This post was originally published on this site

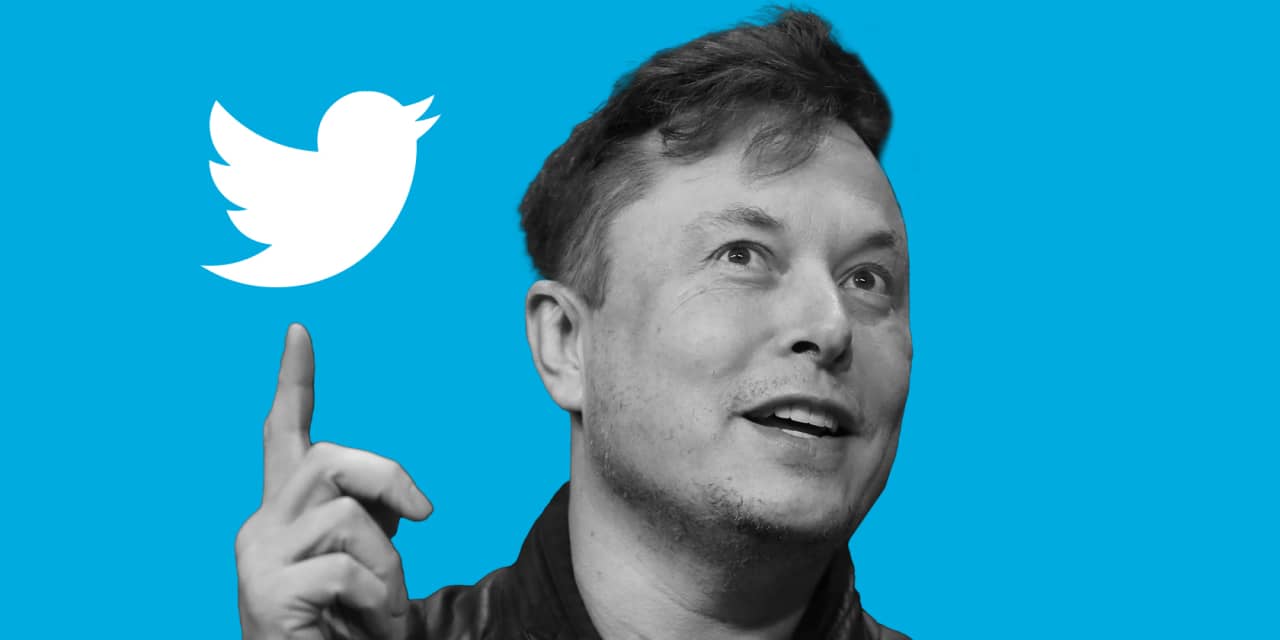

Elon Musk has submitted a bid to buy Twitter

TWTR,

for $43 billion. The Tesla

TSLA,

and SpaceX CEO has been buying equity in the social media giant throughout 2022, and now wants to takeover the company.

“Twitter has extraordinary potential,” Musk said. “I will unlock it.”

While Twitter says it will “carefully review” Musk’s “unsolicited” bid, it poses a fun hypothetical: Who would enough money to buy it, and who would have the interest in actually doing so?

Musk is by far the richest person in the world with a net worth of $273 billion, and and spending $43 billion on a Twitter buyout wouldn’t dent his his fortune too much. Musk’s offer is also a much higher than Twitter’s $36.71 billion market cap as of Thursday morning.

Using Forbes’s billionaires list, 29 people have the fortune to match or exceed Musk’s $43 billion offer to buy Twitter. Those names include titans of industry like Amazon’s

AMZN,

Jeff Bezos and Nike

NKE,

founder Phil Knight, to Mike Bloomberg, to Mark Zuckerberg and MacKenzie Scott.

Obviously, these names are just those who theoretically could afford to put in a bid for Twitter, not that they necessarily have tangible interest in owning the company.

The 29 billionaires on the list who could match Musk’s offer are also filled with tech moguls. Microsoft’s

MSFT,

Bill Gates, Oracle’s

ORCL,

Larry Ellison and Google’s

GOOG,

Sergey Brin all have tech background’s and the money to buy the company.

Others on the list, like Charles Koch and Bernard Arnault, whose vast fashion empire includes Louis Vuitton and Sephora, could also afford to bid for Twitter, but may be less likely due to their lack of a background in tech industry.

So who among these eligible buyers might hypothetically have the most interest?

Jeff Bezos is an obvious one. A bid from Bezos would be a drop in the bucket of his $181 billion fortune, and he already has shown an interest in media properties as evidenced by his purchase of The Washington Post in 2013.

Michael Bloomberg, former Democratic presidential candidate and former mayor of New York, also fits the bill. Bloomberg’s net worth exceeds $82 billion and he also has a strong interest in media properties as he cofounded financial information and media company Bloomberg LP in 1981.

An under the radar name for this likely fruitless exercise could be Zhang Yiming. As the cofounder of ByteDance, the company that owns social media platform TikTok, Yiming is one of China’s richest people, with a net worth of $49.5 billion.

Hypothetical bids from some of these billionaires would likely raise regulatory concerns. Any takeover plans from Zuckerberg or either of the Google founders, for example, could lead to concerns of monopolistic behaviors.

It’s unclear at this time if Twitter is going to be receptive to any sort of a takeover.

Twitter reportedly is holding an all-hands meeting with employees at on Thursday afternoon to discuss Elon Musk’s bid for the company.

Jefferies Equity Research Analyst Brent Thill opined that it could be a company, not an individual, who could look to buyout Twitter. Thill named cloud-based software company Salesforce

CRM,

and Microsoft as possibilities, citing Microsoft’s recent success with LinkedIn.

“It’s hard to see who the next logical player would be,” he said.

Thill was also skeptical that this is truly Musk’s “best and final” bid for Twitter.

He wondered “Could Elon go higher?”