This post was originally published on this site

Oil futures ticked slightly lower Tuesday, with traders awaiting a meeting of members of the Organization of the Petroleum Exporting Countries and their allies on Thursday amid rising pressure to boost output more than planned.

West Texas Intermediate crude for December delivery

CL00,

CLZ21,

fell 20 cents, or 0.2%, to $83.85 a barrel on the New York Mercantile Exchange. The U.S. benchmark traded at a seven-year high last week. January Brent crude

BRN00,

BRNF22,

the global benchmark, was down 6 cents, or 0.1%, at $84.63 a barrel on ICE Futures Europe.

“Despite growing pressure from the major oil consuming countries — following the lead of the U.S. and India, Japan is now also calling for oil production to be expanded to a greater extent — OPEC+ has so far shown no signs that it is willing to do so,” said Carsten Fritsch, analyst at Commerzbank, in a note.

See: OPEC+ needs to ‘thread the needle’ between higher oil prices and losing market share

OPEC+ is scheduled to meet Thursday. The group had previously agreed to unwind production cuts it put in place as a result of the COVID-19 pandemic, lifting output in monthly increments of 400,000 barrels a day, but OPEC+ members appear to have fallen short of meeting existing production increases.

A Reuters survey published Monday found that members of OPEC pumped 27.5 million barrels a day in October. That’s up just 190,000 barrels a day from the previous month and short of the 254,000 barrel-a-day rise permitted by OPEC members under the OPEC+ agreement.

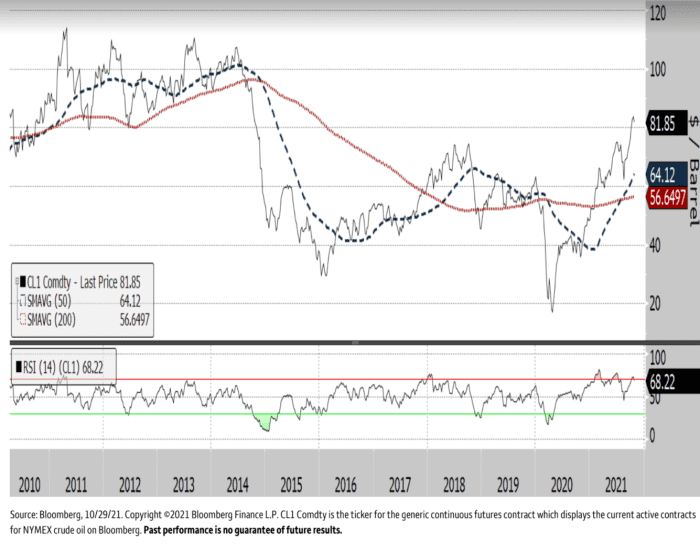

Meanwhile, chart watchers said the outlook for crude remains positive.

“Crude oil remains in an uptrend. The next key levels to watch for support [for WTI] are the 50-week moving average ($64.12), followed by the recent low ($62.05) and the 200-week moving average ($56.65),” said Sameer Samana, senior global market strategist at Wells Fargo Investment Institute in a note (see chart below). “Resistance will likely be found at psychologically-important round numbers ($90, $100) until we get to the 2014 high ($107.95).”

Wells Fargo Investment Institute