This post was originally published on this site

FedEx Corp. investors appear to be preparing for the worst, as the stock sank toward a more than six-month low Monday, a day before the package delivery giant reports fiscal first-quarter results and as some bearish technical signals have appeared.

The company

FDX,

is scheduled to release its earnings report for the quarter through August after Tuesday’s closing bell.

Analysts and investors may be worrying of a repeats of the previous quarter, when it reported in late June a fiscal fourth-quarter profit that missed expectations even as revenue rose above forecasts. Consensus earnings expectations have declined since then while revenue estimates have increased, amid concerns over the continued impact of higher costs for shipping and for labor and shipping delays.

“August quarter remained strong, although we are seeing some delays in shipments, which we expect management to address,” Cowen analyst Helane Becker wrote in a note to clients. She reiterated her outperform rating and $335 stock price target, which implies a 34% gain from current levels.

Concerns that future economic growth could be hampered by the recent spike in COVID-19 cases is also starting to creep into investors minds, as witnessed by the relative weakness in the overall transportation sector, which is often used as a measure of economic health. (Read more about COVID-19 case counts in MarketWatch’s “Coronavirus Update” column.)

FedEx’s stock slumped 1.9% in afternoon trading Monday, putting it on track for the lowest close since March 4.

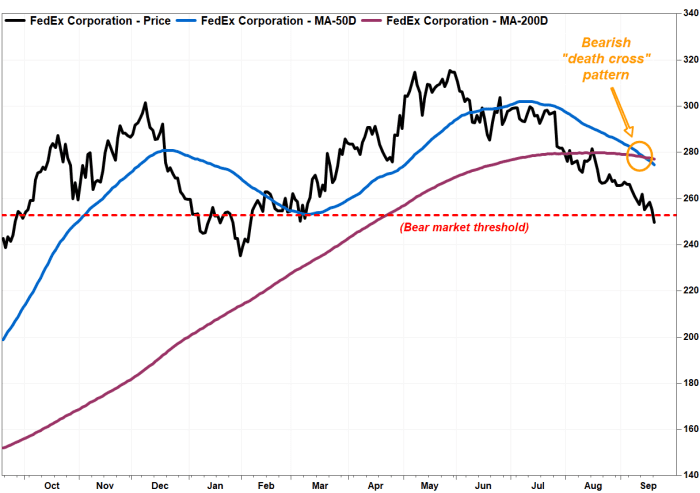

The stock has been in a tailspin the past several months, and is now trading 20.7% below the May 27 record close of $315.59. Many Wall Street technicians believe a decline of 20% or more from a significant high defines a bear market. On that basis, the stock would officially enter a bear market with a close at or below $252.47.

What may also be weighing on sentiment is a bearish “death cross” chart pattern that appeared last week, which many chart watchers believe is a warning of further losses. See FedEx interactive charting.

Also read: ‘Death cross’ in 10-year Treasury yields signals that bond yields may plumb new depths and prices rally.

The stock’s 50-day moving average (DMA), viewed by many as a shorter-term trend tracker, crossed below the 200-DMA, which many view as a dividing line between longer-term uptrends and downtrends, on Sept. 14.

The last “death cross” in FedEx’s stock appeared in August 2018, and the stock didn’t bottom out until it fell a further 63% over the next 19 months. The last opposite bullish “golden cross,” when the 50-DMA crosses above the 200-DMA, appeared in late July 2020, and the stock soared 91% over the next 10 months to the May record close before peaking.

FactSet, MarketWatch

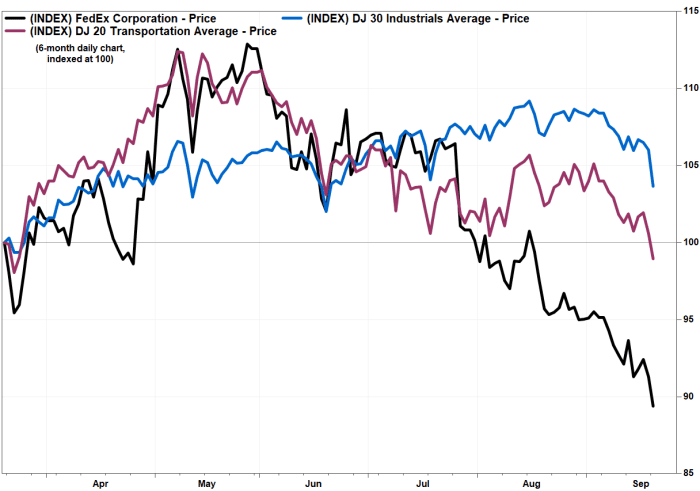

FedEx shares have now lost 10.5% over the past six months, while the Dow Jones Transportation Average

DJT,

has slipped 1.0% and the Dow Jones Industrial Average

DJIA,

has gained 3.7%.

On Monday, the Dow transports slid 1.6%, and were headed for the lowest close since March 24. It has been trending lower for more than four months, and has dropped 12.0% since closing at a record 15,943.30 on May 7.

FactSet, MarketWatch

Meanwhile, the Dow industrials fell 766 points, or 2.2%, on Monday, and was down 5.1% from its record close of 35,625.40 reached a little over a month ago on Aug. 16.

What Wall Street is expecting from FedEx’s earnings report

The FactSet EPS consensus for FedEx’s fiscal first quarter is $4.88, up slightly from $4.87 in the same period a year ago but down from $5.01 in the sequential fourth quarter. At the end of June, or just after FedEx reported fourth-quarter results, the EPS consensus $5.07.

Revenue is expected to be $21.93 billion, up from $19.30 billion a year ago but down slightly from $22.60 billion in the previous quarter. The current consensus has increased from $21.78 billion at the end of June, according to FactSet.

Among FedEx’s business units, the FactSet revenue consensus for FedEx Express is $10.85 billion, for FedEx Ground is $8.06 billion and for FedEx Freight is $2.23 billion.