This post was originally published on this site

An anti-vaccine demonstrator holds a cross, while taking part in a protest against the coronavirus disease (Covid-19) vaccinations in Athens, Greece. Louisa Gouliamaki/AFP/Getty Images

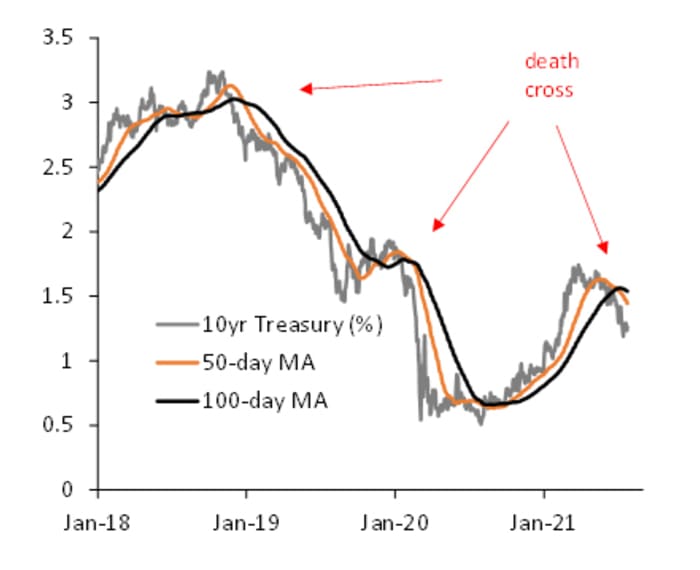

Long-term U.S. Treasury yields are stuck in a so-called “death cross,” or technical pattern that suggests they may keep falling even lower from here.

That’s the view of Dimitri Delis, a senior econometric and macro strategist at Piper Sandler Cos. who is based in Chicago. He points to the 10- and 30-year Treasury yields’ 50-day moving averages, which have now both fallen below their 100-day moving averages.

(Source: Piper Sandler)

The recent drop in the 10-year rate TMUBMUSD10Y and 30-year yield TMUBMUSD30Y to around some of the lowest levels since February has puzzled many who had expected those yields to rise amid strong U.S. economic growth and higher inflation.

Dan Eye, head of asset allocation and equity research at Fort Pitt Capital Group based in Pittsburgh, said low yields reflect the “tremendous amount of demand for high-quality, yield-generating assets by institutional investors, like pension funds and insurers, who have a mandate to go into those government securities.”

From a technical perspective, “the last two times the 50-day moving average crossed below the 100-moving average, the 10-year rate fell by more than 170 basis points (from November 2018 to August 2019) and 140 basis points (from January to August 2020),” Delis wrote in an e-mail to MarketWatch on Thursday. “While I am not the firmest believer in technicals, when many market participants believe it, it can become a self full-filling prophesy.”

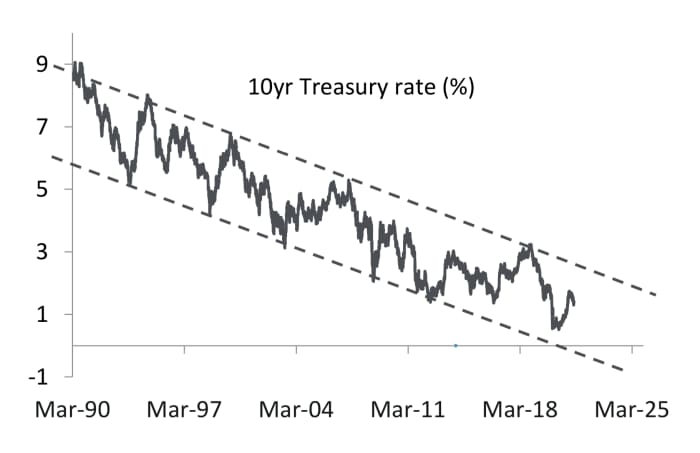

What’s more, Delis says, yields are stuck in a 30-year downward trend exacerbated by a “very strong disinflationary environment” — which is marked by aging demographics; too much debt, which slows down growth; automation; and technology.

(Sources: Bloomberg, Piper Sandler)