This post was originally published on this site

Fund managers dashed for cash in anticipation of more aggressive Federal Reserve policy, according to the latest survey conducted by Bank of America.

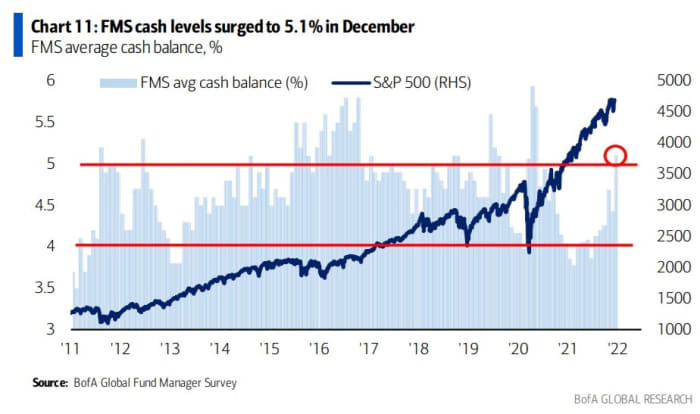

The allocation to cash rose to 5.1% in December from 4.4% in November, the survey of 371 panellists running $1.1 trillion in assets under management found. The survey was conducted between Dec. 3 and 9.

Bank of America said that was the highest allocation to cash since May 2020, as holdings in real estate investment trusts reached a seven-year high and the allocation to stocks was the lowest since 2020.

The Fed’s two-day meeting on interest rates starts Tuesday, and is expected to conclude with a faster pace of bond purchase tapering.

The dash for cash triggered a tactical buy signal as a contrarian indicator, Bank of America said. The typical global equity return three months out is a 4% gain, rising to 6.5% over six months.

The fund managers are expecting the Fed’s taper to end in April, the first rate hike to come in July, with two increases for all of 2022, the survey found.

The S&P 500

SPX,

has gained 24% this year and has set 67 record highs.