This post was originally published on this site

A number of service-sector categories including live entertainment are still quite depressed and the transition back to the office is faltering, so the U.S. economy won’t be as robust this year as had been expected, economists at Goldman Sachs said Monday.

As a result, Goldman

GS,

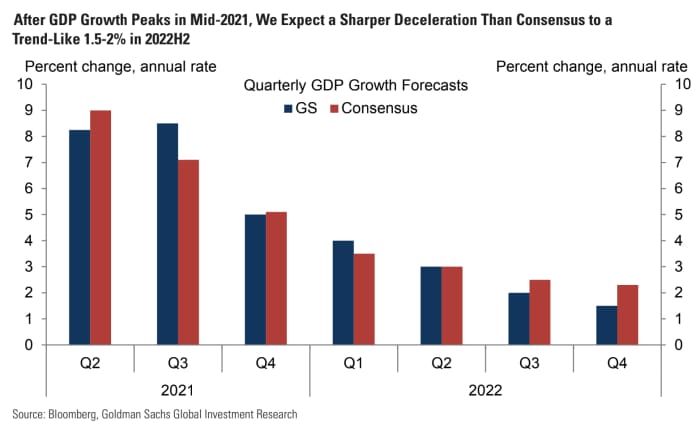

has lowered its GDP forecast by a full percentage point in each of the next two quarters — to a 8.5% growth rate in the third quarter and a 5% rate in the fourth quarter. Growth for the year was cut to 6.6% versus the prior estimate of 7%.

Goldman’s forecast had been notable because it was so much higher than consensus. The firm’s forecast is now gaining attention because it now sees a much sharper slowdown over the next year an a half.

U.S. growth will slow all the way down to a trend-like 1.5%-2% GDP growth by the second half of next year, the firm says.

A consensus survey of economists, compiled by the Philadelphia Federal Reserve, expects the U.S. economy to grow at a 4.3% rate for all of 2022.

This could derail or slow the Fed’s anticipated move toward a more neutral policy stance.

Concern about the outlook has reduced pressure on the Fed to move quickly to start to taper its $120 billion per-month of bond purchases. The central bank’s interest-rate committee will meet Tuesday and Wednesday. Fed Chairman Jerome Powell will hold a press conference at the end of the meeting.

The U.S. economy experienced peak growth in the first half of this year. For the U.S. economy to stay robust, consumer spending will have to rotate from goods to services, Goldman said. But services spending remains soft.

The categories that remain soft are associated with high virus risks or connected to office-based work. These are talking longer to improve than Goldman anticipated.

For instance, office attendance in large cities is still just one-third of the pre-pandemic level, the firm said.

Americans “are likely to remain cautious for now as the spread of the Delta variant keeps covid fears alive,” the firm said.

Stocks

DJIA,

SPX,

were lower on Monday as investors had concerns about the growth outlook.