This post was originally published on this site

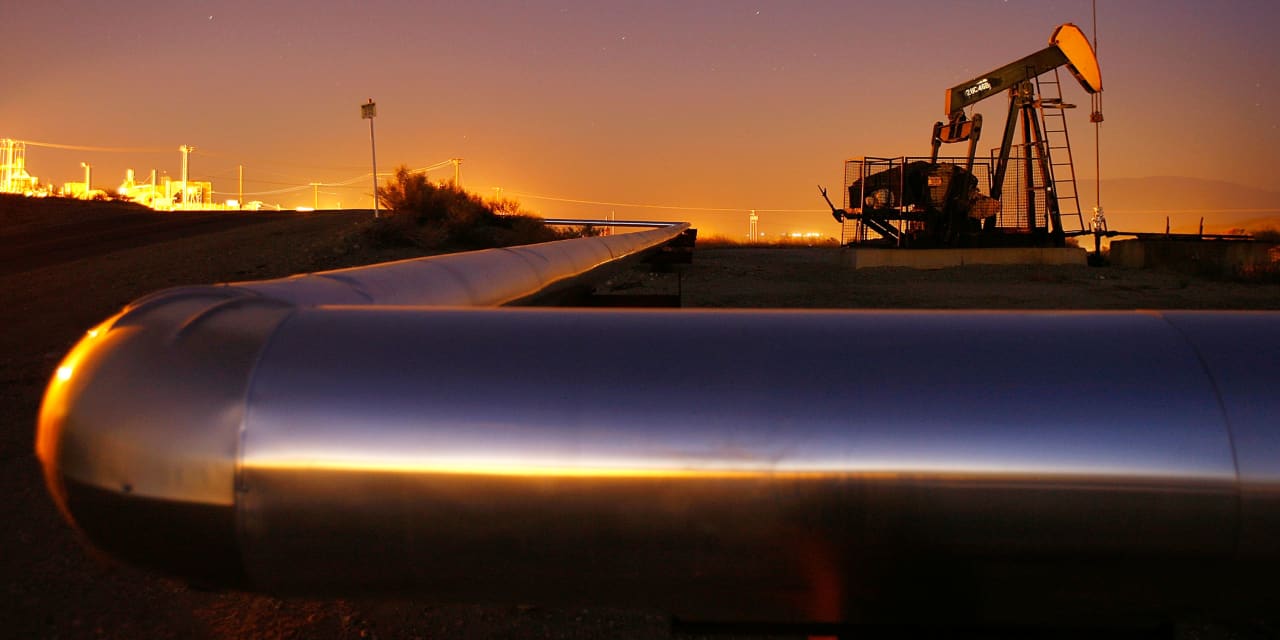

Oil futures traded at a six-week low early Thursday as China was seen preparing to release crude from its strategic reserve and a news report said the Biden administration was pressing other oil-consuming countries to join in.

The Biden administration asked China, India and Japan to release reserves as part of a coordinated effort to push down prices, Reuters reported, citing anonymous sources. News reports on Wednesday said that the issue of releasing reserves came up earlier this week in a virtual meeting between President Joe Biden and Chinese leader Xi Jinping. Bloomberg reported Thursday that China had taken steps to begin releasing some crude from its reserves.

“A concerted approach would certainly have a greater impact on the oil market than if the U.S. embarked on this path on its own,” said Carsten Fritsch, commodity analyst at Commerzbank, in a note.

West Texas Intermediate crude for December delivery

CL00,

CLZ21,

fell 68 cents, or 0.9%, to $77.68 a barrel on the New York Mercantile Exchange. January Brent crude

BRN00,

BRNF22,

the global benchmark, was down 35 cents, or 0.4%, at $79.93 a barrel after dipping below $80 for the first time since early October on Wednesday.

On Wednesday, Biden asked Federal Trade Commission Chair Lina Khan in a letter to immediately “consider whether illegal conduct is costing families at the pump.”

“The discrepancy between the persistently high pump prices and the exchange prices for gasoline, which have been falling since late October, is clearly a thorn in Biden’s side,” Fritsch said.