year highs

For the week, the S&P 500 index’s

SPX

consumer discretionary segment was leading the stock-market gauge lower, down 5% at last check Friday. That might be a sign that investors think companies focused on luxury goods, like vehicles, furniture, vacations and other nonessential items, could be vulnerable to a fizzling economy.

Tesla Inc.

TSLA,

shares were more than 7% lower on the week, at last check, while those of Amazon.com Inc.

AMZN,

were off about 6.7%, while others in the “Magnificent Seven” pack of outperforming stocks this year were also on pace for losses since Monday.

Higher borrowing bites consumers, but also threatens major corporations facing a pile of maturing debt in the next few years. Older, lower coupon securities in a portfolio also now look less valuable.

Gains for the year in a swath of the bond market have been erased by rising yields, with the benchmark Bloomberg U.S. Aggregate index on pace for a – 0.6% return on the year through Friday, and -14.4% on a three-year return, according to FactSet.

The iShares Core U.S. Aggregate Bond ETF,

AGG

an exchange-traded fund that tracks the Bloomberg index, was down 2.1% on the year through Friday.