This post was originally published on this site

Fund managers are saying one thing and doing another, the latest survey from Bank of America finds.

In September, the net percentage who say the global economy will improve over the next 12 months fell to 13%, down 14 percentage points from August the lowest since April 2020, and down from the 91% peak in March 2021.

Similarly, expectations of rising profits have dropped to a net 12%, a 29 percentage point nosedive, and the worst reading since May 2020.

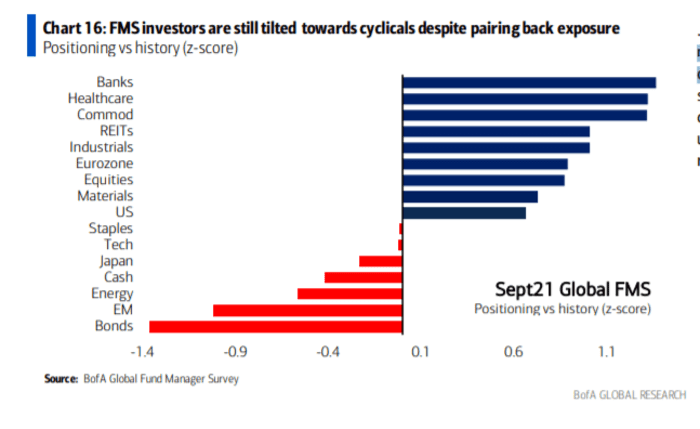

But what’s striking is that the same investors haven’t adjusted their portfolios. Cash levels edged up to 4.3% from 4.2%, which isn’t a particularly high reading. Investor positioning relative to history is still overweight cyclicals, with overweights on banks, commodities, industrials and European stocks, and underweights in bonds, Bank of America found.

In September, investors increased their exposure to global cyclicals, led by a rise in Japan, with gains for materials, commodities and energy.

The survey, which ended Sept. 9, was of 258 managers running $839 billion.

The S&P 500

SPX,

has gained 19% this year, while the yield on the 10-year Treasury

TMUBMUSD10Y,

has climbed 41 basis points.