This post was originally published on this site

I analyzed the fundamentals of Garmin Ltd. (GRMN) in the article published before a steep decline in the share price caused by the coronavirus-induced market hysteria. Despite slightly inflated valuation, it has quickly regained most losses since reaching the bottom on March 23.

However, stronger-than-expected quarterly revenue and EPS that topped forecasts of Wall Street did little to support the stock price, which has barely changed since April 29.

Unfortunately, Garmin’s short-term growth story is under question now, as the ramifications of the pandemic have been adversely affecting its businesses, and, especially, sales of the OEM solutions to carmakers. So, though the company previously expected double-digit annual sales growth in a few segments (see Slide 11 of the presentation), it withdrew guidance in April. Meanwhile, Wall Street is bearish on revenue and earnings.

I suppose now it is worth reassessing its dividend strength and growth prospects.

Delving into the Q1 results

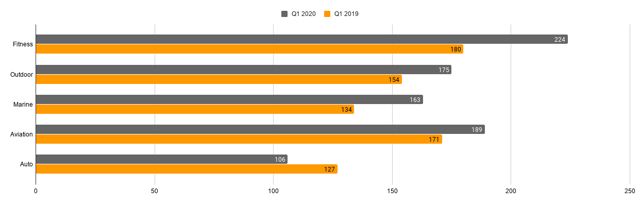

Expectedly, the Q1 results were impacted by a few headwinds inclusive of softness in the automotive industry. However, the company managed to deliver a 12% revenue growth on the back of double-digit expansion in its Fitness, Marine, Outdoor, and Aviation segments that partly offset the contraction in the Auto segment.

Robust demand for advanced wearables and contribution from Tacx, the company’s indoor bike trainers business, catapulted sales of the Fitness division by 24%. As a quick refresher, Tacx was acquired by Garmin last year.

Garmin’s sales by segment. Source: Author’s creation

Chartplotters and advanced sonar sales helped the Marine segment to deliver an around 22% increase in revenue. Adventure watch sales lifted the Outdoor revenue by 14%. In the earnings presentation, Garmin did not clarify what categories in particular propped up sales of the Aviation segment (it develops, manufactures, and sells multiples products from flight instruments & indicators to engine information systems and autopilot); during the earnings call, the CEO said that “additional growth in the ADS-B category” was noticed. He added that “Retrofit [autopilot] systems were strong.”

A 17% contraction in the Auto segmental revenue did not surprise me. This trend had already been observable in 2019; in 1Q19, GRMN reported a 10% decline in the segment’s sales. So, nothing new here. In 2020, demand for the Original Equipment Manufacturer solutions (e.g., infotainment solutions) remained lackluster, as carmakers have been in dire straits because of the consequences of the trade war and the COVID-19 pandemic that, combined together, have taken a toll on supply chains and consumer sentiment.

According to Garmin, it designed “factory-installed head unit solutions for many of today’s leading global automakers, including BMW (OTCPK:BMWYY), Toyota (TM), Honda (HMC) and Mercedes (OTCPK:DDAIF).” In the blog post published on March 19, 2019, the company said it joined BMW AG as a tier-one infotainment supplier. So, it would be pertinent to delve a bit deeper and find out what the German automotive heavyweight itself thinks about the current crisis. In the press release discussing the market environment, it clarified that:

The BMW Group still expects the spread of coronavirus and the necessary containment measures to seriously dampen demand across all major markets over the entire year 2020.

By and large, the outlook for the entire car industry remains murky, so the sales growth prospects of the Auto segment might significantly disappoint investors.

While some segments delivered stellar revenue, they also excelled regarding profitability. Aviation outperformed others, posting a 31% operating margin; Outdoor was in second place with a 27% margin. Marine was slightly less successful, as it converted only 25% of sales into operating earnings. Fitness, the flagship division, was in third place with 14%. Not coincidentally, the Auto segment was a laggard. It only managed to cover COGS and opex, and showed a zero percent margin. In sum, as the performance of the divisions was asymmetric, the group operating margin was only 20.7%.

An important remark worth making is that the company did not scale down its Research & Development activity; contrarily, it spent much more on R&D than in 1Q19. Total R&D expenses rose 13% YoY, while funds allocated to the Outdoor segment even surged by a quarter. Most of the R&D funds, $59.4 million, or 31% of the total, were allocated to the Aviation segment. The outlays were primarily used for product development and improving software capabilities (see page 18 of the Form 10-Q).

As Garmin is rapidly growing, its essential task is to offer cutting-edge, first-class solutions to customers in order not to lose competitive advantage and utilize opportunities that arise from the expansions of the addressable market. As a quick reminder, among its competitors in the wearables market are such titans like Apple (AAPL) and Samsung (OTC:SSNLF). Without continuous innovation, the company will inevitably lose the market share, which, in turn, will trigger an avalanche of distressing issues, from profits decline to the deterioration of liquidity. So, obviously, dividend investors should endorse Garmin’s decision to gradually spend more on R&D, even though higher operating expenses reduce funds available to shareholders. Unnecessary opex savings will bolster operating margin and FCF in the short term, but at the same time, will result in an erosion of financial position in the long term. So, the more GRMN invests in/spends on technologies, the better.

Also, I noticed that Garmin did not reduce R&D spending related to Auto, even despite weakness in the industry and the segmental revenue contraction; expenses were even increased by 11% and equaled $29.8 million. I suppose the reason behind this decision is that the sentiment will inevitably normalize, and automakers will increase manufacturing plans to address recuperated demand. Garmin must be prepared for the market recovery, so it cannot afford itself postponing development activities, as if the company’s technologies become outdated, it will irrevocably lose customers and market share.

On the back of double-digit revenue growth, quarterly GAAP earnings per share rose by 14%, while EPS adjusted for foreign currency losses and its tax effects was up 25%. Nevertheless, while Q1 results were impressive, Garmin has no expectations regarding its 2020 revenue, as the coronavirus pandemic made it impossible to foresee the sales dynamics. The only thing the company knows precisely is that investors should “expect Q2 revenue to decline significantly” (see Slide 13 of the presentation). Analysts are predicting the Q2 revenue to dive by more than 33%, while the 2020 sales may drop by around 9.5%. It is also intuitively evident that plummeting sales of the OEM solutions will be a headache in 2020, perhaps one of the key culprits of sales contraction.

Cash flows remained resilient

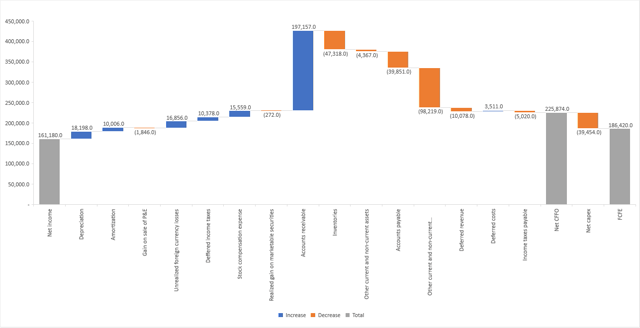

For a dividend investor, it is essential to have a grasp of how a company generates cash flow and allocates capital to understand if it sufficiently covers shareholder rewards or not. It might help to avoid unpleasant surprises in the future. Accounting profit is of no use here, so let’s delve into the cash flow statement.

In the first quarter, Garmin’s net cash from operations surged, bolstered by the top-line expansion, higher net income, and positive working capital change. The firm generated almost $226 million, which more than adequately covered capital investments of $41.4 million. The company’s capital intensity remained low and amounted to just 4.8%. Adjusted for asset sales, Free Cash Flow to Equity added up to $186.4 million. The surplus was enough to more than fully cover the quarterly dividend paid of $108.6 million.

FCF reconciliation. Source: Author’s creation

Financial position

Little can be said here. GRMN is debt-free, so traditional metrics analysts use to assess liquidity and solvency are of no use. It simply has no interest expense or principal to be repaid. The company amassed a cyclopean cash pile (over $1.44 billion, including marketable securities) that will shield it from any repercussions of the coronavirus-induced economic downswing.

Final thoughts

Garmin remains a debt-free company with solid cash returns on shareholder equity (over 16%) and excellent dividend coverage. Though softness in the automotive industry will add to its difficulties in 2020, I believe the company will successfully navigate the downturn. Finally, even in the case of 10% revenue and cash flow contraction, I believe the company might generate over $680 million in net CFFO, the amount adequate enough to cover capital investments and the dividend.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.