This post was originally published on this site

Global investors should no longer overweight the U.S. stock market, strategists at HSBC say, even as they retain their preference for risky assets despite a rocky start to the year.

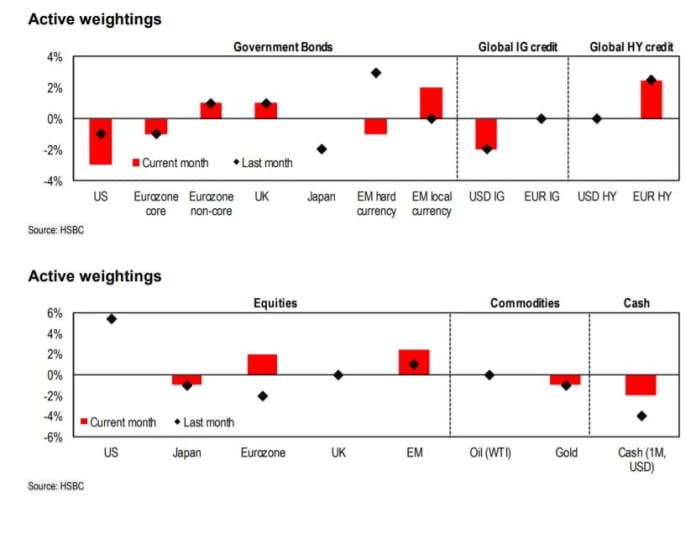

HSBC strategists led by Max Kettner said they cut their overweight in U.S. equities and reversed the underweight in eurozone equities.

On the U.S., the analysts say rising real interest rates in the coming weeks will pressure stocks, but they also highlight that earnings per share expectations have diverged in favor of the U.S. instead of the eurozone in recent weeks, which is against what recent moves in the currency market indicate.

HSBC is now neutral on U.S. equities.

More broadly, the strategists expect global activity data to surprise to the downside in the first half of the year, and for the Federal Reserve and other central banks to continue removing their punch bowls, but they say sentiment and positioning indicators are already very bearish.

They say emerging markets may be a place to hide out, as especially China is in a different stage of the growth and liquidity cycle.

The S&P 500

SPX,

has dropped 5% this year, while MSCI’s Europe, Australasia and Middle East index has slipped 1% in dollar terms. The MSCI emerging markets index has climbed 2% this year.