This post was originally published on this site

Fund managers are getting more defensive as they grow more pessimistic on the economy and corporate profits, according to the latest monthly survey conducted by Bank of America.

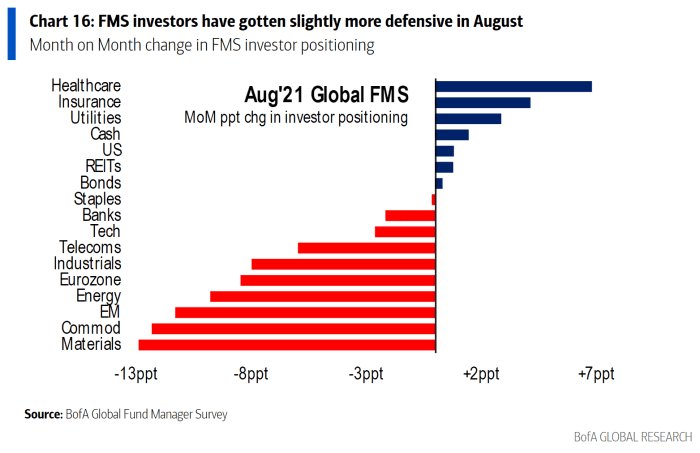

Global fund managers have increased their holdings in healthcare, insurance, utilities and cash, while trimming their exposure to materials, commodities, emerging markets and energy.

The survey found expectations the global economy will improve have fallen to a net 27%, which is the lowest since April 2020; in March 2021, 91% expected improvement. Profit expectations also have fallen, with a net 41% expecting profits to improve, down from a peak of 89% in March, and down from 53% in July.

For the first time since July 2020, investors expect margins to decrease.

Bank of America said it surveyed 257 panellists managing $749 billion in assets.

The S&P 500

SPX,

on Monday ended at a record high for the fifth consecutive session, while the yield on the 10-year Treasury

TMUBMUSD10Y,

fell to 1.26%.