This post was originally published on this site

It’s a December not many will want to remember.

Stocks were on track for a losing month, and in a reinforcement of a central theme of the 2022 equity selloff, former early pandemic highfliers were feeling the worst of the pain.

Analysts at Bespoke Investment Group, in a Wednesday note, took a look at the stocks that make up the New York Stock Exchange’s FANG+ Index, which aims to track the 10 most highly traded technology giants.

They noted that Amazon.com Inc.

AMZN,

on Tuesday became the third megacap index constituent, along with Facebook parent Meta Platforms Inc.

META,

and Netflix Inc.

NFLX,

to finish below its closing low from the COVID crash in March 2020. In other words, the trio have erased their stratospheric post-COVID crash gains.

Bespoke Investment Group

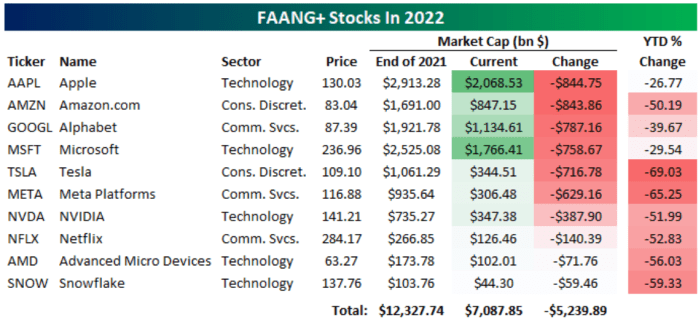

The table above shows that the 10 index components came into the year with a combined market capitalization of $12.3 trillion, and were on track to end the year with a combined market cap of just over $7 trillion, the analysts said.

While Apple Inc.

AAPL,

has fallen the least in the year to date in terms of change in the share price, it has lost the most in market cap at $844 billion. Amazon has seen its market cap fall the second-most at $843 billion, getting cut nearly in half. Tesla Inc.

TSLA,

along with Amazon, is one of two names to be ejected from the “$1 trillion market cap” club this year.

As for the FANG+ index, it peaked in early November last year and has dropped 46% since then, Bespoke noted. The drop, the analysts observed, more recently follows a failed breakout above the top of its downtrend channel as the index is now back to within 5% of this past November’s low. On a relative basis, the group has been underperforming the broader market for even longer with a high in February of last year, they noted.

The Federal Reserve’s aggressive pace of interest-rate hikes in 2022 sent U.S. Treasury yields soaring. That gets much of the blame for the stock-market carnage this year, particularly for the megacap growth stocks that make up the FANG+ index. Growth stocks, whose lofty valuations were based on expectations for big earnings and cash flow far into the future, are particularly sensitive to rising yields. When Treasury yields rise, the value of those future earnings are more heavily discounted.

The tech-heavy Nasdaq Composite

COMP,

was down by around 10.5% so far this month, putting it on track for its worst December performance on record. The Nasdaq is down more than 34% so far this year.

The S&P 500

SPX,

was on track for a 6.8% December drop and was down more than 20% for the year to date, on track for its worst annual performance since 2008. The less growth-oriented Dow Jones Industrial Average

DJIA,

has fared better, down 4.4% in December and headed for a 9% 2022 decline.