This post was originally published on this site

Bring out the bubbly. It no longer looks like Europe’s going to enter a recession, according to Goldman Sachs economists.

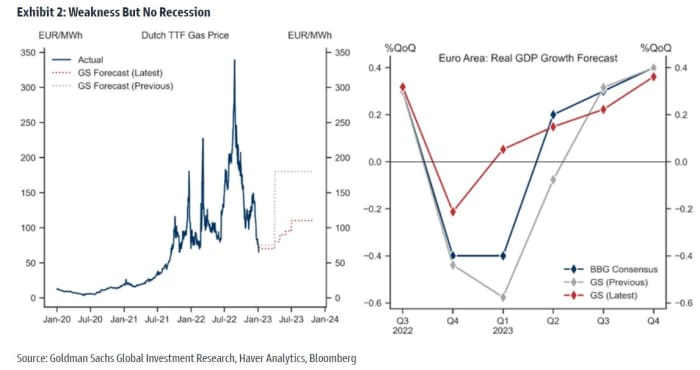

Economists led by Sven Jari Stehn still expect the eurozone economy to contract in the fourth quarter, but now anticipate a slight rise in the first quarter. For 2023 as a whole, the Goldman team expects the euro area economy to rise 0.6%, against a previous forecast of a 0.1% dip.

There are three main reasons. One is that the industrial sector has been surprisingly resilient. Another is that natural gas prices have continued to fall sharply. And finally, China is reopening earlier than expected.

Read: Why Morgan Stanley is even more bullish on China.

Granted, Germany and Italy are still expected to be on the edge of recession, owing to their previous reliance on Russian gas imports. But France and Spain have more diversified energy sources, and also are more service-sector intensive.

The Goldman team expects the European Central Bank to keep tightening rates, bringing them up to 3.25% in May from 2% currently.

Investors seem to be warming to the Europe story. The Vanguard FTSE Europe ETF

VGK,

has gained 6% this year, compared to the 1% rise for the S&P 500

SPX,

The euro

EURUSD,

has climbed 12% from its late September low, when it was below parity against the U.S. dollar.