This post was originally published on this site

Imperial Oil (NYSEAMERICAN: IMO) is one of the largest integrated oil companies in Canada with a market capitalization of more than $10 billion. The company is majority owned by Exxon Mobil (NYSE: XOM) making up roughly 4% of the latter giant’s valuation. As we’ll see throughout this article, Imperial Oil’s size not only justifies its valuation as an Exxon Mobil investment, but it will mean the potential for significant long-term shareholder returns.

Imperial Oil COVID-19 Response

Imperial Oil has responded strongly to COVID-19 and the threat it has put on the company and Canadian oil as a whole.

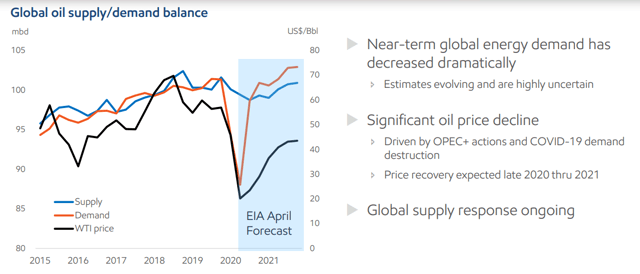

Global Oil Supply / Demand Balance – Imperial Oil Investor Presentation

As can be seen above, from the EIA April forecast, demand has fallen off of a cliff as a result of COVID-19. That led to a dramatic decline in WTI prices to less than $20 / barrel. That massive decline in oil prices is expected to result in a substantial and long-term price decline in oil supply. That will lead to a supply shortage as we get into late-2020.

That is expected to lead oil prices to begin to recover. The forecast for WTI prices is for more than $40 going into 2021. That’s nothing substantial, however, it’s enough for the company’s financial portfolios to improve significantly.

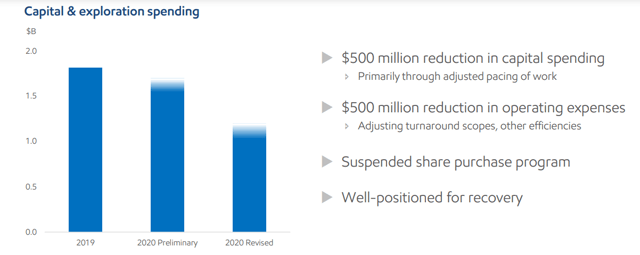

Imperial Oil Spending Forecast – Imperial Oil Investor Presentation

Imperial Oil has dramatically cut its capital and exploration spending. The company’s planned $500 million reduction is a ~30% reduction in expenses and combines with the company’s $500 million reduction in operating expenses. At the same time, the company has suspended its share repurchase program.

Putting all of this together, the company will be saving itself more than $1 billion annually, positioning it well for both the downturn and a price recovery.

Imperial Oil 2019 Results

Imperial Oil performed incredibly well in 2019 showing the company’s potential in an environment with strong cash flow.

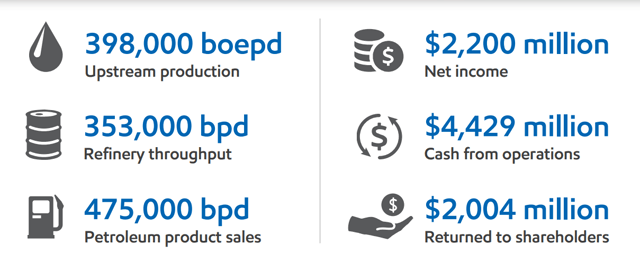

Imperial Oil 2019 Results – Imperial Oil Investor Presentation

Imperial Oil’s fundamental strength comes from its position as one of Canada’s largest integrated producers. The company has almost 400 thousand barrels / day of upstream production, with 350 thousand barrels / day of refinery throughput and 475 thousand barrels / day of petroleum product sales. As an integrated producer, Imperial Oil can free itself from the confines of takeaway capacity while extracting profits at every step of the chain.

Essentially, the company frees itself partially from the bounds of global oil supply and demand by selling its oil as local refined products. However, what’s especially important here is the company’s financial position and its ability to reward shareholders in a normal environment. The company had $2.2 billion in net income and $4.4 billion in cash from operations.

The company turned that to more than $2 billion in shareholder returns. For those who invest today and hold on, that’s a nearly 20% yield on their investment in a normal market environment.

Imperial Oil Integrated Asset Base

Imperial Oil’s financial strength is supported by the company’s integrated asset base, which we discussed partially above, along with its strong upstream reserve base to support this.

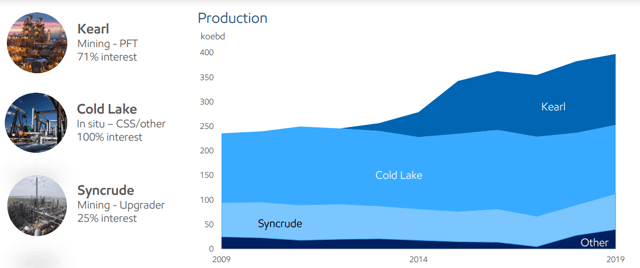

Imperial Oil Upstream Asset Base – Imperial Oil Investor Presentation

Imperial Oil’s upstream production has decreased dramatically over he past 7 years as the company’s Kearl asset, with its 71% interest has come online. Overall, the majority of the company’s asset base is supported by 3 major assets, Syncrude, Cold Lake, and Kearl. Backing this up is the company’s >25 year proven reserve life, which will support continued long-term shareholder rewards.

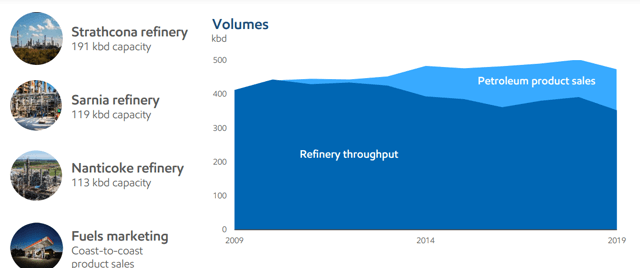

Imperial Oil Downstream Asset Base – Imperial Oil Investor Presentation

Imperial Oil, on top of its upstream asset base, is Canada’s largest refiner and product marketer. The company has 3 main refineries, however, over the past decade, it has seen refinery throughput decline and petroleum product sales increase. That disparity hasn’t hurt the company at all, as it continues to be able to manage turning its production into valuable product sales.

As a part of this, Imperial Oil, as an integrated company, also has a major chemical business. The company focuses on various high value resins and feed stocks to maximize the potential profits from its refining business.

Imperial Oil Cash Flow

Putting together Imperial Oil’s asset base, combined with its recent expansions, the company has been dramatically increasing cash flow.

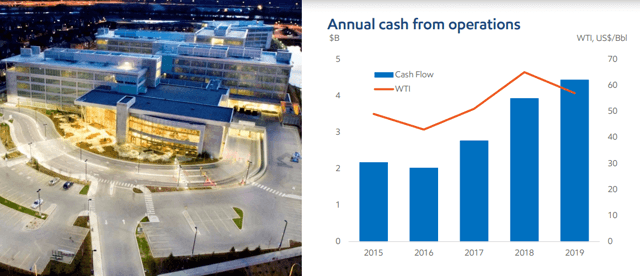

Imperial Oil Annual Cash – Imperial Oil Investor Presentation

Imperial Oil has focused on dramatically increasing its cash flow from operations as WTI has recovered. The company’s current annual cash from operations is now topping $4 billion supporting a strong business for the company. Given that cash flow potential in an environment with >$50 WTI, that will, as we discussed above lead to significant shareholder returns.

It’s also worth noting that Imperial Oil’s dividend obligations are roughly $500 million annualized. That means the company’s cash flow from operations, even accounting for capital expenditures, is more than enough to cover the company’s dividend obligations. The company’s coverage ratios will continue to support shareholder returns and share buybacks can resume once prices recover.

Imperial Oil Financial Strength

Supporting Imperial Oil through this difficult time is the company’s impressive financial strength.

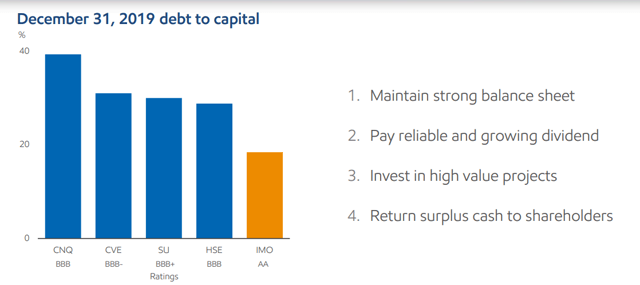

Imperial Oil Debt-to-Capital – Imperial Oil Investor Presentation

Imperial Oil’s debt-to-capital ratio is incredibly manageable at less than 20%. The company has focused on a strong balance sheet along with its reliable and growing dividend. The company is also focused on returning surplus cash to shareholders and investing in high value projects. However, the company, throughout this time has maintained a AA credit rating.

That means two important things. First, the company has access to incredibly low interest rates, especially with recent interest rate cuts in overall rates. That low interest rate will mean the company can borrow money at a low interest rate, i.e. the potential for strong shareholder returns even with a decent ROCE.

Additionally, Imperial Oil has significant room (on top of low interest rates) to expand its debt load. The company could comfortably add a billion or two to its debt load, allowing it to increase shareholder returns. It could do that at an incredibly low interest rate. Buying back shares at its current interest rate would mean cash flow improvements if it can borrow the money for less than its 4% dividend.

Imperial Oil Shareholder Returns

In fact, Imperial Oil has a long history of rewarding shareholders.

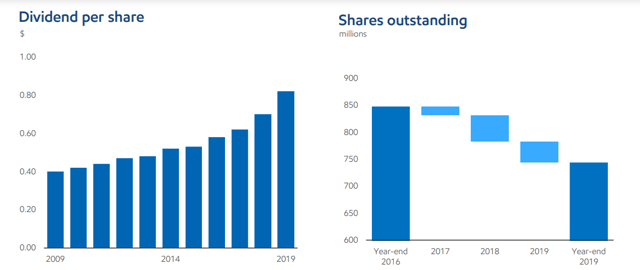

Imperial Oil Shareholder Returns – Imperial Oil Investor Presentation

The above image shows Imperial Oil’s shareholder returns ability. The company has, while remaining fiscally responsible, doubled its dividends per share over the past decade. Simultaneously, the company aggressively repurchased shares, decreasing its shares outstanding by roughly 15% over the past 3 years through the oil crash.

In fact, over the past 3 years, the company’s average shareholder return annualized has been in the double digits.

Going forward, the company has announced it has halted share buybacks, while it’s continuing its respectable dividend. We’d like to see the company take advantage of low share prices to continue its repurchases, however, with that said, we respect the company’s desire to maintain its fiscal strength.

Imperial Oil and ExxonMobil

One other massive advantage Imperial Oil has is that it’s nearly 70% held by Exxon Mobil, one of the largest publicly traded integrated oil companies in the world.

Imperial Oil has been a part of the Exxon Mobil portfolio since the 1800s as a result of the activities of Standard Oil. Throughout that time, Exxon Mobil has had a substantial stake, while benefiting from share buybacks and dividends. At the same time, as the majority owner, Exxon Mobil has continued to share with Imperial Oil its overall expertise in investing and allow the company to access its technological strength.

For now, Exxon Mobil has shown no interest in acquiring Imperial Oil. However, in both the late 90s and the 2008 oil crashes, Exxon Mobil made significant acquisitions. Exxon Mobil is in a worse financial position right now, so Imperial Oil’s overall strong debt position makes it more enticing. That also combines with Imperial Oil’s strong cash flow ability in a good market. These things together make Imperial Oil an interesting investment on the basis of an acquisition.

We don’t know if one will occur, but Imperial Oil is a good target for one.

Imperial Oil Risk

On the flip side, Imperial Oil’s largest risk is continued low oil prices. The company’s integrated nature and direct-to-consumer selling means it has continued to perform well. However, it relies on both continued strength in oil prices along with continued demand, on the retail side of things, for oil and gas. While those assumptions have historically been true, COVID-19 has shown they can change at any time.

Currently, the worst appears to be behind us. However, even if it isn’t, Imperial Oil is one of the best positioned to handle the downturn if it needs to. The company’s credit rating, cash withdrawal abilities, and integrated production all support this.

Conclusion

Imperial Oil is one of the best positioned integrated Canadian oil companies. The company takes the oil it produces, upgrades it, and sells it direct to retail customers. That means that the company can extract value at every step of the chain while separating itself from various manufacturing problems that affect Canadian companies.

At the same time, the company has a long >25 year reserve life and is incredibly profitable in a normal oil environment. It has a long history of shareholder rewards while benefiting from its majority ownership by Exxon Mobil. Looking at the long run, the company will generate strong shareholder returns and is a quality investment.

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.

Disclosure: I am/we are long IMO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.