This post was originally published on this site

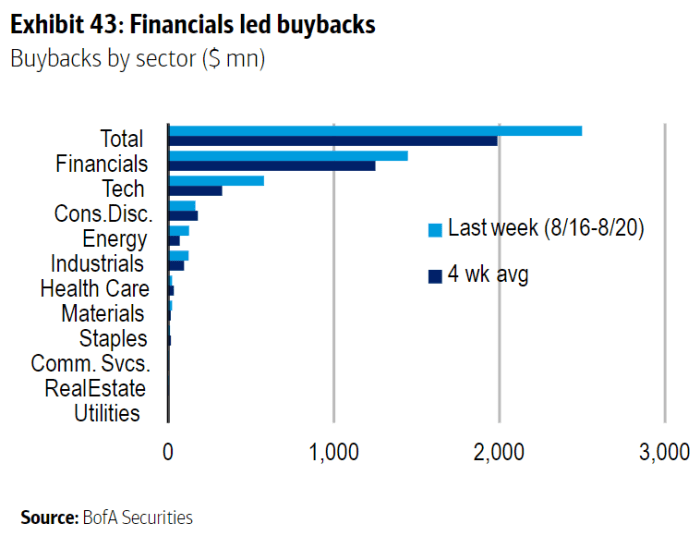

Financial companies have propelled an acceleration in U.S. stock buybacks, overtaking the technology sector with the largest dollar volume this year, according to BofA Global Research.

“Buybacks by corporate clients accelerated from the prior week to the highest level since mid-March, driven by financials,” BofA strategists said in an equity and quant research note dated Aug. 24. “Financials’ weekly buybacks were the largest on record since 2010.”

BOFA GLOBAL RESEARCH REPORT

The uptick in share repurchases by financial firms may signal excess returns are coming for investors, as the S&P 500 sector with the most buybacks in a given week tends to outperform over the next several months, according to BofA. That’s based on flow data since 2010, with the “hit rate” for outperformance being above 50%.

The report shows the “hit rate” for outperformance relative to the S&P 500 index rises over the six-month period following the top sector’s buybacks in a given week. The tech and consumer discretionary followed financials as the sectors with the next largest volumes of buybacks in the week through August 20, according to BofA.

Read: ‘Nice underpinning to the market’: Buybacks may prop stock market rattled after Fed meeting

Mustafa Sagun, chief investment officer of Principal Global Equities, told MarketWatch that he generally likes buybacks done by companies with good growth prospects. It increases earnings per share, providing gains to stockholders.

“I get my earnings growth immediately,” he said in a phone interview Wednesday.

The financial sector isn’t as expensive as other parts of the U.S. stock market and is poised to benefit should interest rates rise in the economic rebound from the pandemic, according to Sagun. He said that he’d rather see buybacks in the sector — as well as investments being made in technology such as artificial intelligence or cash spent on small acquisitions in fintech — than “big, bad” bank mergers.

The U.S. stock market has continued to reach new peaks this week, with the S&P 500

SPX,

and Nasdaq Composite

COMP,

indexes each booking record closing levels Tuesday. Both benchmarks, along with the Dow Jones Industrial Average

DJIA,

were trading higher Wednesday afternoon, according to FactSet data, at last check.

“The U.S. large cap market is hitting all-time highs,” said Sagun. “The rest of the market is not.”

While Sagun remains generally “positive” on the U.S. stock market as company earnings should continue to grow, he said that he favors international equities as they have similar growth prospects over the next couple years but tend to be less expensive. He said that he also sees more opportunities to buy U.S. small-cap stocks

RUT,

as long as growth in the U.S. continues, as their valuations are generally more attractive than large-cap.

Buybacks, meanwhile, are concentrated in large-cap stocks, according to the BofA report. And while company share repurchases across sectors have risen about 49% this year, they remain “far from pre-Covid levels,” the strategists said.