This post was originally published on this site

FireEye, Inc. (NASDAQ:FEYE) offers cybersecurity solutions for enterprise networks, endpoints, and e-mail through an integrated platform. The company is also recognized as a leader in cybersecurity consulting services through its “Mandiant” group. A highly competitive landscape and changing market environment have led to disappointing growth in recent years, which explains the stock’s underperformance, down by nearly 70% since its 2013 IPO. FireEye has responded by transitioning its business model towards cloud-based subscriptions meant to drive margins and profitability with more recurring revenues. Balancing some ongoing valuation concerns and a more challenging environment this year, FireEye presented some favorable operating trends in its latest earnings report. We think the company maintains a positive, long-term outlook, but we’re more cautious on the stock at current levels.

(Source: Finviz.com)

Q1 Earnings Recap

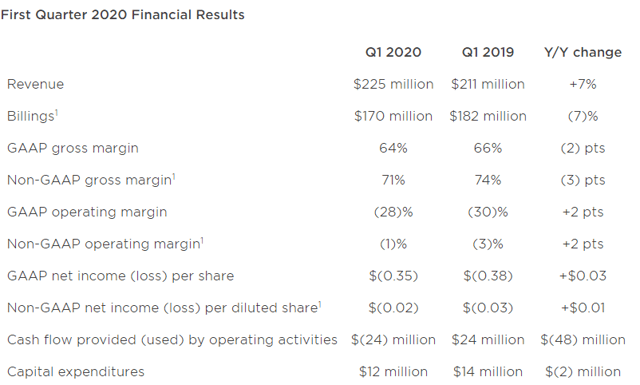

FireEye reported its fiscal Q1 earnings on April 28th with a non-GAAP EPS loss of -$0.02, which beat expectations by $0.02. The GAAP EPS loss of -$0.35 was $0.03 under the estimates. Revenue in the quarter of $224.7 million, up 7% year over year, and $3.3 million above consensus.

(Source: Company IR)

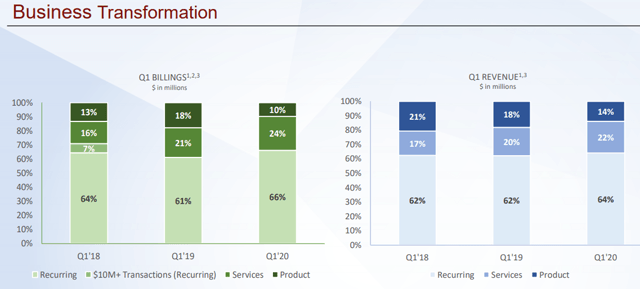

While billings declined by 7% year over year in the quarter, the key here is to recognize an ongoing shift in the business towards services and recurring revenues away from the legacy “product” based model. Management highlights that the business growth segment of Platform, Cloud Subscription, and Managed Services along with the Mandiant Consulting services now represent 53% of our revenue in the first quarter. Product revenues which represented 21% of the total in Q1 2018 have since declined to 14% and the group is now also a smaller percentage of total billings at 10%.

(Source: Company IR)

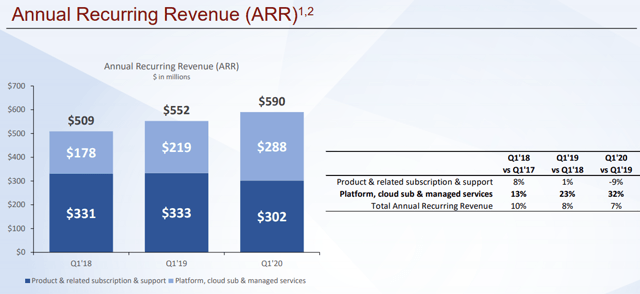

The result is that annual recurring revenue, “ARR”, which is seen as a less volatile and more consistent source of earnings, reached $590 million in Q1, up from $552 million in Q1 2019. The platform, cloud subscriptions and managed accounts are the growth driver, up 32% year over year in Q1 and now represent a positive financial tailwind for the company. Management commented on the ARR dynamics during the conference call:

Revenue reflects growth in our deferred revenue and drives our profitability. For these reasons, we believe ARR and revenue are better indicators of our progress on our transformation journey, especially in the current environment. Looking at revenue and ARR by category and our operating results, platform cloud subscriptions and managed services revenue increased 32% year-over-year. This category now accounts for 49% of ARR, up from 40% at the end of Q1 of 2019. Mandiant services revenues grew 25% year-over-year to a record 51 million and accounted for 23% of total revenue, compared with 19% of total revenue in Q1 of 2019. We continue to see strong demand for our expertise in both Incident Response and strategic consulting.

(Source: Company IR)

Management 2020 Guidance

In terms of the response to the COVID-19 pandemic, management updated full-year guidance considering some near-term disruptions given the coronavirus pandemic. Like many other companies, FireEye moved to work-from-home environment for its employees while also pushing more video conferencing alternatives with clients for its Mandiant consulting group. There is also a belief that global corporations having more employees working from home can leave them more vulnerable to security threats. By this measure, FireEye maintains a positive, long-term outlook with a recognition that the threats facing clients are ongoing.

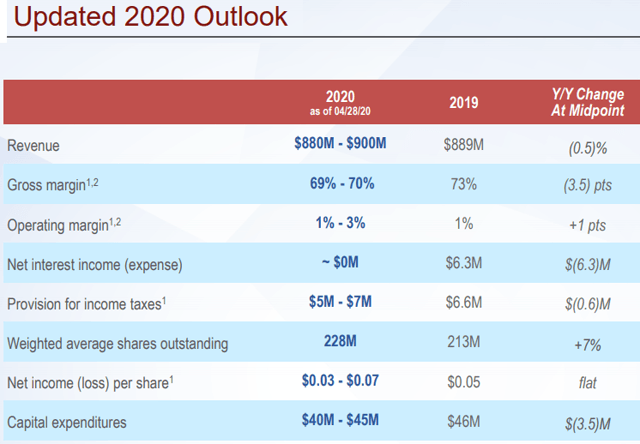

The company did update full-year guidance pulling back on estimates considering higher uncertainty and near-term challenges. Estimated 2020 revenue in a range between $880 million and $900 million at the midpoint is essentially flat compared to $889 million in 2019. While the gross margin is expected to decline to around 70% from 73% last year, the operating margin is seen as an increase to between 1% and 3% from 1% last year.

This would be driven by some lower CAPEX spending and also ongoing restructuring driven by a targeted 6% reduction in headcount and corresponding impact to SG&A. The company thinks it can save $25 million in operating expenses this year compared to 2019. FireEye expects to reach non-GAAP profitability between $0.03 and $0.07 per share, flat compared to $0.05 in 2019.

(Source: Company IR)

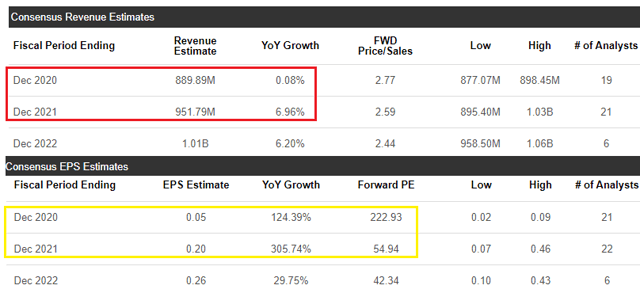

The current consensus estimates for 2020 with revenue of $890 million and EPS of $0.05 are consistent with management guidance. For 2021, the market expects revenue growth to rebound 7% while EPS could accelerate towards $0.20. The stock is currently trading at about 2.8x forward sales estimates and 55x 2021 “next year’s” consensus EPS.

(Source: Seeking Alpha Premium)

Analysis and Forward-Looking Commentary

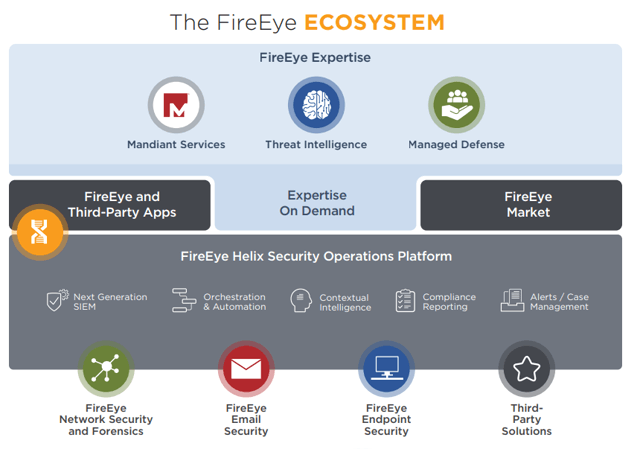

Cybersecurity stocks are a vibrant group with various players focusing on different aspects of IT defense. The way we look at FireEye is that it has a good leadership position in the consulting services with a long history of experience and expertise. On the other hand, platform solutions are more vulnerable to emerging competition in our opinion.

(Source: Company IR)

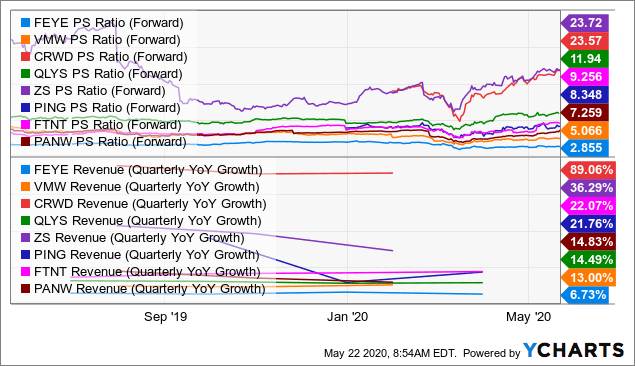

Looking at some other cybersecurity stocks that we include VMware, Inc. (NYSE:VMW), CrowdStrike Holdings (OTC:CRWD), Qualys, Inc. (NASDAQ:QLYS), Zscaler Inc. (NASDAQ:ZS), and Ping Identity Holdings (NYSE:PING), Palo Alto Networks (NYSE:PANW), Fortinet Inc. (NASDAQ:FTNT), FireEye has relatively weak growth and a corresponding lower growth premium. Notably, FireEye trading at a forward price to sales multiple of 2.9x is well below the group average of 12x. On the other hand, FireEye’s 7% revenue growth this last quarter is also significantly lower compared to some of the high growth stocks.

Data by YCharts

Data by YCharts

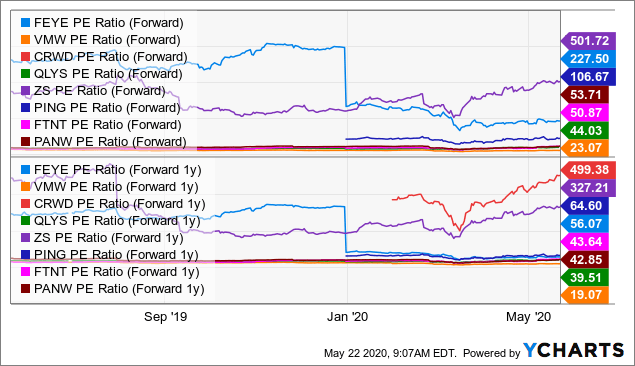

In terms of P/E multiples, FEYE trading a 227x 2020 and 56x 2021 consensus earnings estimates is more expensive compared to the more profitable firms like VMware and Qualys each trading at a 2021 forward P/E multiple of 19x and 40x each respectively. Keep in mind each of these companies focuses on different segments of cybersecurity so are not necessarily comparable, but our point is that FEYE doesn’t appear to stand out in terms of value in the group.

Data by YCharts

Data by YCharts

Verdict

The case for FireEye is that the company can consolidate its strengths and improve profitability as it moves towards a cloud-based subscription model. To the upside, stronger-than-expected earnings and growth momentum would be positive catalysts for the stock. Another setback in the outlook could drive shares lower.

Balancing some positive trends including higher recurring revenues, we rate shares of FEYE as a hold considering the overall weak growth outlook. For investors who are interested in the cybersecurity space, we recommend the iShares Cybersecurity and Tech ETF (NYSEARCA:IHAK), First Trust Nasdaq CEA Cybersecurity ETF (NASDAQ:CIBR) or the ETFMG Prime Cyber Security ETF (NYSEARCA:HACK) for diversified tactical exposure to the segment.

Are you interested to learn how this idea can fit within a diversified portfolio? With the Core-Satellite Dossier marketplace service, we sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks / ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.