This post was originally published on this site

Five Below (NASDAQ:FIVE) shares still have some room left for more upside, albeit very moderate. At a price of $50 per share, when the market was falling off a cliff, FIVE was cheap. Now trading at $97, shares are slightly undervalued. At this point, FIVE might generate returns close to the broad market. We believe FIVE is a growth-at-a-reasonable-price stock.

It is not about e-commerce, it’s about going to the stores

FIVE is carving out a nice for themselves. In a way, they compete with every major retailer out there. Their stores offer products in every imaginable category and for every occasion. We think of FIVE as a store that puts together every specialty retail store (like Best Buy (NYSE:BBY), Michaels (NASDAQ:MIK), Dollar Tree (NASDAQ:DLTR), Big Lots (NYSE:BIG), and Ross Stores (NASDAQ:ROST)) into one store concept, with the big difference that all their products are below $10.

They used to exclusively offer below $5 items (hence their name), but that is going to change, as management talked about a successful market test in which they tested below $10 merchandise items:

Overall, 2019 was a transformative year for Five Below considering the impact of tariffs had on our business and our decision to break the $5 threshold for the first time.

The pricing changes above $5 required extensive testing and analysis before implementation. We have decided to move forward with an enhanced store prototype that expands our offering in the Tech and Room worlds to include new products in the $6 to $10 range. – Q4 Call

Does that change their appeal? We don’t think so. It’s going to give them an opportunity to enhance their merchandise offering and not be limited by the narrow below $5 price range. Volume per transaction might get affected, but it is going to be offset by higher ticket items, making the strategy value-neutral.

Looking at the business on a long-term view, we still think FIVE has lots of room to grow. Their unique business model shelters them from e-commerce competition. It’s hard to make a profit shipping a $10 item, which protects FIVE from the “Amazon” threat.

Just like the success Ross Stores has, FIVE also targets the consumer experience as a key differentiator. Their target market is teens and their parents. Going into a FIVE is all about the “bargain hunting” experience. For a teen, it is about finding that toy, game or cosmetic at a cheap price. For the parent, it is a win-win situation. Targeting the teen market is also interesting. Teens don’t have many responsibilities. They do not have to worry about making ends meet. Most of their allowance is there to be spent, making FIVE a candidate to fill that need.

The benefits of scale

We believe FIVE has already reached the point of having bargaining power. With 900 stores, they are no longer a small business. That plays well in their favor. For example, with so many brick and mortar retailers having a hard time adapting to a changing environment, and some going bankrupt, retail spaces should be opening. With a large store footprint and plans to open more stores, FIVE can have bargaining power over landlords and getting better deals.

Management estimates the market can handle 2,500 stores. For the past 7 years, FIVE have been opening new stores at a 20% CAGR. In 2019, they opened 150 stores, compared to 71 in 2015. Store growth has accelerated in the last few years. However, we can’t expect FIVE to open new stores at the same pace. Opening new stores at a 20% rate of growth would mean FIVE would achieve its goal of 2500 in just 5.5 years. To put that into context, by the fifth year, they would have to open around 350 stores. Not a realistic scenario.

The added scale benefits their marketing spend. The more stores within a region, the more effective their marketing becomes, while lowering their unit cost.

Their size also allows them to get exclusive licensed merchandise. For example, with the release of Frozen 2, FIVE was selling exclusive items:

As expected, the large trend for the fourth quarter was Frozen 2. Our lineup of Frozen 2 products was amazing and included many items exclusive to Five Below. – Q4 call

Source: Investor presentation

The above slide describes their benefits of scale perfectly. It shows the evolution of their remote toys as the company gets bigger, which increases the appeal of their product offering.

Their benefits of scale can also be seen in their numbers:

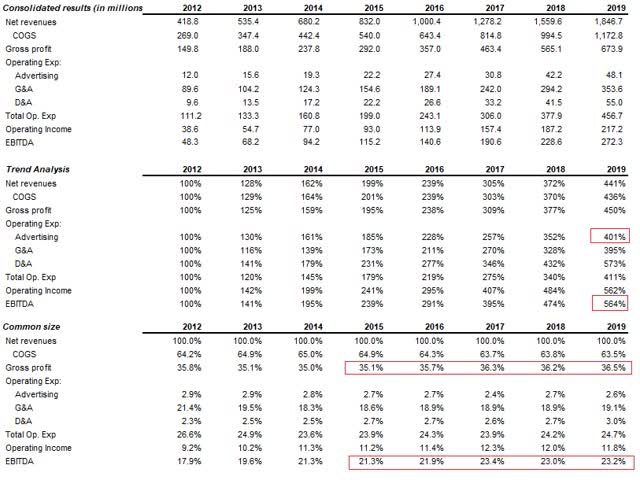

Source: company filings

Revenue growth has translated nicely into gross and EBITDA margin expansion. While advertising expense has remained at 2.7% of total sales on average, on a dollar basis, FIVE has increased its marketing budget by 4 times, from $12M in 2012 to a recent $48.1M.

We also like the company due to its ability to self-fund its growth from cash generated from operations:

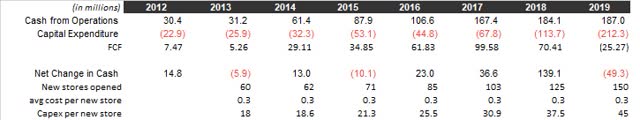

Source: company filings

To open a new FIVE store, it takes 300K in investments. On average, the company has reinvested 50% of CAPEX into new stores as seen by our calculations. The rest have been reinvested as maintenance CAPEX and IT infrastructure. Their strong operating cash flow has contributed to solid FCF generation and increasing cash balances. That said, 2019 was the exception in FCF. However, the negative FCF balance was due to the purchase of a distribution center and the land acquired in Texas, to build another distribution center. The investment was for approximately $56M. That is positive in our view, as the company is building more infrastructure for future growth, especially in the West, where they currently have little presence.

Not cheap but reasonably priced

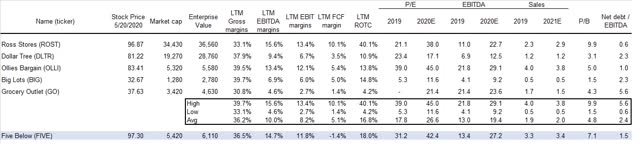

Source: Seeking Alpha

FIVE is trading at a premium to out selected group of peers. Their direct competitor could be Ollie’s Bargain (NASDAQ:OLLI), but since FIVE’s merchandise mix extends many categories, the companies selected reflect that characteristic. FIVE also deserves to trade at a premium. The company has solid fundamentals and lots of room for expansion.

We are willing to pay an EV/Sales multiple of 3.8x for FIVE. We base our sales multiple on the assumption that FIVE can sustain EBITDA margins of 14%. We believe a sustainable reinvestment rate for FIVE to be around 30%. The company’s average return on tangible capital has been 18%. If they can sustain both rates, then FIVE can grow intrinsically by 5.5%. A cost of capital of 7.5% seems appropriate for a company that can fund its growth with internally generated capital.

Analysts are expecting 2021 revenues of $1.7B. If we apply a sales multiple of 3.8x to that figure, we get a per-share value for FIVE of $126, for a potential 25% return.

Takeaway

We like the concept FIVE offers to the market. They are well managed and still have room to expand their retail footprint. Their business model is built for the in-store experience and not so much for e-commerce. At recent prices, there is an opportunity to buy growth at a reasonable price, even if shares have already rebounded. That said, the risks are still high as there is no clear visibility into how long stores are going to remain shut. Some are opening its doors, but is still a slow process, as states lift their stay-at-home-orders. That could also put a dent into the company’s expansion plans. If growth stops, the market might not react positively to that news.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.