This post was originally published on this site

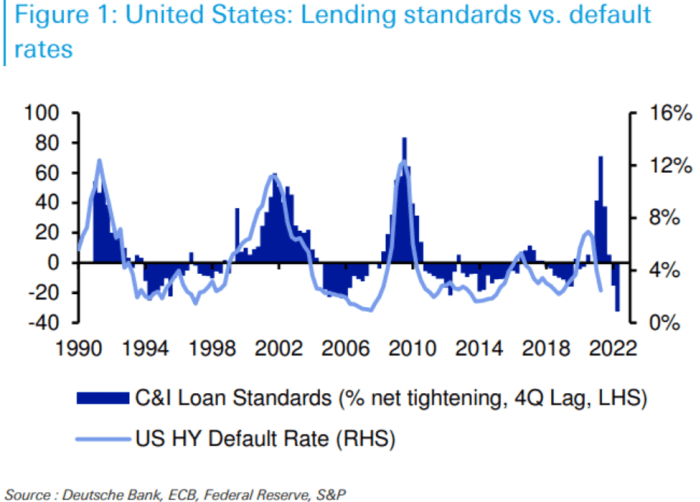

Lending standards in the U.S. are the easiest ever for companies, with real yields in corporate credit markets falling to their lowest level, according to a research note from Deutsche Bank.

“Financial conditions are very very easy for credit,” says an emailed note this week from Jim Reid of Deutsche Bank Research. “So good it’s worrying,” according to the email, which highlights charts showing loose lending conditions and negative real yields in U.S. corporate debt.

DEUTSCHE BANK RESEARCH

Deutsche Bank forecasts a U.S. high-yield default rate of 2.5% in 2022, reflecting “a calm year on this front,” according to the research note.

But easy financial conditions for credit is “actually one of the main reasons we think spreads will widen” in the first half of next year, the note says, “as on a whole series of variables the Fed is well behind the curve and we think that there’s a good chance that the market will take them on even more aggressively over the next few months.” That could cause “a risk-off period.”

The Federal Reserve, which has kept its benchmark interest rate near zero in the economic rebound from last year’s pandemic-induced downturn, is scheduled to hold its next policy meeting in mid-December.

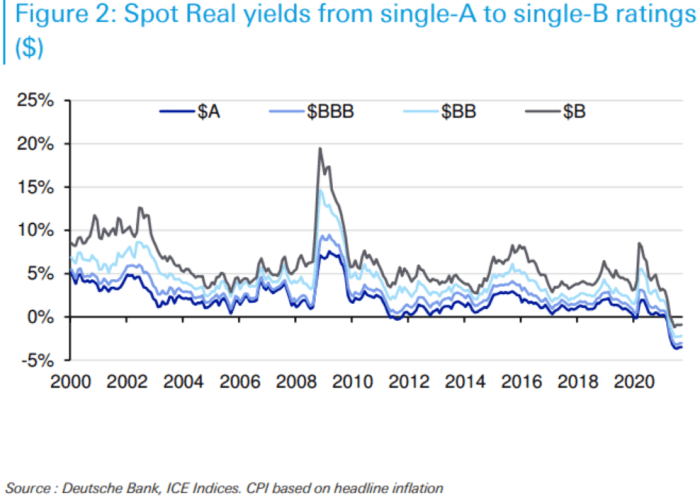

Junk bond spreads over comparable Treasurys have been low this year as investors reach for yield in riskier assets. The Deutsche Bank Research note shows spot negative real yields in investment-grade and junk-rated U.S. corporate debt, when considering the spike in inflation measured by the consumer-price index during the pandemic.

DEUTSCHE BANK RESEARCH

Companies with A or BBB ratings by S&P Global are considered investment grade, while BB and B ratings fall into speculative-grade territory. U.S. investment-grade debt saw negative real yields for the first time this year, with yields now around -3%, according to the Deutsche Bank Research note, emailed Tuesday.

Within junk territory, real yields turned negative for U.S. BB-rated corporate debt for the first time in April, with current levels around -2.8%, the note shows. Real yields for B-graded credits, which became negative in May, are now around -1.4% in the U.S., according to the note.

“Strong growth and high liquidity should mean that full year 2022 is a reasonable year for credit overall but if we’re correct there will be regular pockets” of inflationary and interest-rate concerns in the market, wrote Reid, head of thematic research at Deutsche Bank, along with strategists Craig Nicol and Karthik Nagalingam, in a Nov. 22 report on their credit outlook for 2022. “Overheating risk is more acute than the stagflation risk, especially in the U.S.,” they wrote.

Read: Weekly jobless claims plunge to lowest level since 1969

Some investors have anticipated the Fed may begin hiking interest rates next year, after winding down its monthly purchases of Treasurys and mortgage-backed securities that it started after the COVID-19 crisis to support credit markets and the economic recovery. While the pace of inflation has surged in the pandemic, some Wall Street analysts have pointed to signs that it could start to decelerate next year amid signs supply chain constraints are easing.

Treasury yields have risen this year, but remain near historically low levels.

The yield on the 10-year Treasury note

TMUBMUSD10Y,

rose Tuesday to 1.665%, the highest since October 21, but still below the about 1.75% level seen at the end of March, according to Dow Jones Market Data.

“As we close out 2021, it is fair to say that this year has been one of the lowest vol years for credit on record,” Reid, Nicol and Nagalingam said in their credit outlook report. “We think this low vol environment is unlikely to last and spreads will sell-off at some point” in the first half of 2022 “when markets reappraise how far behind the curve the Fed is.”

Also check out: Falling real yields are a key to the stock-market rally: What investors need to know