This post was originally published on this site

After riding high early in the pandemic, Cathie Wood’s flagship ARK Innovation exchange-traded fund

ARKK,

has tumbled more than 60% from its February 2021 peak, according to Bespoke Investment Group.

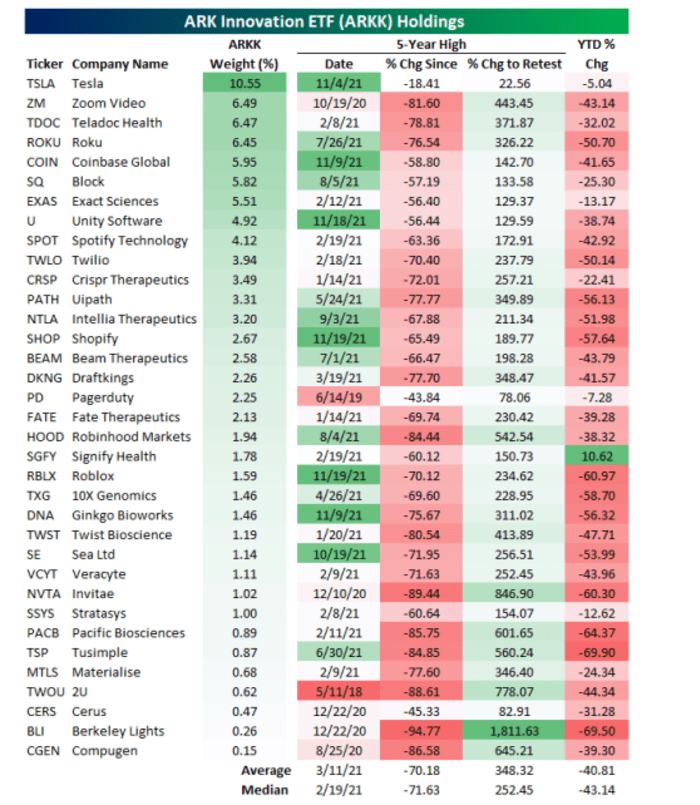

Worse yet, shares of companies held by the fund were down 70% on average from their 5-year highs (see chart below).

Only one stock in the fund — Signify Health Inc.

SGFY,

— was up on the year, while its overall holdings were down 40.8% on average in 2022, according to the Bespoke report issued late Tuesday.

ARKK is down 60% from peak, but the average stock in the fund is down even more.

Bespoke Investment Group

The chart details ARK Innovation’s holdings from its biggest concentration to its smallest, an itemized list of the damage unfolding in some of Wood’s buzziest bets in the arena of “disruptive” technology.

Specifically, the fund’s largest holding, shares of Tesla Inc.

TSLA,

were off 18.4% since peaking Nov. 4, 2021, followed by a nearly 82% drop in its second-largest exposure, Zoom Video Communications Inc.

ZM,

from its high.

“Given that TSLA is by far the largest ARKK holding with a 10.55% weight, its smaller decline relative to the rest of the ETF’s holdings has helped ARKK from falling even more,” Bespoke analysts wrote.

However, the team also said “it’s going to take a huge rally in the ‘growth’ space,” and that ARKK’s average holding would need to climb 348% to get back to prior highs. Wood’s team did not immediately respond to a request for comment.

Shares of many formerly high-flying technology companies have fallen since COVID-19 vaccinations rolled out broadly last year. Most took another step lower since the Federal Reserve switched course in late November, signaling it would end its easy-money stance earlier than previously anticipated to help fight high inflation.

Treasury yields

TMUBMUSD10Y,

have climbed sharply on the Fed’s plans to aggressively raise its policy rate this year, and to significantly reduce its nearly $9 trillion balance sheet, potentially starting at the central bank’s upcoming May 3-4 meeting.